A large month-to-month burn of three.2 billion LUNC tokens has piqued the curiosity of Luna Traditional’s group, which carries on supporting the downtrodden community. Naturally, the month-to-month burn price is especially important in decreasing the over-minted LUNC provide, which might finally lay the groundwork for re-adoption if a contemporary utility case is discovered alongside the best way.

Large LUNC Provide Elimination Is Overshadowed By..

Exactly, there’s 5,551,675,494,775 LUNC tokens nonetheless in circulation on the time of publication, initially ranging from 6.48 trillion. Moreover, greater than 15% of the altcoin’s provide is locked away in staking actions, which provides a way of shortage to Terra Luna Traditional (LUNC).

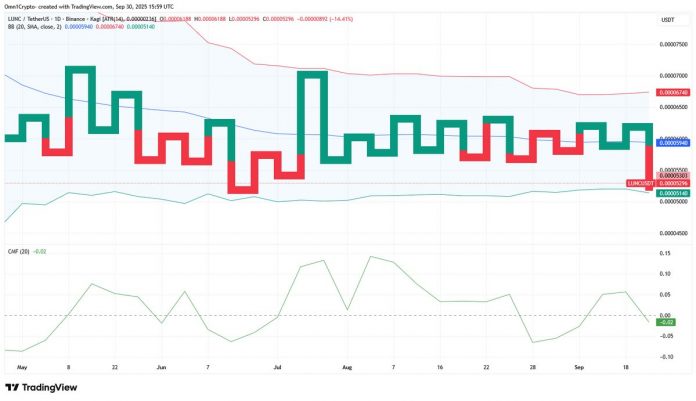

Nevertheless, Luna Traditional’s Lag persists: the year-long downward spiral had despatched the game-tested Layer-1 altcoin to retest $0.000052, the identical key assist degree that had helped LUNC rebound consecutively in June & April, 2025. Whereas this erratic Terra Luna Traditional worth motion isn’t precisely new, OKX, one of many globe’s main exchanges, delisted quite a few LUNC pairs.

Every week in the past, OKX introduced the delisting of LUNC/USDT, LUNC/USD, USTC/USDT, in addition to the associated pairs on Perpetuals markets. With this, LUNC’s chain takes one other enormous hit in buying and selling quantity, which is already garnering simply over $11 million on most days in September.

LUNC Worth Will get Beat Down On Key Proposal Scrap

One other key difficulty behind this LUNC worth turbulence is the inconsistent whale assist. Large-time crypto buyers, popularly known as crypto whales, haven’t proven sturdy shopping for energy on the present worth vary of $0.000052, regardless of this assist degree helping in consecutive bounce backs earlier this 12 months.

This might be attributable to division amongst LUNC members, because the altcoin group not too long ago refused a key stablecoin proposal. The provide in query, proposal #12192, didn’t obtain sufficient LUNC member assist for approval, regardless of the USTD stablecoin having an automatic yield-bearing focus that might entice new buyers.

Delve into DailyCoin’s trending crypto scoops:

SEC Axes XRP, ADA, SOL ETFs: Staking Desires Crushed?

Jim Cramer’s “Purchase Crypto” Name Shooks BTC Group

Folks Additionally Ask:

It highlights a latest milestone in Terra Luna Traditional’s burn mechanism, the place roughly 3.2 billion cash have been incinerated (by way of taxes, Binance charges, and group efforts), decreasing the overall provide to underneath 5.6 trillion & pushing cumulative burns previous 400 billion since 2022.

The burn created short-term shortage hype, sparking a fast 10-20% rally as merchants wager on lowered provide driving worth; much like previous occasions just like the 1.6B weekly burn in February 2025, which fueled a ten% surge amid broader market restoration.

Restricted ecosystem progress hampers sustained beneficial properties—TVL has dropped to only $800K amid low dApp exercise, whereas excessive promote strain from liquidity swimming pools overshadows burns; the 2022 UST collapse stigma additionally erodes investor confidence.

Burns come from on-chain transaction taxes (a portion auto-burned), Binance’s payment donations (over 50% of whole burns, e.g., 760M in Feb 2025), and group/validator contributions, with latest weekly charges hitting 1-2B tokens.

Momentary boosts might fade with out utility progress; analysts see potential 50% rally to $0.00008 if TVL rebounds, however descending patterns recommend draw back danger to $0.000056 assist until broader adoption kicks in.