Most of them are all the time price shopping for. Every so often, even the Oracle of Omaha misses one thing vital.

In the event you’re ever in want of a brand new inventory decide, you possibly can all the time borrow an concept or two from Berkshire Hathaway‘s (BRK.A 0.55%) (BRK.B 1.06%) portfolio of holdings hand-picked by Warren Buffett himself. And you need to. Given sufficient time, Berkshire shares constantly outperform the broad market largely as a result of conglomerate’s investments in publicly traded corporations.

Not each Berkshire Hathaway holding is all the time an ideal purchase, nonetheless. Typically they’re buying and selling at too steep of a valuation for newcomers, and different occasions, they’ve simply changed into clunkers.

With that because the backdrop, this is a more in-depth take a look at two Warren Buffett shares you possibly can be ok with shopping for in the present day, however one title you would possibly wish to keep away from till one thing huge modifications for the higher.

Picture supply: The Motley Idiot.

Purchase: American Specific

Many buyers do not realize that — via the attrition of different holdings in addition to its personal progress — bank card outfit American Specific (AXP 0.55%) is now Berkshire Hathaway’s second-biggest inventory holding, accounting for 17% of the outfit’s portfolio of publicly traded equities. Underscoring this bullishness is the truth that Berkshire additionally holds stakes in Visa and Mastercard, however has chosen to solely maintain a lot smaller positions in each.

Then once more, it isn’t tough to see what the Oracle of Omaha has seen in AmEx since first establishing the place again within the Nineteen Nineties. It is not only a cost intermediary just like the aforementioned Mastercard and Visa. It operates a complete consumerism ecosystem, serving as the cardboard issuer in addition to the cost processor, whereas additionally managing a perks and rewards program that is enticing sufficient for some members to pay as much as $900 per 12 months to carry the plastic. These perks embrace credit score towards resort stays and ride-hailing, money again on grocery purchases, and discounted leisure, simply to call a number of. Though some have tried, no rival has been capable of efficiently replicate this providing.

After all, it is price stating that American Specific’s cardholders are typically a bit extra prosperous than common, and are due to this fact principally unfazed by financial smooth patches. As CEO Stephen Squeri identified of its Q2 numbers regardless of the turbulent financial backdrop on the time, “Our second-quarter outcomes continued the sturdy momentum we’ve seen in our enterprise during the last a number of quarters, with revenues rising 9 p.c year-over-year to succeed in a file $17.9 billion, and adjusted EPS rising 17 p.c.”

Purchase: Kroger

It is not a serious Berkshire holding, and positively not one which’s talked about a lot by Buffett (or anybody else, for that matter). However Kroger (KR -0.08%) is quietly one in every of Berkshire Hathaway’s best-performing shares.

You understand the corporate. With 2,731 shops producing annual gross sales on the order of $150 billion, Kroger is among the nation’s largest grocery chains. Oh, it does not develop in a short time, or produce a ton of revenue; this 12 months’s anticipated top-line progress of round 3% is simply more likely to result in working revenue of rather less than $5 billion. That is simply the character of the well-saturated, low-margin meals enterprise.

What Kroger lacks in progress firepower, nonetheless, it makes up for in stunning consistency.

Though the unstable meals enterprise does not precisely lend itself to it, not solely has this firm not failed to provide a significant full-year revenue yearly for over a decade now, however has roughly doubled its backside line throughout this stretch. Making a degree of remaining related by doing issues like coming into the e-commerce realm has helped rather a lot.

Extra vital to would-be buyers, though the grocery store’s reported progress does not appear all that spectacular, the corporate’s discovered different methods to create appreciable shareholder worth. Its quarterly dividend cost has grown by a hefty 250% over the course of the previous decade, for instance, boosted by inventory buybacks which have roughly halved the variety of excellent Kroger shares. Actually, reinvesting Kroger’s dividends in additional shares of the more and more scarce inventory over the course of the previous 30 years would have constantly outperformed an funding within the S&P 500 throughout this stretch.

Keep away from: UnitedHealth Group

Lastly, whereas Buffett was keen to dive right into a small place in beleaguered well being insurer UnitedHealth Group (UNH -0.37%) a number of weeks again, you won’t wish to do the identical simply but…if ever.

However first issues first.

Sure, there’s some drama right here. UnitedHealth shares have been overwhelmed down since April, beginning with a shock shortfall of its first-quarter earnings estimates, adopted by then-CEO Andrew Witty’s abrupt resignation for “private causes” in Could. Then in July, the corporate confirmed that the U.S. Division of Justice was investing its Medicare billing practices. Its second-quarter earnings posted later that very same month additionally missed analysts’ estimates as a result of identical excessive reimbursement prices that plagued its first-quarter outcomes. All informed, from peak to trough, UNH inventory fell 60% in the midst of this 12 months.

As Buffett himself has stated, after all, you need to be fearful when others are grasping, and grasping when others are fearful. Taking his personal recommendation, he lately plowed right into a stake in a long-established firm that is more likely to be able to overcoming all of its present woes. Berkshire now owns 5 million shares of UNH which are at present price rather less than $2 billion.

Besides, possibly that is a type of occasions you do not observe Buffett’s lead, recognizing that UnitedHealth Group — together with your complete healthcare trade — appears to be working into these regulatory and pricing headwinds an increasing number of frequently. UnitedHealth’s Medicare enterprise bumped into comparable authorized bother again in 2017, as an illustration, whereas its pharmacy advantages administration arm OptumRX was sued by the Federal Commerce Fee simply final 12 months for artificially inflating insulin costs. It might even be naïve to not discover the federal authorities is more and more scrutinizing each facet of the nation’s healthcare trade, now that care prices have raced past affordable affordability.

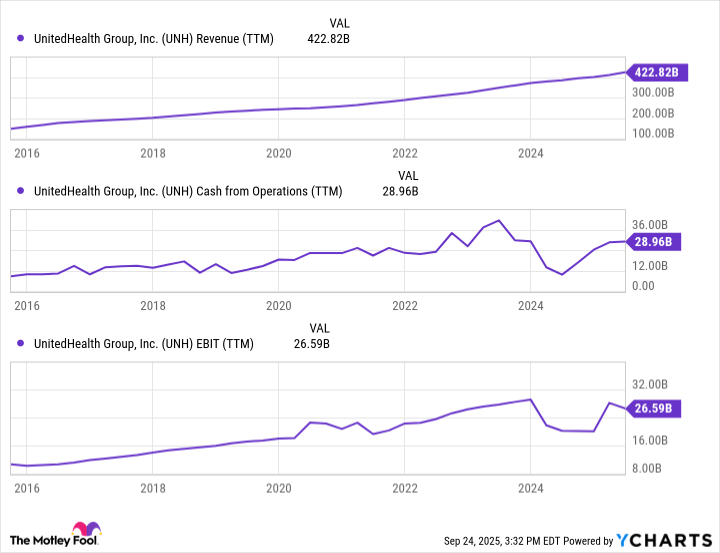

And for what it is price, though UnitedHealth has managed to proceed rising its high line yearly for over a decade now, precise working income and EBITDA stopped rising early final 12 months, not counting the current sudden surges in its medical care prices.

UNH Income (TTM) knowledge by YCharts

What provides? The whole healthcare trade could also be at a tipping level, so to talk, and never in a great way. Though this would not essentially be catastrophic for UnitedHealth, it actually would undermine its worth to buyers. If nothing else, you would possibly wish to wait on the sidelines for the proverbial mud to settle earlier than following Buffett into this unsure commerce.