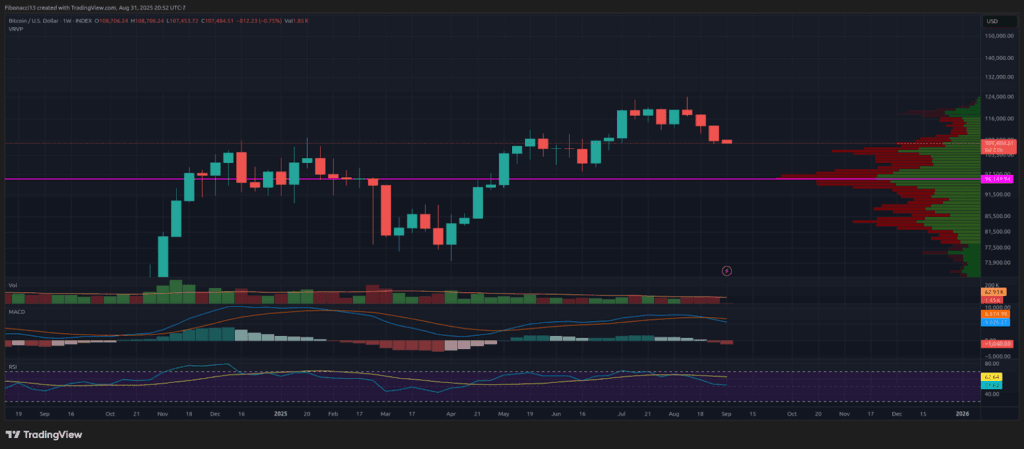

Bitcoin begins September below stress after a brutal August shut — now all eyes are on $100K. Bitcoin closed the month of August with a disappointing week for the bulls. After making a brand new all-time excessive in mid-August at simply over $124,000, bitcoin has put in three crimson candle closes in a row on the weekly chart. This previous week’s candle closed down close to the lows, swinging momentum clearly over to the bears.

The MACD oscillator confirmed a bearish cross on the weekly shut as properly, which ought to assist keep downward stress coming into this week. RSI is now sitting in a comparatively impartial place simply above the 50 line, however at its lowest degree since mid-April.

This primary week of September will see bitcoin heading down to check the assist ranges from the Might-to-June value consolidation. Bulls might be in search of the high-volume node round $104,000-105,000 to carry value, and ideally forestall this week’s candle from closing under that degree. Bears might be making an attempt to push the worth down by means of this assist again to the important thing 1.618 Fibonacci extension degree from the 2022 bear market at $102,000. Closing this week within the $102k neighborhood or decrease can be very unhealthy for the bulls, as it could threaten to interrupt under the notorious laser eyes degree of $100,000 and check the final main swing low at $98,000.

Taking out $100,000 to the draw back would give lots of weight to the “long-term prime is in” thesis. $96,000 is mainly the final line of protection right here for the bulls if value manages to slide by means of all these higher assist ranges.

So heading into this week, search for consumers to attempt to step in and switch issues round on the $105,000 degree. Bulls might be seeking to proper the ship this week and put in some kind of reversal candle to show issues round. However for now, the bears are in full management and can look to proceed the promoting stress into September.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipating the worth to go increased.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Assist or assist degree: A degree at which value ought to maintain for the asset,a minimum of initially. The extra touches on assist, the weaker it will get and the extra possible it’s to fail to carry the worth.

Resistance or resistance degree: Reverse of assist. The extent which is more likely to reject the worth, a minimum of initially. The extra touches at resistance, the weaker it will get and the extra possible it’s to fail to carry again the worth.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Oscillators: Technical indicators that fluctuate over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low degree (usually representing oversold situations) and a excessive degree (usually representing overbought situations). E.G. Relative Energy Index (RSI) and Shifting Common Convergence-Divergence (MACD).

MACD Oscillator: Shifting Common Convergence-Divergence is a momentum oscillator that subtracts the distinction between 2 shifting averages to point development in addition to momentum.

RSI Oscillator: The Relative Energy Index is a momentum oscillator that strikes between 0 and 100. It measures the pace of the worth and modifications within the pace of the worth actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is under 30, it’s thought-about to be oversold.