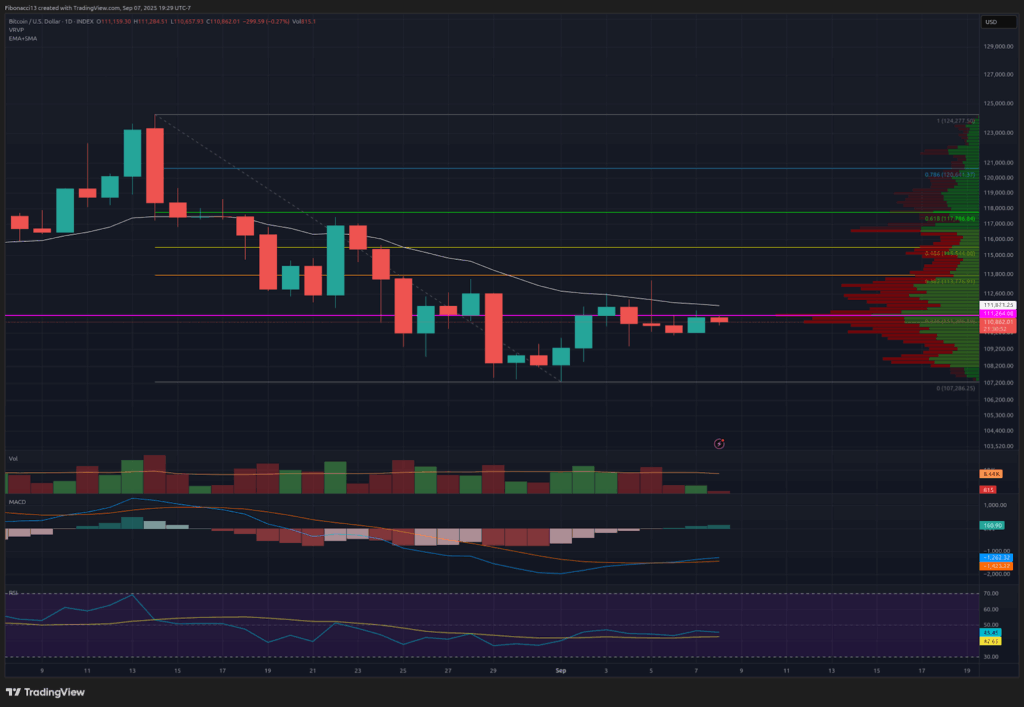

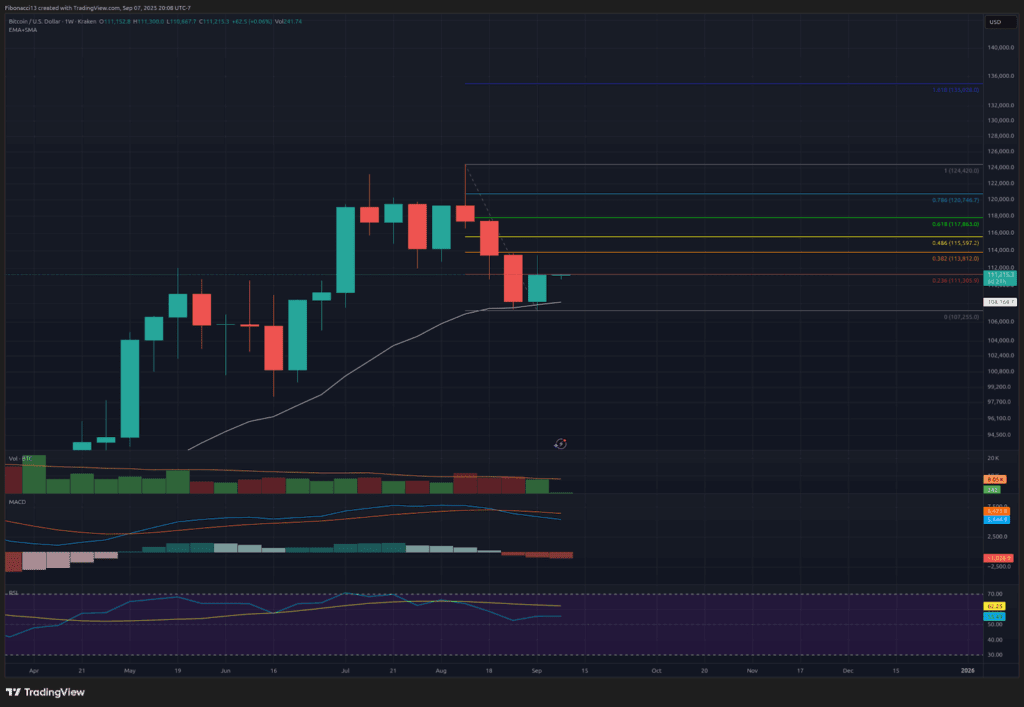

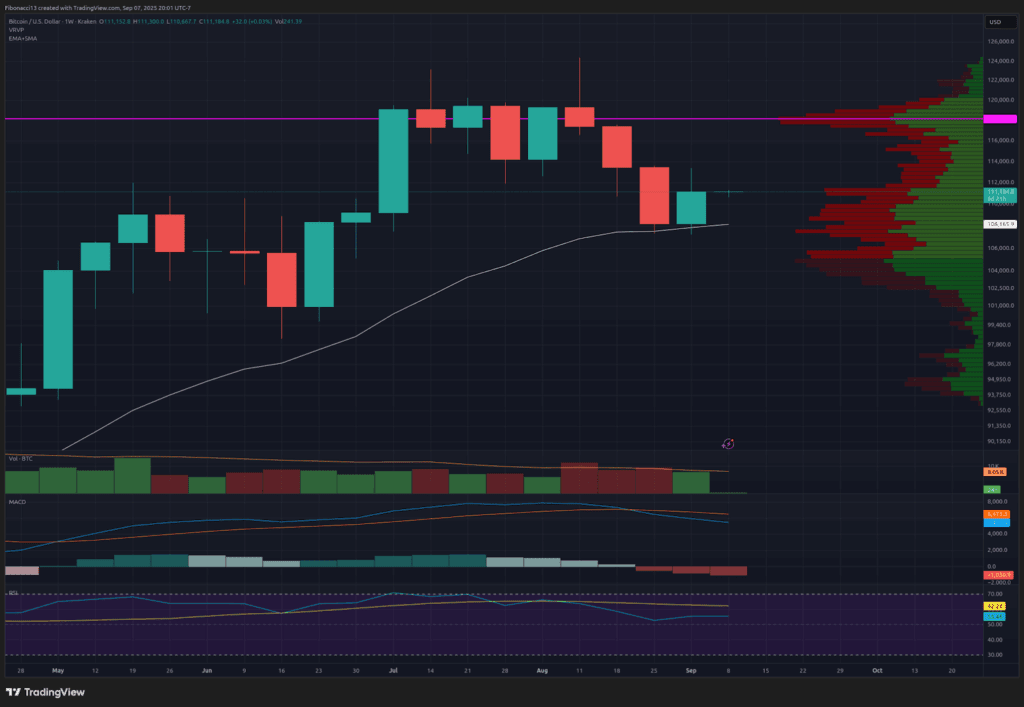

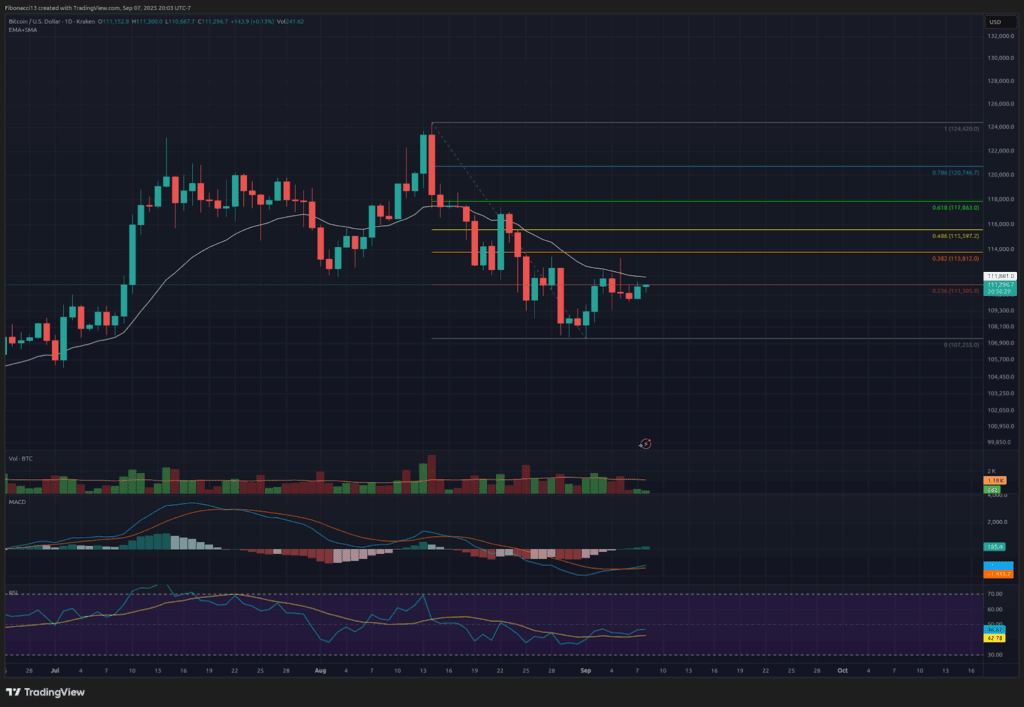

Bitcoin Value discovered help on the 21-day EMA final week, avoiding a deeper slide after closing on the prior week’s lows. Bulls managed to defend the $107,000 degree, however momentum stalled slightly below resistance. From Wednesday by means of Friday, Bitcoin failed to shut above $112,500 and ended the week at $111,162.

The shortcoming to reclaim $112,500 highlighted a pause within the current restoration. Nonetheless, holding above $107,000 has stored the bias barely to the upside for now. Merchants are carefully watching whether or not this consolidation develops right into a base or a continuation of the downtrend.

Key Help and Resistance Ranges Now

At current, $107,000 is crucial line of protection for Bitcoin Value. A breakdown under there would shift the main focus to decrease help zones at $105,000, $102,500, and probably $96,000.

On the upside, $112,500 is the primary resistance that should flip into help. If bulls handle to shut the every day above that degree, the subsequent goal is $115,500. Past there lies $118,000 — a formidable barrier that would wish a weekly shut to substantiate a renewed uptrend.

Outlook For This Week

The week forward might convey extra volatility. On Thursday, September eleventh, U.S. inflation knowledge is due at 8:30 AM Jap. A warmer-than-expected print could spark risk-off sentiment and drag Bitcoin decrease, whereas a softer quantity might present aid for bulls.

If Bitcoin Value can reclaim $112,500 early within the week, a push towards $115,500 is probably going. Failure to take action retains the market weak to a different check of the $107,000 low.

Market temper: Impartial, leaning bullish — help is holding, however resistance stays agency.

The subsequent few weeks

Trying additional out, Bitcoin should ultimately clear $118,000 with conviction to re-establish the uptrend and fend off bears. A decisive weekly shut above this degree would possible attract momentum consumers and enhance sentiment into October.

If $107,000 breaks as a substitute, the trail opens towards $105,000 and $102,500, with the potential of a sweep as little as $96,000 earlier than a sturdy backside is discovered. Given the sample of current closes, some analysts warning that another dip can’t be dominated out.

Terminology Information:

Bulls/Bullish: Patrons or traders anticipating the value to go greater.

Bears/Bearish: Sellers or traders anticipating the value to go decrease.

Help or help degree: A degree at which worth ought to maintain for the asset,at the least initially. The extra touches on help, the weaker it will get and the extra possible it’s to fail to carry the value.

Resistance or resistance degree: Reverse of help. The extent which is prone to reject the value, at the least initially. The extra touches at resistance, the weaker it will get and the extra possible it’s to fail to carry again the value.

EMA: Exponential Transferring Common. A shifting common that applies extra weight to current costs than earlier costs, decreasing the lag of the shifting common.