With the latest passing of the GENIUS Act, a landmark US regulation for stablecoins, world consideration has intensified. To debate the rising stablecoin panorama in Asia, BeInCrypto sat down with Dr. Sam Search engine optimization, Chairman of Kaia. As certainly one of Asia’s main crypto platforms, Kaia is on the forefront of shaping regional stablecoin methods.

Stablecoins Take the Highlight in Asia

President Donald Trump has signed the GENIUS Act, the primary US federal legislation governing stablecoins, simply someday after it cleared the Home. The landmark laws requires one-to-one reserves, common audits, and limits issuance to licensed banks, credit score unions, and sure accredited non-banks, whereas banning algorithmic or unbacked cash.

The transfer has already triggered a wave of company curiosity. Inside weeks, main US retailers corresponding to Amazon and Walmart started exploring proprietary stablecoins to chop card-network charges, pace settlement, and combine loyalty packages. Supporters see this as a step towards mainstream adoption; critics warn it might pull deposits from conventional banks and power them to speed up digital-currency methods.

The timing comes because the US greenback faces its sharpest first-half drop since 1973, prompting European buyers to show to euro-denominated buying and selling and euro-pegged stablecoins to scale back FX danger. Whereas the greenback stays dominant, the regulatory readability of the GENIUS Act might strengthen its place in crypto simply as Asia weighs find out how to profit from USD-based liquidity with out undermining native currencies.

Kaia DLT Basis’s Chairman, Dr. Sam Search engine optimization, mentioned with BeInCrypto how Asian policymakers and platforms ought to reply — and why a regional stablecoin alliance could also be crucial for the area’s long-term autonomy.

Search engine optimization didn’t hesitate to choose the stablecoin when requested about essentially the most crucial development in Asia’s digital asset market.

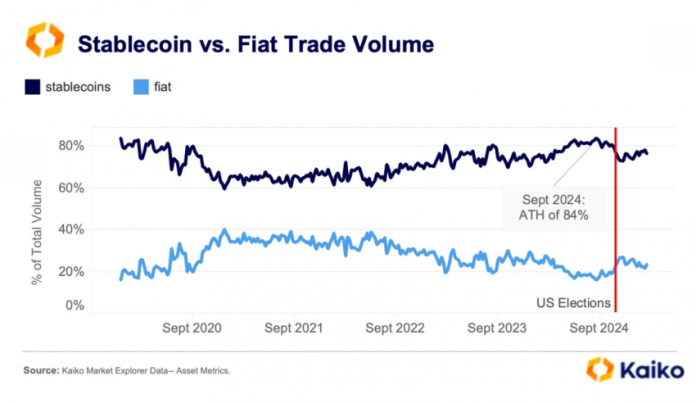

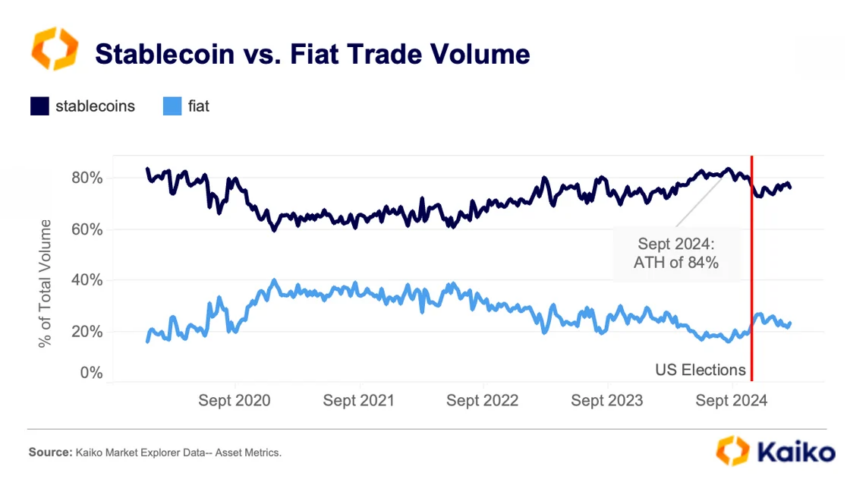

“Essentially the most fashionable one is stablecoin,” he stated. “Even earlier than the Genius Act, the rising utilization and quantity of stablecoin really ignited the dialogue and attracted a lot consideration in Asia.”

He confused that stablecoin adoption is increasing quickly throughout Asia, making it removed from a phenomenon restricted to the US or Europe. USD-backed cash are additionally closely utilized by Asian people and companies. The surge extends past speculative buying and selling, with stablecoins more and more embedded in on a regular basis transactions, cross-border commerce, and regional regulatory agendas.

Leaders and Regional Defenders

When requested which nations are driving innovation, Search engine optimization pointed to 2 main ones.

“I might say most likely Singapore or the UAE, as a result of they have been fairly superior by way of making rules for stablecoins. In Singapore, they already made the only forex stablecoin regime in 2023, not solely concerning the Singapore greenback, but in addition different main 10 currencies. And likewise the UAE, they made many regulation frameworks associated to crypto and stablecoins.”

Singapore’s early motion positioned it forward of different Asian jurisdictions in setting clear, enforceable guidelines. The UAE, led by Dubai and Abu Dhabi, has additionally constructed a complete regulatory framework for digital belongings, together with stablecoins.

Against this, Search engine optimization stated, a number of nations give attention to stablecoins pegged to their very own currencies.

“Japan, Korea, Hong Kong, China, and the Philippines are extra targeted on their currency-based stablecoins as a result of they care about their individuals and their forex.”

This displays a shared precedence: defending home financial programs and safeguarding nationwide currencies from being displaced by foreign-backed cash.

Genius Act: Each Risk and Alternative

The GENIUS Act has created a transparent framework for regulated USD stablecoins corresponding to USDC and PayPal USD. For Asia, Search engine optimization sees each hazard and potential.

“If we don’t have native forex stablecoins, the fiat forex can be much less used because the utilization of USD stablecoins can improve rather a lot. But when we put together the regional stablecoin and the correct utilization of USD stablecoins, then this might be a chance for the Asian nations.”

Search engine optimization famous that regulated USD stablecoins underneath the GENIUS Act might additionally unlock new capital flows for Asia’s tokenized asset markets — from authorities bonds to actual property — boosting fundraising and buying and selling exercise. He additionally emphasised that as a result of stablecoins are usually issued and transacted on public blockchains, they’re clear to all contributors. On the similar time, privateness can nonetheless be preserved by selective anonymization of person information.

Japan’s Strict Mannequin and the Want for Stability

Japan’s Cost Providers Act permits solely banks, belief corporations, and licensed remittance suppliers to difficulty stablecoins, requiring full reserve backing and common audits. Search engine optimization sees this as a robust safeguard for the yen.

“Regulation for stablecoin is a means of defending the Japanese forex and the Japanese market. Requiring a robust reserve inside sure jurisdictions really can forestall the cash from going out from the nation.”

However he additionally cautioned towards overreach.

“If the reserve requirement is simply too strict, that may forestall the non-local gamers from coming into and cut back the interoperability with stablecoins backed by denominations of different nations, which is likely one of the most important roles of digital currencies. We want a stability for non-local gamers to play.”

Funds, E-Commerce, and Inclusion

Search engine optimization believes stablecoins might push Web3 into the mainstream in Asia, particularly in funds and e-commerce.

“Completely sure,” he affirmed. “In some nations, for instance, in Vietnam and Indonesia, QR funds are practically dominant, slightly than bank card funds.”

By integrating stablecoins into QR-enabled wallets, tens of millions might transact with no need a checking account or card, which requires them to undergo the complexity of the financial institution’s authentication course of.

“We don’t should reinvent the interface by having the stablecoin as one other technique of forex we are able to improve the transactions of cost and decrease the issue of the cost.”

Europe’s Edge and Asia’s Alliance Hole

Search engine optimization famous that Europe enjoys simpler liquidity coordination because of the euro and the MiCA framework. With its a number of currencies alongside the regulatory range, Asia doesn’t have this benefit.

“A single forex is pointless in Asia, however a multi-currency stablecoin alliance could be very efficient. It may enhance liquidity between completely different currency-backed stablecoins.”

Such an alliance might be a basis for cross-border interoperability and cut back friction between regional markets.

Kaia’s Roadmap for Regional Cooperation

Kaia is targeted on increasing real-world use instances for stablecoins and driving adoption in Asia. It already helps USDT natively and plans to onboard yen-, rupiah-, and Hong Kong greenback–backed stablecoins. The second section is to construct an on-chain FX marketplace for seamless forex swaps and environment friendly cross-border settlements. This may enhance liquidity, decrease transaction prices, and allow quicker funds.

The ultimate stage is to ally Asian stablecoin issuers to standardize practices and broaden regional community results.

“We’re positively engaged on that,” Search engine optimization stated of Kaia’s collaboration with LINE Messenger, one of the well-liked ones within the area. “Sometime, the LINE customers from Japan or different nations might use completely different stablecoins contained in the LINE messenger. Nevertheless it requires correct regulation as effectively.”

Kaia is working carefully with LINE to discover stablecoin integration, anticipating that after the authorized framework is prepared, LINE customers can ship and obtain stablecoins seamlessly, domestically and internationally.

Kaia is a Layer 1 blockchain platform launched in August 2024. It combines Klaytn from Kakao and Finschia from Naver, Korea’s dominant tech giants. Naver’s LINE Messenger has a large Asian person base in Japan, Taiwan, and different nations.

Kaia chain community onboarded Tether’s USDT in Might this 12 months, and it’s also in discussions with different stablecoin and fintech corporations to create potential KRW, JPY, and different currency-backed stablecoins.

Asia’s Defining Alternative

For Search engine optimization, the technique is obvious: construct native forex stablecoins, selectively combine USD liquidity, and join them by a regional interoperability framework.

“Stablecoins are now not only a crypto device. They’re changing into the connective tissue of digital finance in Asia… able to linking funds, tokenized markets, and on a regular basis commerce.”

The GENIUS Act might solidify the greenback’s regulated function in world crypto. Whether or not Asia responds with fragmentation or a united technique will decide the area’s monetary autonomy for years.

The submit GENIUS ACT and Past: Kaia Explains Asian Perspective appeared first on BeInCrypto.