The JUP market is at a crossroads: on one hand, it’s going through robust promoting stress, whereas on the opposite, it’s supported by constructive information and technical restoration alerts.

Will JUP quickly discover a backside to bounce, or proceed its downward slide?

Sponsored

Sponsored

Basic Motivation

Jupiter (JUP) has lately introduced a collection of vital developments that might act as medium-term catalysts. The challenge launched JupNet built-in with BitcoinKit, opening the door for native BTC cross-chain DeFi. If profitable, JupNet would permit BTC capital to simply move into DeFi purposes equivalent to lending, yield farming, and multi-chain liquidity, thereby enhancing Jupiter’s sensible use case.

On the similar time, 21Shares – certainly one of Europe’s most respected crypto funding product issuers – unveiled AJUP, an ETP-like product enabling direct publicity to JUP. The presence of AJUP helps JUP scale back its dependence on retail-driven flows and will increase recognition from conventional markets.

If successfully carried out, these strikes will enhance the utility of the ecosystem and strengthen Jupiter’s means to draw institutional capital.

Technical Alerts: Bounce Potential from the $0.41 Zone

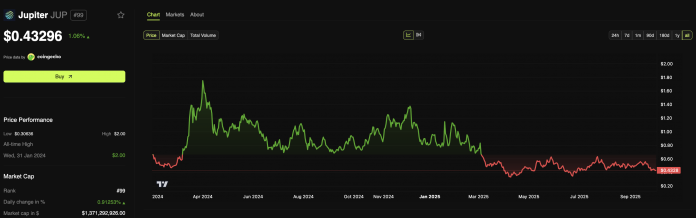

On the spot market, nonetheless, JUP has been below heavy stress as the worth plunged from its peak. Information from BeInCrypto exhibits that JUP has fallen by 78% from its all-time excessive, marking a steep JUP drop. Buying and selling volumes and liquidity information spotlight the dimensions of sell-offs, whereas market cap and TVL counsel a spot between value motion and on-chain fundamentals.

Technically, short-term charts present JUP bouncing barely from assist round $0.41. Shifting Averages close to $0.44–$0.45 act as key resistance ranges. Indicators equivalent to MACD trace at a bullish crossover, whereas RSI climbs up from oversold territory. This means a good likelihood of a short-term rebound.

Sponsored

Sponsored

Nonetheless, bears nonetheless dominate total momentum. A decisive break above $0.45 may goal $0.48 subsequent.

That mentioned, neighborhood sentiment performs a vital function. Partnerships alone will not be enough. Many neighborhood members name for measures like buybacks or token burns to scale back circulating provide and restore confidence, which may assist value motion.

“yall needa do some extra buybacks and burns or one thing man. That is pitiful value motion. I do know yall are making a shit ton and will have a wholesome warchest to color a pleasant chart to provide traders and holders one thing to consider in.” – X consumer famous.

Information from DefiLlama exhibits that Jupiter continues to be one of many high 4 DEX Aggregates by way of buying and selling quantity previously 24 hours. Cumulative charges and income thus far are $1.24 billion USD and $313 million USD, respectively.

Moreover, as reported by BeInCrypto, Meteora’s allocation of three% TGE to JUP stakers is seen as a wise liquidity transfer to encourage staking and create sustainable token demand. If liquidity and staking initiatives are executed properly, they may ease short-term promoting stress and enhance the on-chain construction.

In abstract, the trail to restoration for JUP is actual however not computerized. It is dependent upon whether or not constructive catalysts might be executed successfully, promoting stress subsides, and neighborhood confidence is restored via governance measures or significant on-chain changes.