Macro Background

The August U.S. information delivered a blended sign that left merchants with no simple solutions. Inflation shocked on the upside, with headline CPI rising 0.4% m/m towards expectations of 0.3%. Core CPI matched forecasts at 0.3%. On a yearly foundation, headline inflation printed 2.9% y/y, barely above consensus.

On the identical time, the labor market despatched a transparent warning. Unemployment claims jumped to 263K, properly above the 235K anticipated, marking the best weekly print since early 2023. Mixed with final week’s weak Nonfarm Payrolls report (+22K jobs) and damaging revisions, the image of cooling employment is changing into more durable to disregard.

For the Federal Reserve, this mixture is tough: inflation continues to be sticky, however development momentum and labor power are fading shortly.

Market Response

Markets responded with sharp intraday swings.

-

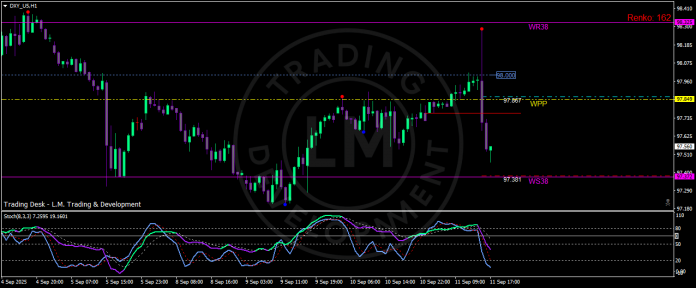

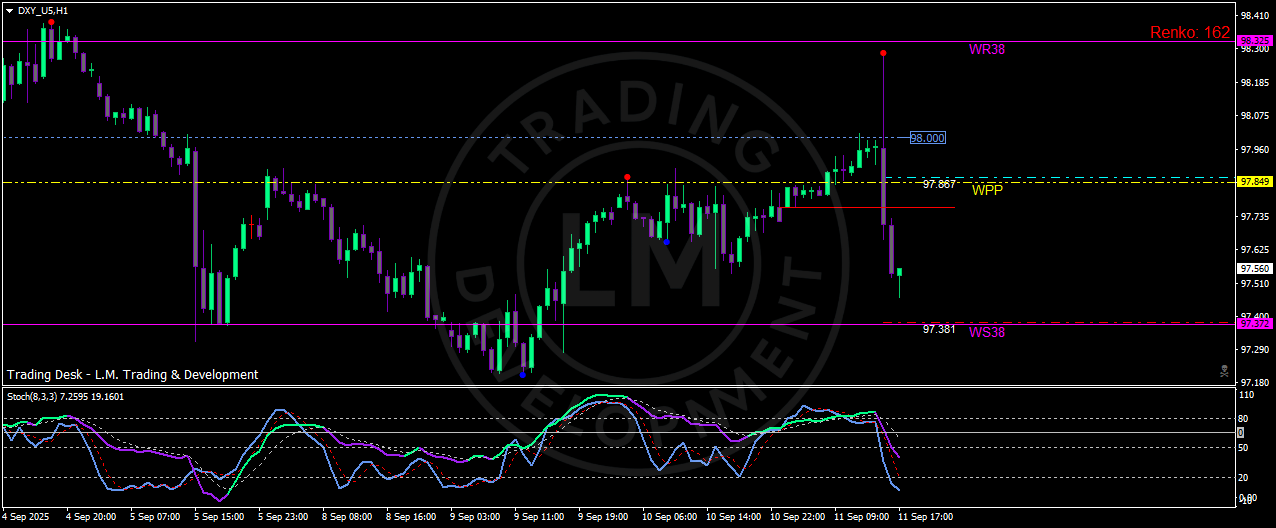

Greenback Index (DXY): The index initially spiked towards 98.00 after the CPI launch however shortly reversed decrease as jobless claims highlighted labor fragility. Worth fell again below the weekly pivot at 97.85 and examined help round 97.56.

-

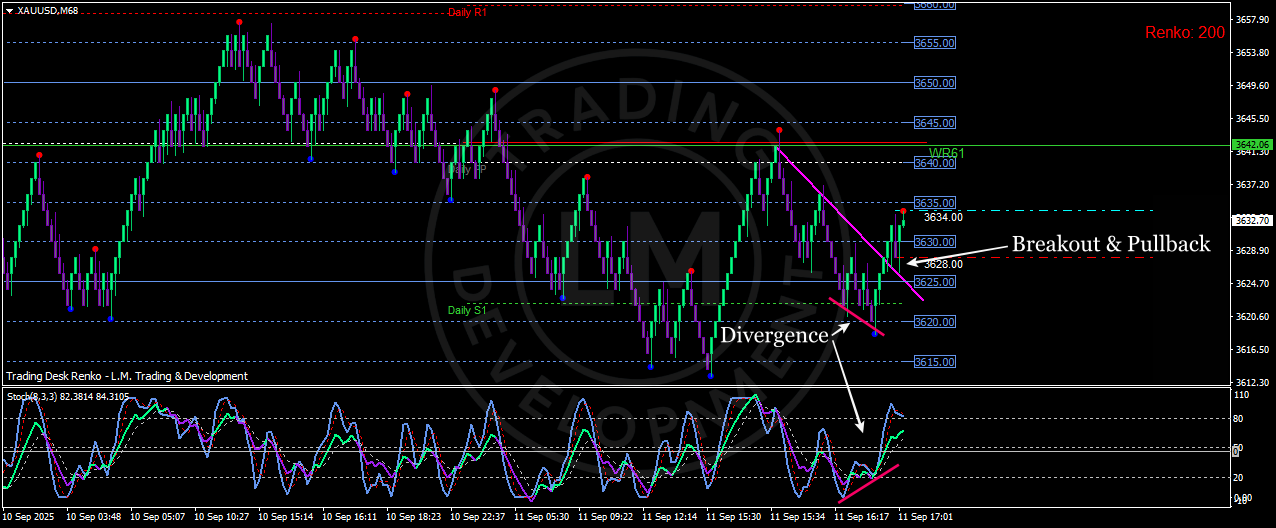

Gold (XAUUSD): The metallic capitalized on the greenback’s weak spot, breaking greater after defending the 3620–25 help zone. Momentum carried costs towards the 3635–3640 resistance space (WR61), with stochastic divergence confirming the bullish sign.

-

Bonds: Treasury yields jumped on the CPI shock however later retreated, reflecting renewed expectations of Fed easing. The two-year yield erased early positive aspects.

-

Equities: U.S. indices stabilized after uneven commerce, with buyers specializing in the chance of coverage help in September.

Coverage Angle

The info intensified the Fed’s coverage dilemma:

CME FedWatch now assigns over 70% chance to a 25bp charge minimize in September, whereas practically 30% of merchants are betting on a 50bp minimize. This can be a important shift from only a few weeks in the past, when many Fed officers nonetheless favored “greater for longer.”

Technical Ranges

Greenback Index (DXY):

-

Resistance: 98.00, then WR38 at 98.32

-

Assist: 97.56, then 97.38 (WS38)

Gold (XAUUSD):

-

Assist: 3620–25, then 3615 (Each day S1)

-

Resistance: 3635, then 3640–42 (WR61)

-

Bias: bullish above 3625, with potential to retest 3645–50.

Buying and selling Implications

For merchants, the hot button is the divergence between asset lessons:

-

Gold is main greater as Fed minimize bets strengthen, making it a cleaner hedge than oil or equities.

-

Greenback Index failed to carry positive aspects, exhibiting vulnerability regardless of sticky inflation.

-

Brief-term setups:

-

Lengthy XAUUSD bias above 3625, focusing on 3640–3645.

-

DXY biased decrease if 97.50 breaks, with room to 97.38.

-

Within the coming classes, consideration will shift to imminent U.S. retail gross sales and PPI. If each present softness alongside weak jobs information, recession fears will dominate, preserving strain on the greenback and supporting gold.

Conclusion

The August information confirmed a tough combine: inflation is proving sticky whereas labor markets weaken. For merchants, the result’s easy: the Fed is trapped, the greenback is weak, and gold is the primary beneficiary.

So long as XAUUSD holds above 3625, dips are prone to appeal to consumers. A sustained transfer via 3640–42 would affirm bullish momentum and open house towards 3650. In the meantime, the Greenback Index should reclaim 98.00 to keep away from additional draw back strain.

This evaluation displays a private view for instructional functions solely and isn’t monetary recommendation.