After a short-lived restoration, Bitcoin (BTC) is making an attempt to bounce from a vital stage to reclaim the $110,000 help. Nevertheless, some analysts counsel {that a} retest of the $90,000 stage might be the following cease for the cryptocurrency.

Associated Studying

Bitcoin Drops To Weekly Lows

Bitcoin misplaced the $110,000 help for the primary time in practically two months, dipping beneath the decrease boundary of its native vary, between $108,700-$119,500. The flagship crypto hit an eight-week low of $107,900 on Friday afternoon, elevating considerations for its short-term rally amongst traders.

Crypto analyst Ali Martinez steered that the market is beginning to present indicators of fatigue, with Bitcoin Dominance displaying cracks after carrying “the majority of the bull market momentum.”

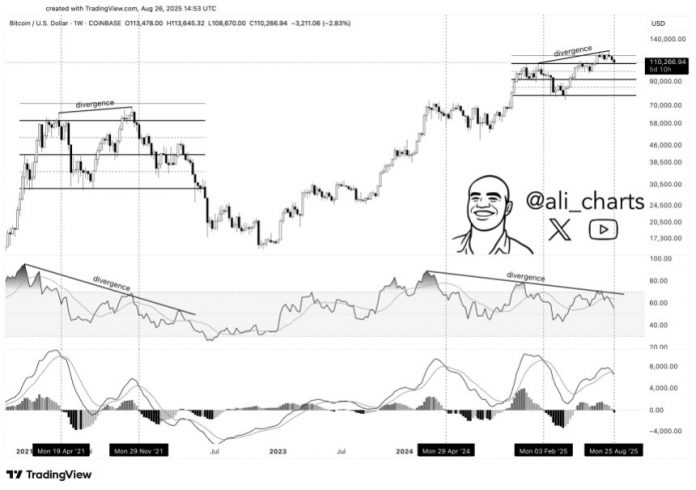

To the analyst, BTC’s present worth motion indicators a macro development shift, mirroring the 2021 worth motion and the circumstances that preceded the 2021 cycle peak. On the time, the cryptocurrency hit a peak of $60,000 in April, retraced, rallied to $70,000, and set a robust bearish divergence towards the Relative Power Index (RSI) earlier than the bear market started.

This time, Bitcoin is displaying the identical setup that foreshadowed the tip of the final cycle, with worth making increased highs whereas the RSI makes decrease lows, Martinez defined.

Amongst different technical indicators, the analyst highlighted that the MACD indicator had turned bearish this week. He detailed that this bearish crossover aligns with the value drop and reinforces the draw back dangers.

In the meantime, he added that the current dying cross within the Bitcoin MVRV Momentum indicator “indicators a macro momentum reversal from constructive to detrimental. It is a traditionally dependable warning signal of cyclical tops.”

The analyst affirmed that the on-chain proof suggests Bitcoin’s high could also be in, at the least briefly, with bias shifting bearish and a danger of retesting decrease help ranges.

Will BTC Mirror Its 2021 Drop?

Martinez additionally famous that the $108,700 help is essential for BTC’s short-term efficiency, as a weekly shut beneath this space would verify a deeper development shift, which occurred in 2021.

After peaking in late 2021, the flagship crypto misplaced its native vary above the $58,000 mark, which led to a retest of the macro vary’s mid-zone and an eventual drop beneath the macro vary’s lows within the coming months.

If BTC loses its fast technical ground, the value may retest the $104,500 and $97,000 help ranges, risking a drop to the mid-zone of the macro vary, across the $94,000 space.

Altcoin Sherpa weighed in on the cryptocurrency’s efficiency, stating that Bitcoin ought to have robust help between the $103,000-$108,000 ranges, because the 200-day Exponential Shifting Common (EMA) sits across the $104,000 mark.

Associated Studying

Nevertheless, analyst Ted Pillows considers that $124,000 seems to be the native high. He defined that, traditionally, Bitcoin’s bottoms happen after a retest of the weekly 60 EMA, which presently sits across the $92,000 help zone and has a CME hole.

“On this situation, Bitcoin will begin a reversal after 3-4 weeks and a brand new ATH by November/December,” Ted concluded.

As of this writing, Bitcoin trades at $107,947, a 7.5% decline within the weekly timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com