Buying and selling is straightforward, however folks make it laborious. I do know this as a result of, similar to you’re in all probability doing, I used to make buying and selling very laborious on myself. Once I first began buying and selling about 15 years in the past, it felt like I used to be always on the unsuitable aspect of the market. As quickly as I entered a place, it was as if somebody was inside my pc, ready to push worth within the different path. I actually felt like somebody was ‘buying and selling towards me’ and making an attempt to take my cash.

Buying and selling is straightforward, however folks make it laborious. I do know this as a result of, similar to you’re in all probability doing, I used to make buying and selling very laborious on myself. Once I first began buying and selling about 15 years in the past, it felt like I used to be always on the unsuitable aspect of the market. As quickly as I entered a place, it was as if somebody was inside my pc, ready to push worth within the different path. I actually felt like somebody was ‘buying and selling towards me’ and making an attempt to take my cash.

Does this sound acquainted to you??

In that case, it’s in all probability as a result of you aren’t conscious of the facility of pull backs or learn how to commerce them correctly. You might be in all probability getting into on the unsuitable time; simply when the markets are prepared to maneuver towards you. You might be doing this since you are getting into when it ‘feels’ good, as an alternative of when it makes goal, logical sense to take action.

Immediately’s lesson will present you why market pull backs or retracements are SO highly effective and why you want to begin specializing in them ASAP….

The idea behind buying and selling pull backs…

Everybody has heard the outdated cliché, “The development is your good friend till it ends”, however what precisely does “buying and selling with the development” entail? It may well appear imprecise to the inexperienced or starting dealer. What we’d like are SPECIFICS, not imprecise clichés that accomplish nothing (unrelated aspect be aware; that is additionally what we’d like from politicians).

OK…so 90% of my trades are with the underlying bias of the market, in different phrases, I hardly ever attempt to choose tops and bottoms. Nonetheless, that doesn’t imply I don’t commerce towards the present path of the market. For instance, I may even see a long-term uptrend in Crude Oil after which look forward to the market to start out falling earlier than I are available and purchase the market, however I’m doing that as a result of I imagine within the underlying development. That is very completely different to high and backside choosing and it’s what professionals name “buying and selling from worth or buying and selling pull backs or buying and selling retracements” (all imply the identical factor).

Ready for a pull again and buying and selling from that pull again is a a lot larger chance play than getting into on the prolonged a part of a transfer. Pull backs may help decrease entry level danger as we’re normally buying and selling at a key market space (worth space) that has beforehand proven assist /resistance (relying on the path you’re buying and selling in fact). As we all know, key ranges are sometimes main containment factors and the tide can shift at these inflection factors in a short time and result in giant strikes in the wrong way (in our commerce’s favor).

To place it extra succinctly, the rationale why buying and selling pull backs is so worthwhile, is as a result of markets ebb and movement, and a pull again lets you refine your entry level so that you’re getting into at or near the turning level between the ebb and movement (once more, this isn’t high or backside choosing as a result of we’re not making an attempt to foretell a development change). You received’t all the time get it precisely proper, however should you keep on with the underlying development or commerce from a key chart stage, you possibly can normally get shut.

Let’s take a look at a chart to know this higher…

Within the chart beneath, we’ve got a transparent downtrend in place. By the point the circled areas occurred, it was apparent a downtrend was underway, should you don’t perceive why, then learn this text on development buying and selling. So, on the level of the purple circled areas, skilled merchants had been definitely searching for pull backs throughout the development, to hitch the development from a high-probability level. Whereas, shedding merchants had been pondering the ‘development was prolonged’ and pondering it could finish after each downward swing. As you possibly can see, should you tried to purchase close to any of these low factors, the market solely moved up a small distance earlier than the development resumed, and the MUCH larger pay-off got here should you had appeared to be a vendor on the retracements larger, or a vendor on power.

Additionally, many merchants solely really feel comfy getting into when the market is presently shifting within the path they like. So, many merchants misplaced cash as a result of they offered proper close to these backside factors, when the market regarded weak, however was truly on the brink of retrace larger. That is partially why buying and selling provides many individuals bother; since you sometimes should do the alternative of what you’re feeling such as you need to do, to generate income. I can guarantee you that promoting when this chart was retracing larger, wasn’t simple to do, as a result of it felt just like the ‘backside was in’, however we should always belief the underlying development, we should have religion it’s going to resume…

Retracements: The cornerstone of a market technician

Determine development then search for pull backs…

The first approach to commerce pull backs is to search for traits after which search for pullbacks throughout the development. What you’re doing right here is first figuring out the general momentum of a chart; which path is the chart typically shifting, from left to proper? This might be your path of least resistance, or the trail the market is more than likely to proceed shifting down within the close to future.

We have to bear in mind nevertheless, that markets don’t transfer in straight strains. So, in case you have recognized an uptrend for instance, it doesn’t imply the market could not transfer down for a day or two or three or perhaps a week or two, inside that total uptrend. The factor merchants overlook about is the factor of time. A downward pull again of three or 5 days, can appear important to the common dealer who actually desires to generate income, however within the context of a multi-month or multi-year uptrend, these few days are only a blip, a blip that may trigger you to lose some huge cash should you aren’t cautious.

Let’s take a look at an instance of this…

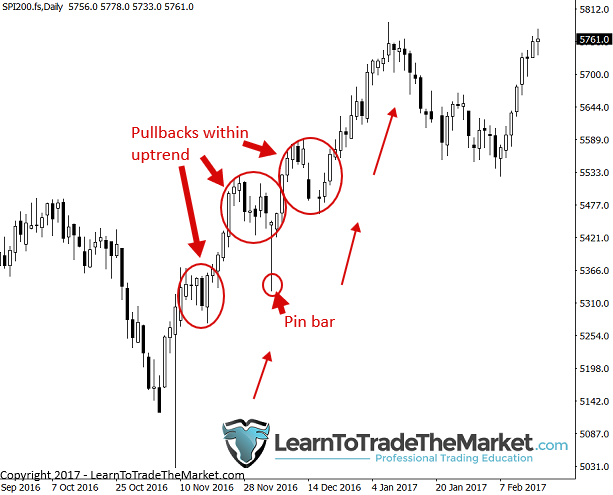

Discover within the chart beneath, a transparent uptrend was in place. Be aware the minor pull backs to the draw back throughout the development; these are high-probability alternatives to enter the development. The very best entry and the obvious, was the bullish pin bar notated on the chart; a main instance of buying and selling a worth motion sign on a pull again or “shopping for weak point in an uptrend” …

Determine most up-to-date swing transfer and commerce early retracement

Now, there are numerous occasions when the market development shouldn’t be tremendous clear or apparent, and through such occasions we will nonetheless use pull backs or retracements to our benefit. Discover within the chart beneath, there was an present uptrend, this was apparent, however then worth started to drag again, to swing decrease, inside that uptrend. Over the course of some weeks, it turned evident this was a protracted pull again that would preserve shifting decrease, but it was not fairly clear whether or not the general uptrend was over simply but. On this case, we will search for upside retraces to get brief or to promote. Particularly, after the primary retrace larger bought turned decrease once more, we might then be seeking to promote on subsequent retraces…

Buying and selling pull backs to assist / resistance ranges or shifting averages

We additionally need to focus our consideration on key chart ranges of assist or resistance in addition to shifting averages, for pull backs. You may simply establish assist and resistance ranges and look ahead to worth to drag again to them after which both enter blindly or look forward to a worth motion affirmation sign to enter and ‘fade’ the latest market path into the extent. By that I imply, if the market was falling right into a stage, you purchase on the stage, and if it was rising into the extent, you promote at it, or fade it. Transferring averages are normally higher in apparent traits; you possibly can look ahead to smaller retracements to the shifting averages (exponential shifting common or ema) after which look to hitch the development from that ema, ideally on a worth motion sign, but it surely’s not all the time crucial, particularly in very robust traits.

50% retraces even on intraday charts.

Pull backs present us entry alternatives on each day in addition to intraday charts. One approach to search for pull backs is to observe for 50% retracements of strikes. These don’t all the time should be main strikes, as we will see within the chart beneath. Typically, there received’t be an apparent key stage to observe for pull backs to, or there received’t be a shifting common, so it’s also possible to use the Fibonacci retracement instrument to search for approximate 50% retracements of strikes, look to get in close to that fifty% stage. Ideally, the market might be trending and you’ll look ahead to these 50% retracements throughout the trending construction, after which re-join the general development path from the 50% stage. We will see an instance of this on the 4-hour chart beneath:

Pull backs to key ranges can lead to huge danger reward potential

Buying and selling pull backs can even help in creating excessive danger to reward performs, particularly if we’re getting into from a long-term key stage and utilizing the 4 hour or 1 hour chart to pin-point an entry. It’s not unusual to select up trades that exceed a danger reward of 5 to 1 and generally much more.

Within the chart beneath, we will see an instance of buying and selling a pull again to a key assist stage. We had a pleasant pin bar purchase sign to verify our entry and see the large potential danger reward right here. Pullbacks to key / long-term ranges typically lead to enormous strikes the opposite path as worth bounces or repels from the extent, creating enormous potential pay offs / danger rewards:

Order varieties used to enter on pull backs…

Usually talking, one can use market entry orders or restrict entry orders to enter the market after a pull again. As mentioned above, a pullback offers us with a high-probability spot to enter a market, as a blind entry at a predetermined stage with a pending restrict order or on ‘affirmation’ with confluence which normally means a worth motion sign, which might be entered on a market order sometimes.

When ready for a pull again and TLS or confluence, we normally can use market orders when the circumstances are met.

When getting into on a blind entry at an occasion space or comparable key stage, we will set a restrict ‘pending’ entry order at or very close to to the extent.

What to do in a ‘runaway development’ that doesn’t actually pull again….

Please be aware, that simply as nice trades may be entered on pull backs, the ‘golden rule’ nonetheless prevails; that markets transfer in prolonged traits and stay in over-extended strikes for longer than you suppose. It’s those that have the center to decide to buying and selling within the path of what appears like an ‘over-extended development’ when everyone else is working scared, that make the cash. I might ideally need to be buying and selling pull backs and getting into on retracements throughout these giant strikes, however they don’t all the time come…

Typically we’ve got to leap on-board the practice and generally we have to be ready to overlook the commerce if we don’t get a pull again. Markets typically run additional than we count on, traits last more than we think about…

In these market circumstances, we might ideally commerce in-line with these strikes however ideally enter a commerce after a pull again, but when we solely utilized this idea, we are going to miss some trades as there received’t all the time be a pull again. So, if markets don’t pull again and we miss a commerce if we don’t get on board, we are going to kick ourselves 50% of the time. An answer is to learn the each day chart time-frame on a day-to-day foundation and watch for any worth motion alerts which can present entry alternatives. Even within the absence of a pull again in costs, there are sometimes clues that the market is more likely to proceed and breakout with the development (resembling inside bar sample development breakout). As I’ve stated, worth motion is like studying a guide from left to proper; you must know what occurred on the earlier web page for the present web page to make sense…this can be a ability mastered with training / coaching, time and expertise.

Conclusion

Buying and selling pull backs not solely offers you with very high-probability entry factors into traits and from ranges with enormous potential danger rewards, it additionally helps with the psychology of buying and selling. You may think about this yet one more benefit of pull backs and another excuse they’re so highly effective; buying and selling pull backs will train you nice habits.

A dealer really centered on buying and selling pull backs should be taught self-discipline and endurance, as a result of buying and selling pull backs means you aren’t simply getting into wherever and everytime you need. It means you’re held accountable to a set of deliberate eventualities that you’ve outlined in your buying and selling plan and that you simply wait and look ahead to available in the market.

I personally make use of the concept of set and overlook and this has compelled self-discipline and routine into my buying and selling strategy by solely buying and selling at pre-determined ranges and eventualities. It helps me keep away from the urge of leaping into the market on market orders and over-trading, and it develops the affected person, sniper buying and selling mindset that’s the basis on which my total buying and selling technique is constructed. Immediately’s lesson is a simply small preview of what you’ll be taught in my worth motion buying and selling course and members’ space. I hope you’ve gotten realized one thing new which you could apply to your buying and selling.

PLEASE LEAVE A COMMENT BELOW – I WOULD LIKE TO HEAR YOUR FEEDBACK 🙂

QUESTIONS ? – CONTACT ME HERE