Help and resistance.

Development traces.

Chart patterns.

Have you ever ever requested your self…

“Do these instruments actually work within the markets?”

“How can I actually inform?”

In case you have, you then’re forward of no less than 50% of all merchants on the market!

As a result of whereas most of them put blind religion into textbooks and movies…

…you’re beginning to develop past that.

However, how will you confirm what’s happening?

And is there a method to make use of that information to construct a worthwhile buying and selling system?

From scratch, even!?!

Nicely, my buddy, you’ve come to the best place.

In at this time’s information, you’ll be taught:

- The important thing to creating buying and selling techniques that not solely generate income, but additionally hold you persistently on monitor within the markets

- The final word guidelines for constructing a rock-solid, rules-based buying and selling system

- A whole, battle-tested framework for crafting buying and selling techniques that ship actual, repeatable outcomes

- The largest pitfalls merchants face when constructing techniques and methods to overcome them with confidence

You prepared?

Then let’s get began…

The Key To A Worthwhile Buying and selling System Is Eliminating Discretion In Your Buying and selling

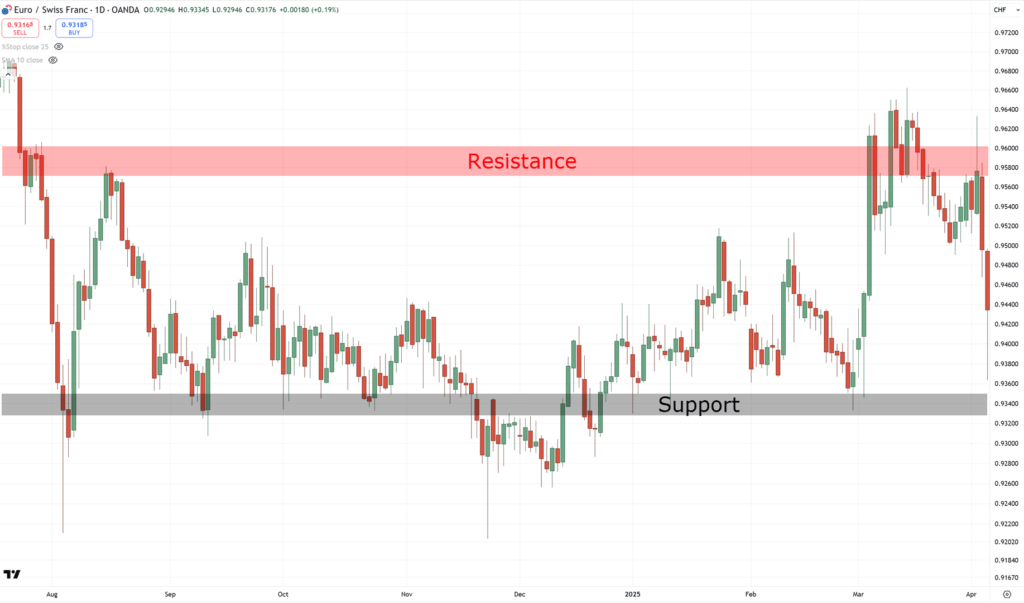

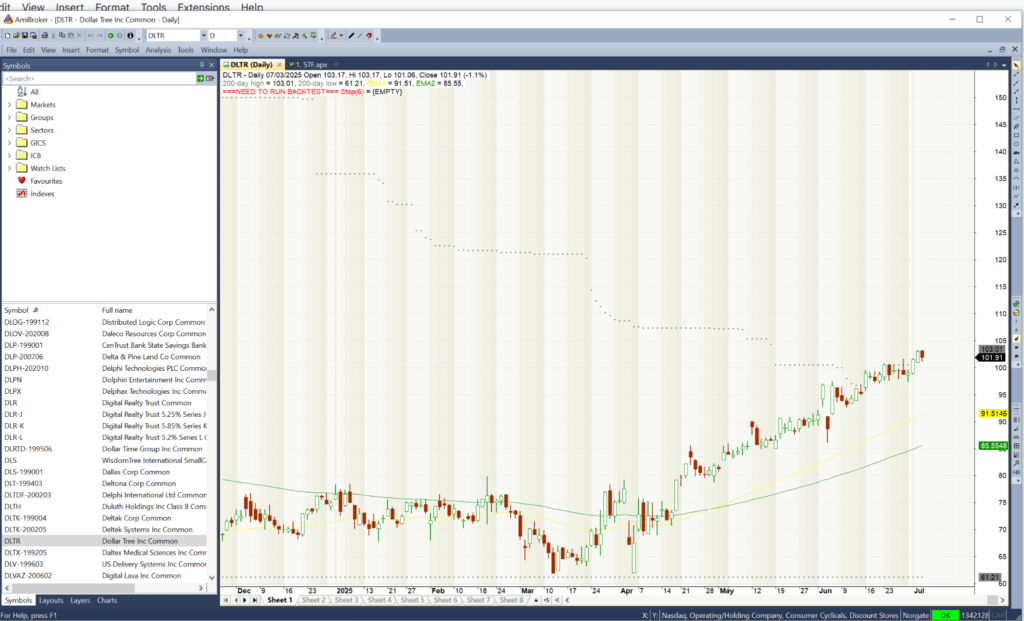

Have a look at this chart…

Let’s say you’ll attempt to purchase at help and promote at resistance.

So, are you able to inform me the place help and resistance are?

Nicely…

When you’ve been practising for some time, you may need plotted one thing like this…

Easy, proper?

However right here’s the factor…

Even proper now, I’m guessing you disagree with how I’ve plotted my help and resistance.

What extra with different merchants?

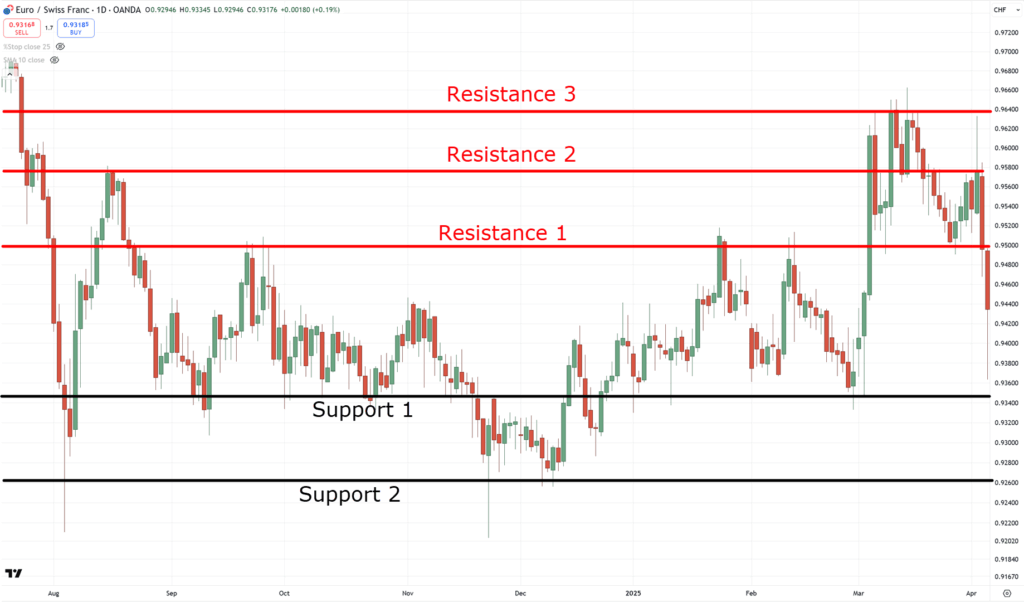

What I imply is that should you present this identical chart to 2 different folks, they might nicely have plotted very otherwise…

After all, you possibly can say:

“These had been minor help; it shouldn’t have been plotted!”

“We’d like extra knowledge, zoom out extra!”

However that’s the factor…

There are too many components that you possibly can add!

And what occurs whenever you add extra components or variables?

That’s proper…

Inconsistency!

Most significantly, it makes it nearly unimaginable to backtest your methods.

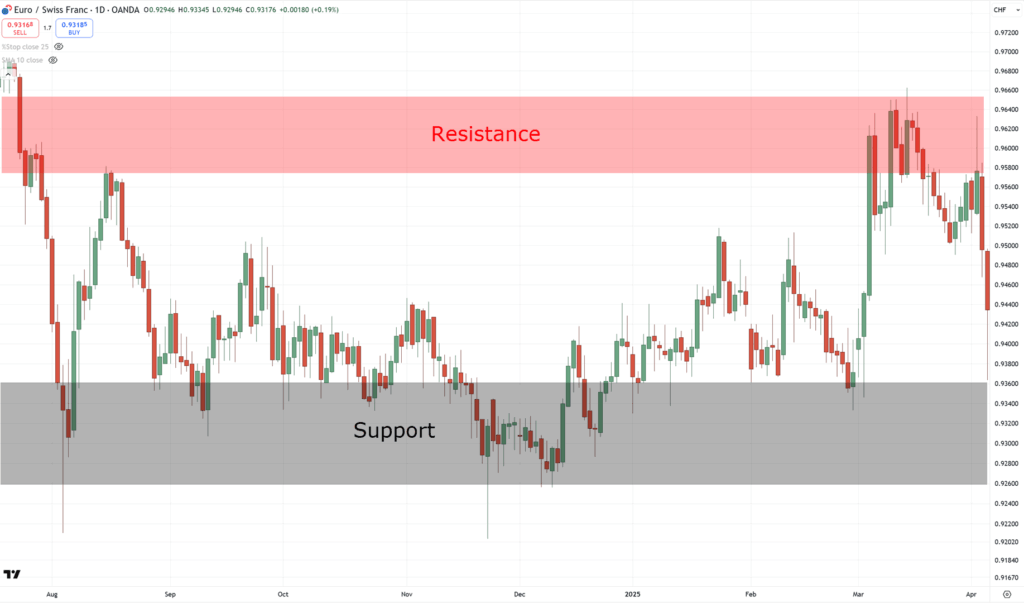

So, what if we simplify as an alternative?

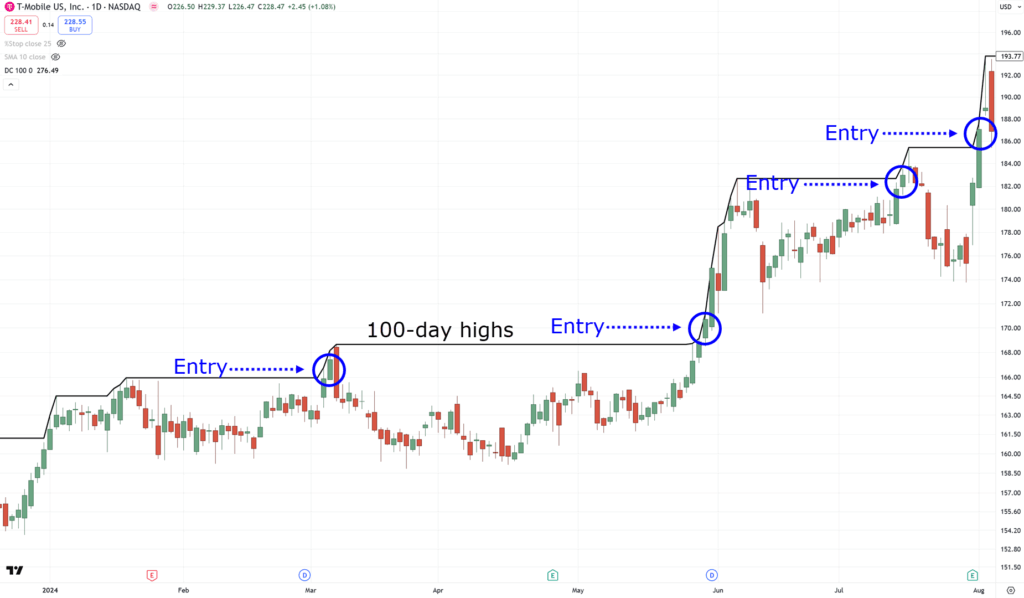

Let’s say you solely purchase every time the value makes a 100-day excessive…

…are you able to plot on the chart what number of instances you possibly can’ve entered?…

Nicely, there’s no mistaking it.

As a result of I’m 90% certain each you and I’d’ve plotted the identical…

And even should you confirmed it to a few extra folks, the outcomes would most probably stay the identical.

As you may see, there’s consistency!

However I’m certain you’re considering proper now:

“Does it work?”

Nicely, right here’s the excellent news…

The consistency makes it far simpler to check reliably and precisely.

In truth, it’s that consistency which makes it a real “system.”

Because it’s all black and white.

And that’s what we’ll be specializing in for the remainder of this information.

After all, entries are only one a part of the technique….

What else do it’s essential hold “systematic” when constructing a worthwhile buying and selling system?

Let me present you…

The Worthwhile Buying and selling System Guidelines

One essential facet is defining your guidelines.

Whereas constructing a worthwhile buying and selling system is extra than simply indicators, you want these components nailed down:

- Market Choice

- Indicators

- Entries

- Place Sizing

- Exits

Let’s do a fast rundown, we could?

Market Choice

Nicely, if all you do is purchase shares and crypto primarily based on suggestions and rumors…

You then wager you’re going to have inconsistent outcomes!

So, ensure you undertake a market choice rule.

It forces you to search for markets to commerce persistently and as systematically as you may.

Indicators

Charts can typically develop into very cluttered, can’t they?

That is the place numerous merchants fail.

You could categorize the indicators that you’ll use.

For instance:

One indicator in your development filter (if ever).

One indicator for entries.

One indicator in your cease loss.

One indicator in your exits.

Only one for every!

Make sure that every indicator enhances the chart.

Entries

Constructing on our earlier instance, that is the place you may apply a easy “if this, then that” thought course of.

For instance…

If the value closes and makes a 100-day excessive, you then enter a protracted place on the subsequent candle’s open.

If the value closes beneath RSI 30, then you may enter a protracted place on the subsequent candle’s open.

No ambiguity right here!

The identical idea should apply to different indicators as nicely.

Place Sizing

This mainly falls beneath threat administration.

When you commerce shares, you’re possible utilizing portfolio allocation.

Nonetheless…

When buying and selling CFDs or coping with leverage, a typical place sizing technique is to threat 1% of your capital per commerce when the value hits your cease loss.

If you wish to be taught extra, test it out right here.

Exits

Hold exits in step with being as “systematic” as doable when constructing a worthwhile buying and selling system.

You’ll be able to’t say:

“I’ll exit my commerce as soon as the value hovers beneath the realm of resistance.”

“I’ll exit my commerce as soon as the candle makes a break of construction.”

Preserve the If-This-Then-That method…

If the value closes beneath the 50-period transferring common, exit the commerce on the subsequent candle’s open.

Don’t deviate.

There are lots of of paths to constructing a worthwhile buying and selling system.

Whereas the checklists I share with you ensure you’re getting in the best route, you’re sure to seek out many techniques on the market that won’t even work within the markets…

…and that’s regular!

Constructing a sturdy system takes time.

However what if I informed you there’s a shortcut?

In any case, there’s no must reinvent the wheel.

Don’t fear, the whole lot you’ve realized to date nonetheless applies.

Test it out.

The RETT Framework: Your Key to Constructing a Worthwhile Buying and selling System

The RETT framework stands for:

- Learn buying and selling books that comprise backtest outcomes

- Extract the buying and selling ideas

- Check the buying and selling system

- Tweak the buying and selling system

Let me clarify.

Learn buying and selling books that comprise backtest outcomes

The primary a part of this framework alone will prevent lots of of hours of experimentation on what works and what doesn’t.

Why?

Merely put, it positions you to face on the shoulders of giants.

Listed below are some wonderful examples to get you began:

- Following the Development by Andreas Clenow

- Unholy Grails by Nick Radge

- Imply Reversion Buying and selling Programs by Howard B Bandy

The perfect half is that it doesn’t must be solely books anymore.

You might simply as simply acquire information from articles or analysis papers!

The important thing level is that they need to comprise an entire, worthwhile buying and selling system that works within the markets.

Extract and perceive the buying and selling idea

Crucially, you by no means need to take any backtest by others without any consideration.

Certain, it’s invaluable info.

However you need to ensure you additionally look past the numbers, too.

Ask an important questions:

- What are the core rules behind this buying and selling system?

- Why does it work?

- When does it underperform?

- Is that this one thing that may swimsuit me?

Always remember that you’ll be entrusting your hard-earned cash into the system!

And that’s the entire level of understanding how the buying and selling ideas work.

When you don’t perceive the technique, how will you belief it?

Check the buying and selling system

Right here comes the (considerably) tough half…

…backtesting the technique your self!

Nonetheless, that is the place you begin making the system your personal.

It lets you confirm whether or not or not the numbers you noticed are legit and a part of a worthwhile buying and selling system.

There are a number of methods to check this, and I’ll share extra particulars with you within the later part.

However on the finish of the day, you basically must hold this stuff in thoughts:

- Backtesting platform

- Knowledge supply

- Code in your buying and selling system

Are you able to see how what you noticed earlier comes into play?

It actually highlights the significance of preserving your technique as systematic as doable.

No fundamentals, no help and resistance, no development traces, no ambiguity.

All black and white and systematic!

Now…

The purpose right here is to attain no less than 80% much like the outcomes you noticed within the e book or article.

It’s unlikely you’ll get 100% the identical as a consequence of totally different knowledge.

Nonetheless, if your personal private backtest is basically much like the worthwhile buying and selling system you noticed within the e book, you then’re nearly able to go!

Nicely, nearly…

Tweak the buying and selling system

That is the most effective half – tweaking the technique to your wants!

It’s precisely why it’s essential nail down the “E” within the RETT framework, to extract and perceive the buying and selling idea.

If a buying and selling system is known nicely sufficient, altering an indicator setting mustn’t break it.

I’ll give an instance.

Let’s say a system makes use of a 20-period transferring common to path your cease loss…

However you inform your self:

“Ah man, this trailing cease loss is simply too tight.”

“I need to enhance the trailing cease loss so my trades final a bit longer.”

What do you have to do?

You enhance your trailing cease loss to a 50-period transferring common…

If that “worthwhile” buying and selling system breaks down and begins dropping, then there’s a excessive probability that the technique will cease working as quickly as market situations change.

Make sense?

By fastidiously following the RETT framework, you can begin tweaking the buying and selling system in keeping with your threat urge for food.

It shouldn’t have an effect on the entire technique simply by inserting new indicators!

Perceive it, check it, after which polish it.

So now, do you need to see an entire instance of how the RETT framework, nicely, works?

Let me present you!

The RETT Framework: A Worthwhile Development Following System

It is best to completely undergo the entire means of verifying this method in your finish.

In any case, that’s the entire level of this information!

At any price, right here’s how I went about it…

Learn buying and selling books that comprise backtest outcomes

The e book that I’ll be referencing is Andreas Clenow’s Following the Development.

It’s an incredible learn because it additionally goes behind the psychology of what it means to be a development follower.

From the title, you may in all probability guess that I’ll be utilizing a development following system!

Extract the buying and selling ideas

The precept behind development following boils right down to this:

- Commerce within the route of the development

- Purchase excessive, promote increased (or promote low, cowl decrease)

- Path your cease loss so you may trip the development

- Commerce quite a lot of markets to extend your odds of capturing a development

- Danger a fraction of your capital in order that losses are minimal

There are different buying and selling strategies, corresponding to imply reversion and momentum, however on this case, I’ll be specializing in development following.

You possible know that development following techniques revenue when markets are trending (clearly)…

…they usually go right into a dropping streak or drawdown when markets are ranging.

However all the time make an effort to grasp when your technique works and when it doesn’t.

Cut back the variety of surprises!

Check the buying and selling system

You should use the identical buying and selling system that was shared within the e book or provide you with your personal (so long as it goes together with the ideas of Development Following).

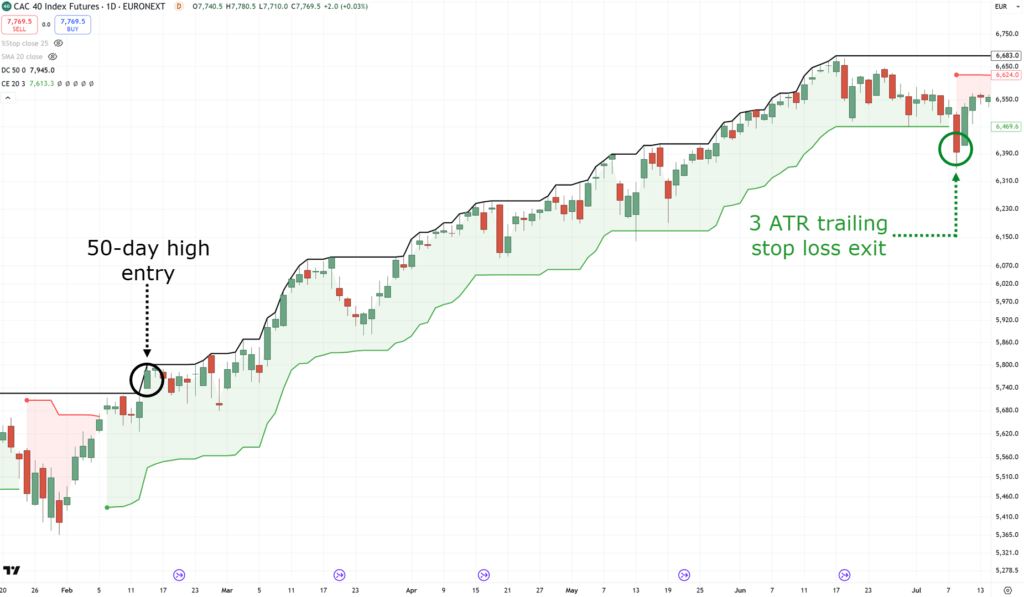

So, right here’s a Development Following system I got here up with…

The Guidelines (lengthy):

- Go lengthy when the value closes at its highest over the past 50 days

- 3 ATR is your trailing cease loss

- You threat 1.5% on every commerce

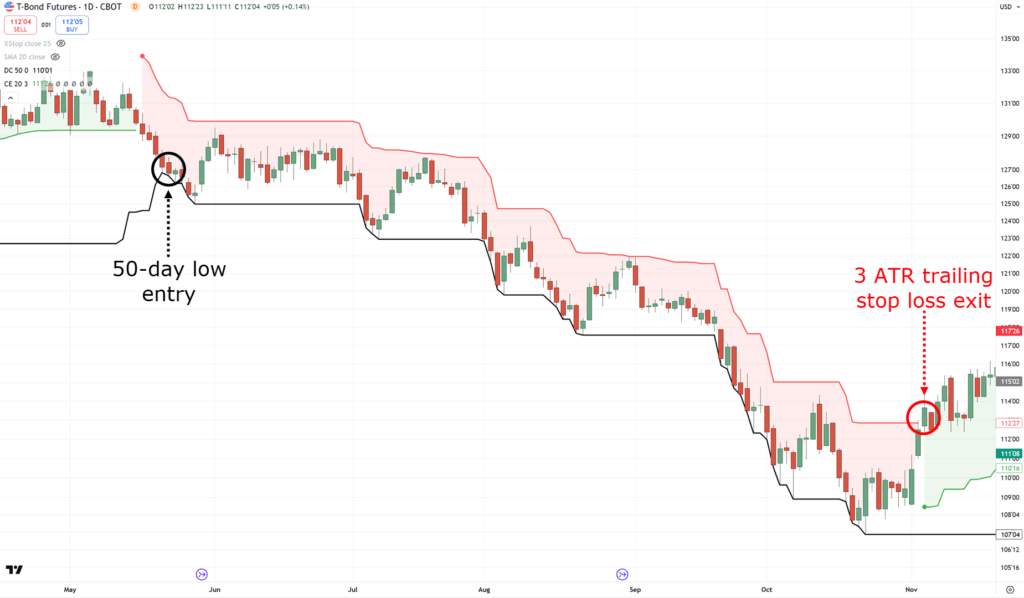

The Guidelines (brief):

- Go brief when the value closes at its lowest over the past 50 days

- 3 ATR is your trailing cease loss

- You threat 5% threat per commerce

Markets traded:

- Gold, Copper, Brent Crude Oil, Platinum, Pure Fuel

- USDJPY, AUDUSD, NZDUSD, EURUSD

- China A50, Nasdaq 100, Canada 60, Hold Seng Index 30, France 40, S&P 500

- Canada Bond 10YR, Euro BTP, US T-Be aware 5YR

- Soybean Meal, Feeder Cattle, Corn, Soybean, Soybean Oil, Tough Rice

And simply so we’re clear, right here’s how the technique seems in a chart:

And right here’s one other one for shorts…

These are cherry-picked charts, so there will probably be losses!

However the level is to point out you what the technique seems like on the charts in order that you realize what to visualise on.

Lastly, we use the 50-day donchian channel in addition to the 20-period ATR multiplied by 3 by way of the chandelier exit indicator.

Acquired it?

Transferring on…

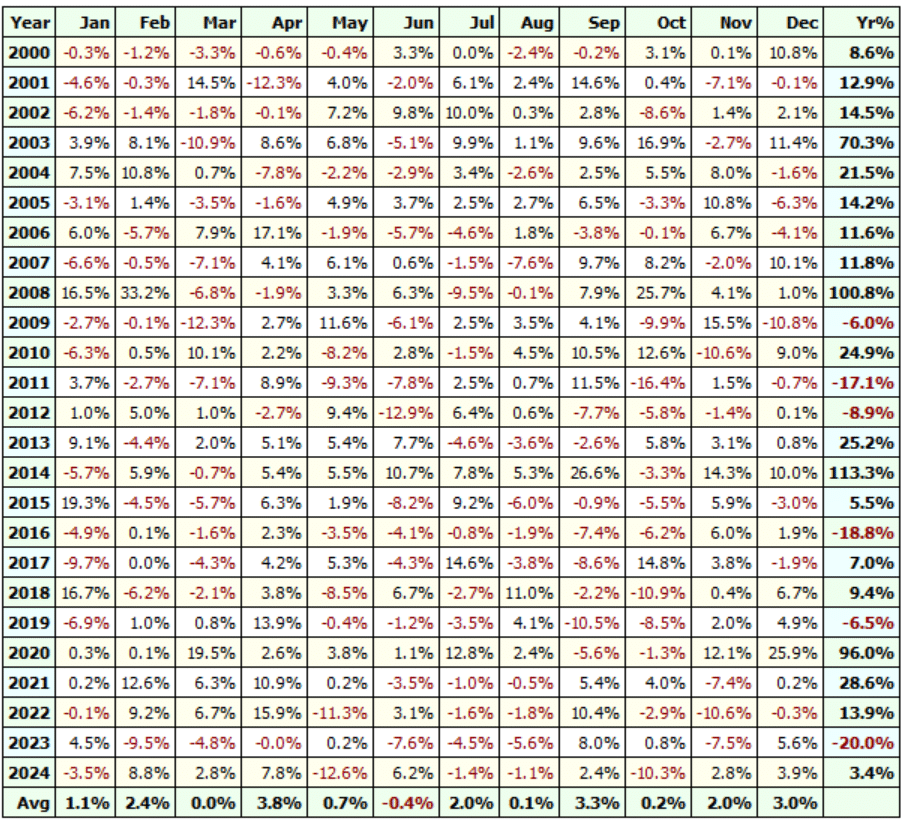

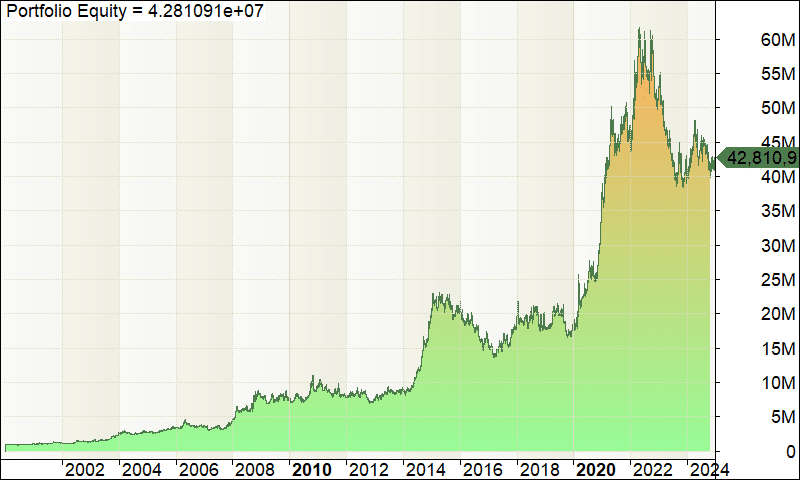

The backtest interval is from 2000 to 2024. That’s 24 years of knowledge, together with the dot-com bubble and 08-09 monetary disaster.

Outcomes:

- Successful price: 34%

- Common acquire to loss: 20

- Annual return: 16.21%

- Most drawdown: 38%

Right here’s the breakdown for each month and yr…

And at last, the fairness curve…

Tweak the buying and selling system

I do know…

…that 41% drawdown will need to have been fairly tough, proper?

However the truth is that the system has an edge out there, even via the monetary disaster.

Right here’s the excellent news, too…

You’ll be able to tweak the system to super-charge your returns, corresponding to:

- Rising the markets on the record

- Rising the ATR worth

- Rising the 50-day excessive or low entries

For the reason that system is strong, it might most probably nonetheless work even should you change the indicator settings.

However discovering which settings work finest for you is as much as you to tweak and check out!

Now, let me present you how one can begin backtesting by yourself…

Which Backtesting Platforms to Use on The way to Construct A Worthwhile Buying and selling System

On this remaining part…

I’ll cut up it into three components on how one can get began on constructing your worthwhile buying and selling system:

- Backtesting platform

- Knowledge supply

- Programming

Every part deserves an article by itself, to be sincere!

However since this information is designed to chop your studying curve in half, I’m providing you with the important overview.

Acquired it?

So, first…

Backtesting platform

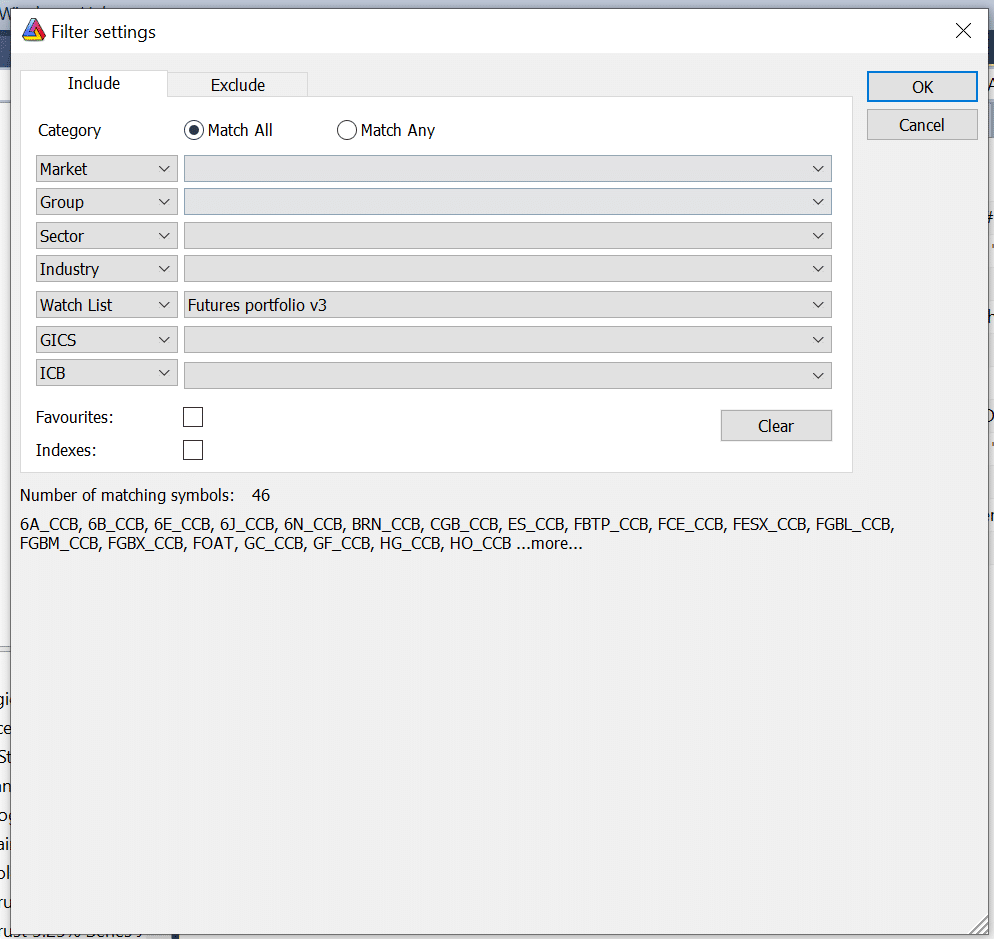

The platform that I take advantage of to backtest my methods is Amibroker…

What makes Amibroker highly effective will not be its charting capabilities.

It’s way more about the way it can backtest throughout a number of markets on the identical time!…

Because of this, you get a way more balanced thought of how your portfolio will carry out whenever you begin buying and selling your system.

After all, there’s extra to Amibroker than what I’ve simply shared with you, however you’ve gotten my core cause for utilizing it now.

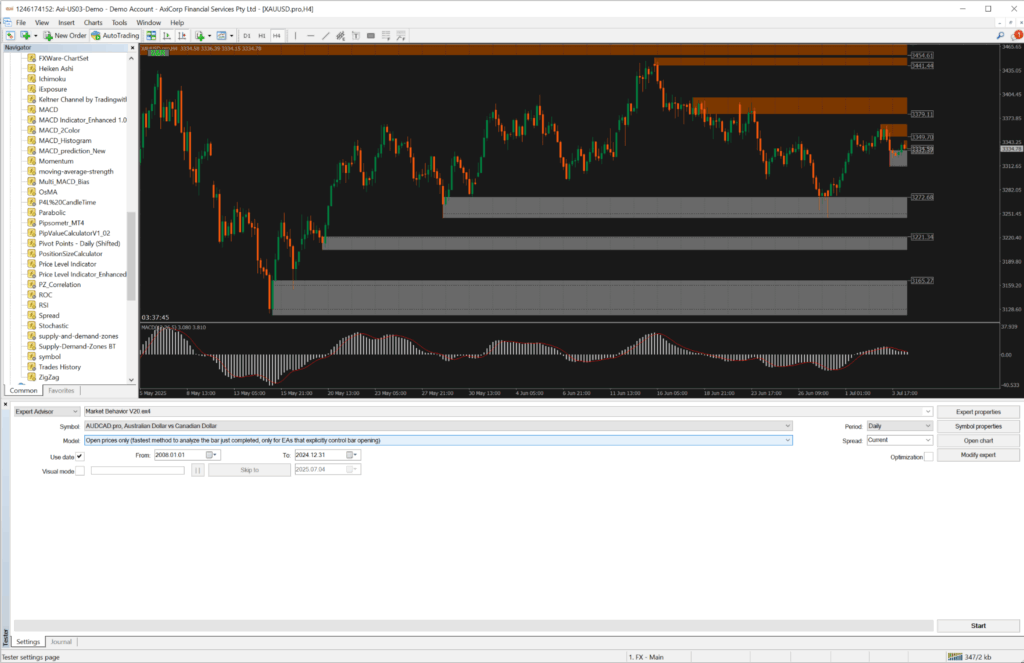

One other widespread backtesting platform that’s free and one that you just’ve most probably used already is MetaTrader 4…

Whereas it’s actually accessible, it’s not the most effective instrument for portfolio testing.

You must hit ‘backtest’ on every of the markets you intend to commerce on, after which manually mix their stories.

However should you’re somebody who focuses on the decrease timeframes and you intend to concentrate on a number of markets, then MetaTrader 4 can put you on the trail of short-term algorithmic buying and selling.

Now…

There are different backtesting platforms that I haven’t tried however heard good issues about.

So, you may try a pair extra right here:

Subsequent up…

Knowledge supply

Between the three, that is probably the most essential.

As a result of it doesn’t matter what backtesting platform you utilize, you will need to have correct knowledge.

There have been loads of circumstances the place a method exhibits revenue in free market knowledge, however fails miserably on extra correct knowledge.

Right here’s a fast rundown on a few of the knowledge sources I like to recommend:

- Norgate Knowledge – That is the info supply I take advantage of for my very own buying and selling. It covers US shares, Australian shares, Foreign exchange, and Futures.

- CSI Knowledge – That is one other good knowledge supply to contemplate. It covers US shares, Australian shares, Foreign exchange, Futures, LSE, and Canadian shares

- Tick Knowledge Suite – The draw back is that it solely covers a number of markets and principally the foreign exchange markets; nonetheless, it supplies very detailed tick knowledge, which makes it appropriate for testing and optimizing short-term buying and selling methods via MetaTrader 4 or 5

Now comes the ultimate a part of the equation!

Programming

That is the place you’ll must convert your buying and selling system right into a language the backtesting platform can perceive.

(And likewise why I taught you to be as systematic as doable!)

Because of this, this stage usually requires some coding information.

So, should you’re accustomed to programming, you then do have an edge.

And should you don’t?

Nicely, except for studying methods to code (which I do suppose is one of the best ways to go about this), there are different choices…

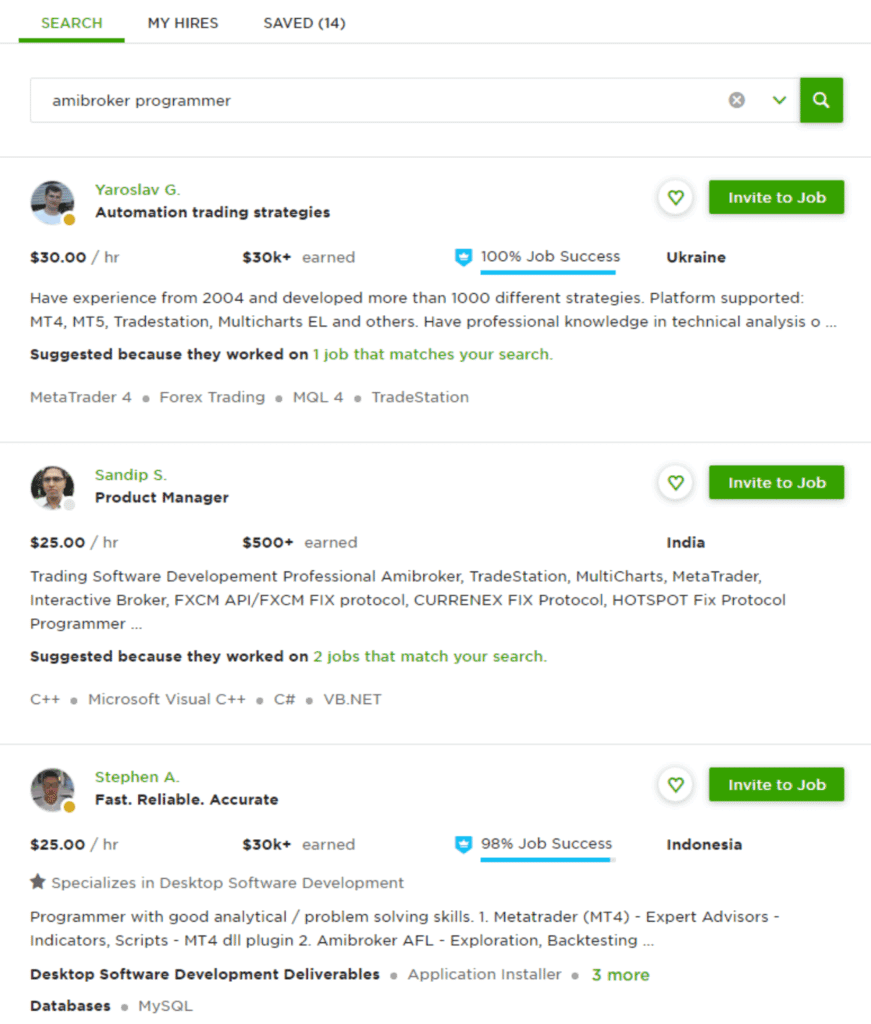

Rent a programmer

There’s a ton of programming languages on the market, much more than backtesting platforms.

So, you will need to discover a programmer who particularly focuses on the identical coding language that your backtesting platform operates.

One option to do it’s to rent somebody via Upwork…

Admittedly, you possibly can attempt to use ChatGPT to generate code…

However primarily based on my expertise, you already must have coding information to make that work.

Whereas tremendous fundamental methods could be generated via AI, when you begin including threat administration guidelines, commerce administration guidelines, and screener guidelines…

…it will possibly rapidly collapse.

So, what if there’s a method you may generate buying and selling methods with out studying methods to code?

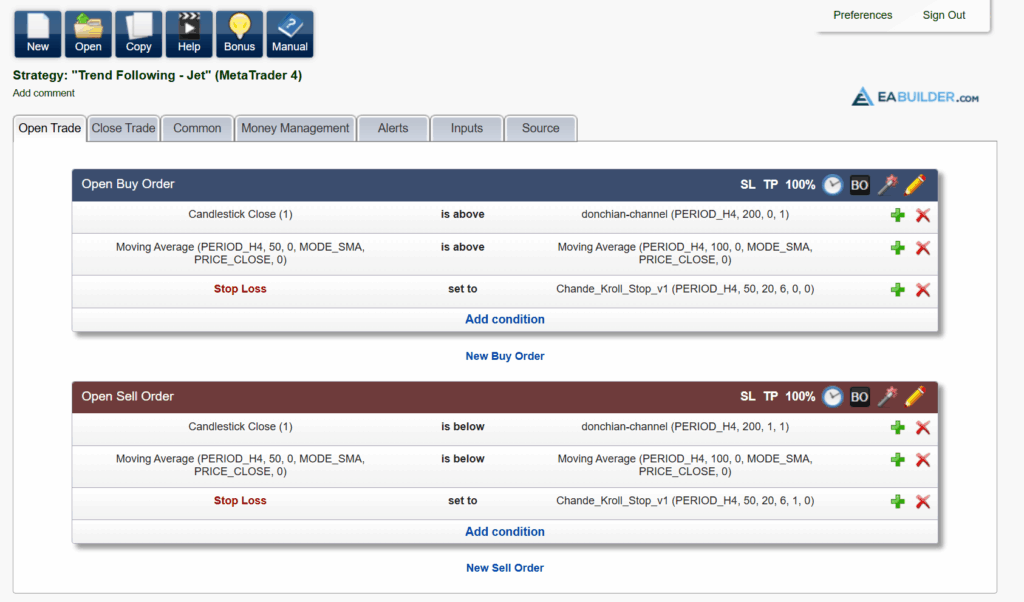

One choice is eabuilder:

It’s not free by any means, but it surely actually does the job.

When you’re accustomed to MT4 and you’ve got a few customized indicators readily available…

Then you may add these indicators and use them that can assist you develop a worthwhile buying and selling system…

One draw back is that it solely helps MetaTrader 4, MetaTrader 5, and TradeStation.

It may prevent numerous effort and time, although!

So, that’s just about it!

A whole and full-context information on methods to construct a worthwhile buying and selling system.

With that stated…

Let’s do a fast recap on what you’ve realized at this time.

Conclusion

Constructing a worthwhile buying and selling system could be a laborious, long-term journey.

But it surely actually places you into an elite minority of merchants.

As an alternative of infinite trial and error, you start utilizing instruments to grasp which techniques are actually efficient and truly uncover how they work.

It’s an important step in your growth.

Right here’s what you’ve realized at this time:

- To construct a worthwhile buying and selling system, eradicate discretion with clear, rule-based methods.

- Guarantee your technique contains market choice, place sizing, and indicators for entries, exits, and commerce administration.

- Use the RETT method: Learn, Extract, Check, and Tweak concepts to suit your type.

- Backtesting is essential—have the best platform, knowledge, and a way for creating your system, whether or not by coding it your self or outsourcing.

With that stated…

What are a few of your experiences in looking for that worthwhile buying and selling system?

Is it your first time excited about the distinction between techniques buying and selling and discretionary buying and selling?

How about backtesting platforms?

Are there different platforms you may advocate?

Let me know within the feedback beneath!