A crypto selloff triggered by macro tensions worn out $19.37 billion in leveraged trades in simply 24 hours. Nevertheless, now that the storm has handed and the chips have fallen the place they did, let’s take a look at how the 2 greatest cryptocurrencies are faring in the intervening time.

However first, a precursor. On 10 October, 2025, US President Trump introduced his commerce conflict in opposition to China in a response to China limiting fee earth mineral exports.

(Supply: CoinGecko)

He stated, “Primarily based on the truth that China has taken this unprecedented place, and talking just for the united statesA., and never different Nations who had been equally threatened, beginning November 1st, 2025 (or sooner, relying on any additional actions or adjustments taken by China), the USA of America will impose a Tariff of 100% on China, over and above any Tariff that they’re presently paying.”

lol WHAT DID CHINA THINK TRUMP WOULD DO?!?!

100% tariffs on high of all the opposite tariffs. pic.twitter.com/gcPhIbl4C5

— China Uncensored (@ChinaUncensored) October 10, 2025

Moreover, he introduced export management of crucial software program, that drove the hypothesis of a full blown tariff conflict between the 2 international locations, crashing the crypto market.

.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

0.82%

Bitcoin

BTC

Value

$111,593.88

0.82% /24h

Quantity in 24h

$60.13B

<!–

?

–>

Value 7d

// Make SVG responsive

jQuery(doc).prepared(operate($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

dropped to $107,468 on Friday, earlier than bouncing again to shut at $114,559 down practically 6% for the day. The worth motion noticed a short uptick and touched $110,000 once more, earlier than slipping by 1.82% on Saturday to finish at $112,69.

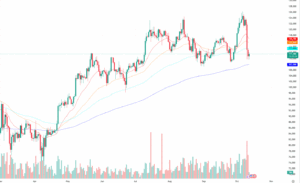

For now, BTC is buying and selling under its 50-day EMA, however has maintained its place above the 200 EMA, signaling a bearish short-term however the long-term bullish sentiment is undamaged.

Supply: TradingView

If it breaches via $115,000 it could carry its 50-day EMA into play. If it manages to carry and maintain above that stage, it’s doable for BTC’s value to maneuver in the direction of the $125,761 stage.

$BTC replace

BTC hit new ATHs, then flash-crashed via all liquidity packing containers right down to $102K.

A fast restoration from $108K reveals sturdy absorption, however $116K (Oracle line) should flip to help for upside continuation.This wasn’t a traditional correction, it was a liquidity flush.… pic.twitter.com/CoTZ5Z80y5

— Pirow (@DanielPirow) October 12, 2025

On the flipside, if BTC falls under $110k, the subsequent main help is at $100,000.

EXPLORE: High 20 Crypto to Purchase in 2025

ETH Secure At $3,825 After Large Crypto Selloff

Panic liquidations noticed ETH value slip briefly to round $3,500. Since then nonetheless, ETH has bounced again to reclaim the help stage at $3,825. It’s presently buying and selling at

.

A whale shorted $600 million in Bitcoin and $300 million in ETH, contributing to just about $19 billion in a crypto selloff, one of many greatest in current historical past.

BREAKING:

WHALE JUST OPENED A MASSIVE $330M $ETH SHORT

IS THE DUMP COMING? pic.twitter.com/f49YjKhGmE

— AlΞx Wacy

(@wacy_time1) October 10, 2025

Evaluation Donald Dean famous that $3,825 is now the important thing short-term help stage. Nevertheless, this relies as macro developments might result in extra downsides the approaching week.

$ETH $ETHUSD Ethereum – Massive Drop, What's Subsequent

As talked about, $3825 seems to be our short-term help after the massive transfer down from a whale shorting BTC together with mass liquidations. $19 Billion Impression for crypto, unreal.

Monday might present further weak spot, however long-term… https://t.co/unr786Qx7A pic.twitter.com/f6lYzt3mC3

— Donald Dean (@donaldjdean) October 11, 2025

Regardless of the current shakedown, ETH’s technical setup remains to be promising. Dean identified to a bull flag sample forming on the each day chart, which indicators a possible rebound if ETH maintains about $3,875.

If the help holds, ETH can probably goal resistance ranges between $4,500 and 5,766. On the flipside, a drop under $3,500 might result in deeper help zones.

(Supply: TradingView)

Market analyst Alex Wacy said that the current shakedown has cleared extra leverage and weak palms, setting the stage for a powerful rally and that ETH might attain a brand new ATH within the coming weeks.

Humorous how so many “specialists” are out of the blue calling for a BEAR MARKET.

Leverage wiped. Liquidity cleared. Weak palms capitulated.

That is precisely when MASSIVE RALLIES are born.

All indicators to me level to a brand new $ETH ATH within the coming weeks. pic.twitter.com/E5xOoqTh21

— AlΞx Wacy

(@wacy_time1) October 11, 2025

In line with Wacy, ETH might attain someplace between $4,300 and $5,175 in October and round $12000 in the long run by late 2025.

EXPLORE: Greatest New Cryptocurrencies to Spend money on 2025

WLFI, Aster and Sonic Labs Launch Main Token Buybacks After The Crypto Crash

After the world was witness to one of many worst crypto crashes in current occasions, three altcoin tasks have stepped in and launched large token buybacks, meant to cut back promoting strain and restore confidence amongst customers.

World Liberty Monetary (WLFI), introduced a $10 million buyback utilizing the USD1 stablecoin. In line with blockchain information, the buyback was carried out regularly utilizing a TWAP mannequin, which helps unfold purchases over time and keep away from sharp value actions.

Whereas others panic, we stack.

At present we purchased $10 million value of $WLFI — and this gained’t be the final time.

We all know how the sport is performed.https://t.co/do3wPuiuZc— WLFI (@worldlibertyfi) October 11, 2025

The repurchased tokens can be faraway from circulation to help value over time.

Aster moved 100 million of its ASTR tokens from its treasury to purchase again from the market, simply after the platform rolled out its Stage 2 Airdrop Checker.

Sonic Labs dedicated $6 million to buy its native $S tokens, which had been added to the treasury.

Whereas most networks had been struggling to remain on-line, Sonic operated flawlessly. Zero pending transactions, near-instant finality, and sub-cent charges throughout each DEX and app.

And whereas others pulled again, we stepped ahead by including $6 million in open-market shopping for, rising… https://t.co/56bYdob3rN pic.twitter.com/BjlyIkzm7D

— Sonic (@SonicLabs) October 11, 2025

It emphasised that community remained secure regardless of the crash, with CEO stating that native belongings could provide higher long-term returns than counting on stablecoins.

EXPLORE: Subsequent 1000X Crypto – Right here’s 10+ Crypto Tokens That Can Hit 1000x This Yr

Veteran Dealer Peter Brandt Is Bullish On Bitcoin, XRP, Ethereum, and XLM

Legendary dealer Peter Brandt believes BTC, ETH,XRP and Stellar (XLM) might be on the brink of transfer greater.

In his submit on X, he shared that BTC’s chart appears just like previous patterns that led to massive rallies.

Just a few remaining posts for the weekend, then I’ll depart you children along with your desires$XRP – only a minor response in larger theme of issues$BTC – bull nonetheless alive and properly$XLM – a bull waking from a nap$ETH – able to rock and roll

If I modify my thoughts I gained't let pic.twitter.com/rL1nVETYSn— Peter Brandt (@PeterLBrandt) October 11, 2025

He additionally stated the ETH is holding sturdy regardless of current market drops.

For XRP and XLM, Brandt identified indicators of accumulation, which means merchants may be quietly shopping for the dip and that these cash might observe the same path upwards.

In brief, his message being, quick time period volatility however, long run setup for these belongings look promising.

BitForex CEO Linked To $735M BTC Brief

A current on-chain investigation by crypto researcher “Eye”, has linked a mysterious whale on Hyperliquid who controls over 100,000 BTC to Garett Jin.

Jun is the previous CEO of BitForex, an alternate that was shut down following fraud allegations.

1/ An investigation into the alleged id of the mysterious Hyperliquid/Hyperunit whale, who holds over 100,000 BTC. Not too long ago, he offered over $4.23B in BTC to accumulate ETH and is similar particular person behind the $735M BTC quick order positioned on the identical platform. pic.twitter.com/WeNvmiYP8v

— Eye (@eyeonchains) October 11, 2025

In his submit on X, Eye identified to the whale’s primary pockets, named ereignis.eth. This pockets is related to a different ENS handle, garrettjin.eth, which leads on to Jin’s verified X account, @GarrettBullish, suggesting a powerful hyperlink between the 2.

Eye defined, “The ENS identify ereignis.eth (“occasion” in German) confirms his hyperlink to this pockets, figuring out him because the actor behind the large-scale operations on Hyperliquid/Hyperunit.”

The pockets’s transaction historical past additionally strains up with Jin’s enterprise dealings, together with transfers to staking contracts and pockets funded by exchanges he was beforehand related to, like Huobi (HTX).

Additionally, the pockets acquired and despatched funds tied to BitForex-related addresses and Binance deposits, which had been used to execute large trades, certainly one of which concerned $735 million value of BTC.

Not everyone seems to be satisfied although. Crypto analyst Quinten François argued that the proof is a bit too handy for his take.

It doesn’t add as much as me.

Why would you’ve got an .eth identify resulting in your X deal with in a pockets that immediately connects to market manipulation wallets and wallets for different crime?

I don’t assume anybody is silly sufficient.

— Quinten | 048.eth (@QuintenFrancois) October 12, 2025

The submit Can BTC And ETH Rebound After A $19B Liquidation Storm? appeared first on 99Bitcoins.