Institutional staking might quickly obtain a big enhance as reviews emerge that Grayscale is making ready to stake its substantial Ethereum holdings. This transfer would mark a pivotal shift for one of many world’s largest crypto asset managers, bringing billions of {dollars} price of ETH into lively community participation.

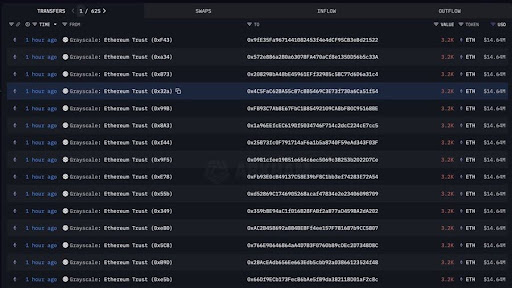

In an X submit, on-chain analyst CryptoGoos has delivered to gentle a big improvement within the institutional crypto house. Grayscale is reportedly making ready to stake its large Ethereum holdings. Though not but confirmed, such a transfer, which was flagged by on-chain information following a switch of over 40,000 ETH, is a big sign of Grayscale’s evolving technique and a possible game-changer for the ETH market.

Why The Grayscale Transfer Might Speed up Mainstream Adoption

In keeping with the information, Grayscale’s alleged switch of a giant sum of ETH is in keeping with preparatory steps for staking. The agency, which holds roughly 1.5 million ETH in its varied trusts, is now positioning a portion of that huge holding to earn staking rewards.

If that is certainly the case, it will be a historic second. Grayscale would develop into the primary US-based ETH ETF sponsor to supply staking within the market, a function that has been some extent of competition with the Securities and Trade Fee (SEC).

Whereas reviews recommend Grayscale is making ready to stake ETH, market analyst TheKingfisher has issued a big warning based mostly on the ETH GEX+ chart, which he states is flashing a powerful detrimental sign. This evaluation facilities on a key choices metric generally known as Gamma Publicity (GEX), an indicator that gives perception into how skilled merchants, or sellers, are positioned available in the market. The sellers are quick gamma on the present implied volatility (IV) of 61 and an index value of $4,593.

This dynamic is the place volatility is prone to be amplified. As an alternative of a market that strikes slowly and predictably, the ETH GEX+ sign means that value swings might be sudden and excessive, catching most retail merchants off guard with the pace of strikes. Nevertheless, good cash considers the event a uncommon alternative to capitalize on aggressive supplier hedging. Within the meantime, this atmosphere calls for tight danger administration.

The Gateway To Value Discovery

Ethereum value is at a pivotal level, at the moment consolidating between the $4,000 assist stage and its earlier all-time excessive. MilkRoadDaily has additionally revealed that the following essential step for ETH is a weekly shut above its all-time excessive, which might put the asset right into a section of value discovery, the place historical past reveals the largest strikes have occurred.

Drawing on this historic sample, MilkRoadDaily means that within the earlier market cycle, ETH cleared its outdated highs with a parabolic run, ripping an extra 240%. If this historic sample have been to repeat itself, an analogous transfer from its present place might venture a brand new value goal of round $16,500.