Key takeaways

-

Heidrick & Struggles surged 19.6% after asserting a $1.3B go-private acquisition deal.

-

The $59-per-share all-cash supply marks a significant milestone in HSII’s transformation technique.

-

The buyout highlights continued non-public fairness curiosity in human capital and consulting corporations.

Shares of Heidrick & Struggles Worldwide, Inc. (HSII – Free Report) surged 19.6% on Oct. 6, after the worldwide government search and consulting agency introduced that it had entered right into a definitive settlement to be acquired by a non-public funding consortium in a deal valued at roughly $1.3 billion. The all-cash transaction, priced at $59 per share, represents a considerable premium over the corporate’s prior closing worth. The deal marks a significant milestone for HSII, which has developed from a conventional government search enterprise right into a broader management advisory agency with a powerful presence in organizational consulting, tradition shaping and on-demand expertise options.

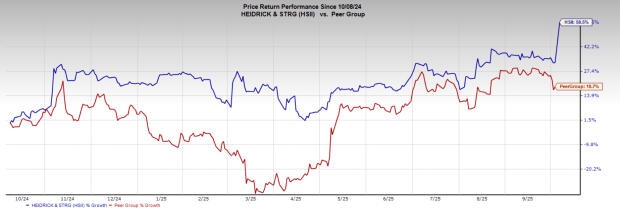

Over the previous few years, HSII, a Zacks Rank #2 (Purchase) firm, has efficiently diversified its choices to incorporate digital transformation and expertise analytics, permitting it to compete extra successfully with bigger rivals corresponding to Korn Ferry (KFY – Free Report) and ManpowerGroup Inc. (MAN – Free Report) . KFY and MAN presently carry a Zacks Rank #3 (Maintain). Over the previous yr, HSII has gained 58.5% in contrast with its peer group’s 18.7% progress.

Picture Supply: Zacks Funding Analysis

HSII’s anticipated earnings progress price for the following yr is 17.6%. The Zacks Consensus Estimate for its current-year earnings has improved 2.4% over the previous 60 days. It has a VGM Rating of A.

Market members interpreted the acquisition as a sign that personal fairness continues to see worth in skilled companies and human capital companies, notably these with robust consumer relationships. HSII inventory opened sharply larger on Monday and maintained good points all through the session, closing close to the deal worth. In distinction, the broader market noticed blended outcomes, with the Dow Jones Industrial Common barely decrease and the S&P 500 and Nasdaq Composite reaching file highs on the again of renewed enthusiasm for synthetic intelligence and semiconductor shares. Traders seem enthusiastic concerning the buyout, which guarantees rapid worth realization for shareholders in a risky fairness market surroundings.

The corporate’s board of administrators has unanimously authorized the transaction, which is predicted to shut within the first half of 2026, topic to regulatory approvals and customary closing situations. Upon completion, Heidrick & Struggles will develop into a privately held entity, and its shares might be delisted from the Nasdaq.

Need the most recent suggestions from Zacks Funding Analysis? Obtain 7 Finest Shares for the Subsequent 30 Days. Click on to get this free report