Estonia, twenty second October 2025, ZEX PR WIRE, AgriFi, a blockchain-powered agricultural finance protocol, is redefining how farmland turns into an investable, yield-generating, and clear real-world asset (RWA).

By combining DeFi infrastructure with data-verified agriculture, AgriFi permits fractional farmland possession and yield-backed returns, remodeling farmland from an illiquid legacy asset right into a clear, tradable, and traceable digital funding.

Reimagining Agriculture as a Actual-World Asset (RWA)

For hundreds of years, farmland has been the spine of worldwide wealth creation, however one largely inaccessible to odd traders.

AgriFi is altering that narrative.

By tokenizing farmland and crop yields on the Polygon community, AgriFi introduces a new data-backed asset class the place possession, yield, and transparency are verifiable on-chain.

Via the AGF Token, traders can take part within the world agricultural financial system, farmers can entry capital effectively, and shoppers can hint their meals with confidence.

“Agriculture is the inspiration of real-world worth. At AgriFi, we’re remodeling it right into a clear, investable digital ecosystem the place each crop, each parcel, and each transaction tells a verifiable story.”- Veronica Trump, CMO at AgriFi

From Actual-World to On-Chain

Actual-World Property (RWAs) are bodily or off-chain property represented on blockchain by way of tokenization, enabling them to be traded, used as collateral, or built-in into DeFi protocols.

The tokenized asset sector has already crossed over USD 30 billion in on-chain worth, exhibiting rising institutional urge for food for property past simply native crypto. But most RWA efforts so far emphasize actual property, non-public credit score, or treasury devices, not agriculture.

AgriFi fills the lacking hyperlink: bringing farmland, crop yields, and agri-production into the on-chain DeFi financial system.

Why Agriculture Is Poised to Be the Subsequent Trillion-Greenback RWA Class

- Foundational and Tangible

Land and crop yields are among the many most important, enduring actual property. In contrast to speculative property, agriculture is tied to meals manufacturing and world demand. - Illiquidity of Conventional Agriculture

Farmland and crop yields are traditionally illiquid: excessive entry thresholds, geographic constraints, fragmented possession, and restricted entry for small traders. Tokenization unlocks liquidity and divides possession. AgriFi eliminates these obstacles by means of fractional blockchain possession, making agriculture accessible to retail and institutional traders alike. - Rising Demand for Sustainable & Traceable Investments

ESG-focused capital is more and more looking for property that ship real-world affect, local weather alignment, and traceability. Agriculture inherently aligns with these investor objectives. - Knowledge-Backed & Clear

With IoT sensors, AI fashions, and oracle integrations, AgriFi ensures each metric from soil well being to crop yield is verified and recorded on-chain.

Advances in IoT sensors, satellite tv for pc imagery, AI agronomic fashions, and oracle methods make verifying yield, crop well being, and land high quality possible, lowering threat in tokenized agriculture. AgriFi’s whitepaper paperwork these integrations. - Diversification & Yield Potential

Agriculture gives an asset class uncorrelated or partially decorrelated from conventional markets, providing yield potential tied to crop efficiency somewhat than monetary cycles.

How AgriFi’s Tokenization Mannequin Works

- Asset Structuring & Authorized Wrapping

AgriFi establishes a authorized construction linking actual farmland or challenge parcels to a special-purpose automobile or contract framework that anchors token worth to that underlying asset.

- Fractional Token Issuance by way of AGF Token / Sub-Tokens

The underlying asset is split into digital tokens (e.g. “AGF-Farm-X tokens”), which signify fractional possession or participation in yield. The AGF Token acts because the native utility token inside the ecosystem (WhitePaper: agrifi.tech)

- Knowledge & Yield Verification

IoT sensors, distant sensing, and agronomic fashions enter crop well being, environmental metrics, and harvest knowledge. Verified oracles feed this into good contracts, enabling yield-based distributions and efficiency monitoring.

- Distribution of Returns

After harvest, token holders obtain returns—both in stablecoins, yield tokens, or reinvestment—in response to predefined good contract guidelines (e.g. p.c to token holders, operational reserves, growth funds).

- Secondary Markets & Liquidity

Tokenized farmland shares might be traded on suitable DeFi markets or by way of whitelisted exchanges, enabling liquidity and worth discovery.

The AgriFi Structure

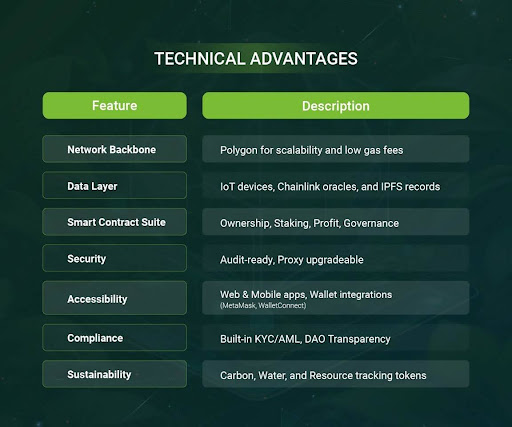

AgriFi operates on a multi-layered ecosystem that connects real-world farmland with blockchain infrastructure.

Blockchain Layer – Powered by Polygon

- Community Alternative: Polygon’s excessive throughput and low transaction charges allow real-time interactions like staking, buying and selling, and voting.

- Token Customary: ERC-20 compliant AGF Token, whole provide 7.2 billion, absolutely circulating.

- Sensible Contracts:

- Possession Contract: Hyperlinks AGF tokens to particular farmland portfolios.

- Staking Contract: Permits lock-ups (30–360 days) with APYs between 5%–18%.

- Revenue Distribution Contract: Automates yield payouts from agricultural earnings in stablecoins.

- Governance Contract: Permits token holders to vote on new farmland tasks and protocol parameters.

- Safety: Audit-ready contracts; upgradeable proxy patterns really helpful.

Enterprise Logic Layer

- Farmland Tokenization Module: Converts agricultural property into blockchain-based possession tokens.

- Revenue Sharing Module: Off-chain income (e.g., crop gross sales/leases) convertible to stablecoins for on-chain distributions by components.

- Governance (DAO): Implements democratic decision-making with weighted voting rights.

- Oracle Integration: Fetches crop yields, commodity costs, and land valuations utilizing Chainlink and verified knowledge feeds.

Off-Chain & Knowledge Layer

- Safe Database: Shops metadata like land measurement, authorized paperwork, and KYC knowledge.

- IoT Integration: Connects real-time gadgets for monitoring soil, water, and crop well being.

- File Storage: Leverages IPFS/Filecoin for immutable data of land titles and audits.

- Compliance: Integrates KYC/AML frameworks and authorized recognition of tokenized possession.

Entry & liquidity:

- API gateway + Web3 for wallets (MetaMask, WalletConnect).

- DEX readiness on Polygon (e.g., QuickSwap/SushiSwap) and compliant venues; liquidity packages might be activated with out over-promising listings.

The AGF Token: Fueling the Decentralized Farming Economic system

The AGF Token lies on the coronary heart of the AgriFi ecosystem. It isn’t only a monetary instrument, it’s the financial spine connecting farmers, traders, and DeFi individuals.

Token Highlights

- Community: Polygon (ERC-20)

- Whole Provide: 7.2 Billion AGF

- Absolutely Circulating: No hidden or locked reserves

- Market Cap (at newest snapshot): ~$274 Million

Core Utilities

- Fractional Farmland Possession:

Every token represents a share in actual farmland portfolios—providing liquidity, diversification, and transparency. - Sustainable Yield Era:

Earn 5–18% APY by locking tokens for 30–360 days. Rewards are funded from verified agricultural returns, not speculative inflation.

- Revenue Sharing:

Token holders obtain periodic stablecoin distributions reflecting farm-generated income. - Governance Participation:

AGF holders vote on farmland acquisitions, staking parameters, and sustainability initiatives.

AgriFi goes past finance; it’s redefining belief in meals.

- Product Authentication: Every batch is assigned a singular Digital Twin Token, monitoring its journey from farm to shelf.

- Meals Security & Recollects: Blockchain traceability permits real-time batch recollects in case of contamination.

- Moral & Sustainable Sourcing: Certification tokens confirm natural, fair-trade, and ESG requirements.

- Shopper Apps: Allow QR scanning, sustainability monitoring, and reward tokens for moral buying.

Via this mannequin, AgriFi unites farmers, traders, retailers, and shoppers in a single, clear ecosystem.

By merging blockchain, DeFi, and IoT, AgriFi is:

- Democratizing agricultural funding for everybody, from retail traders to establishments.

- Driving sustainable, data-driven farming by means of clear capital flows.

- Constructing the inspiration for a world Agri-DeFi financial system the place revenue, transparency, and sustainability coexist.

About Agrifi

Agrifi is driving an agricultural revolution, harnessing blockchain know-how to remodel the agricultural provide chain. Our mission is to reinforce transparency, effectivity, and sustainability in agriculture whereas empowering farmers and supporting small-scale agricultural practices.

Be a part of us on this thrilling journey to discover the way forward for agriculture whereas probably enhancing the worth of your AGF tokens. We’re not simply redefining agricultural finance; we’re revolutionizing the way forward for farming and meals manufacturing.

Prepared to start out staking your AGF tokens? Go to our web site at https://agrifi.tech/for detailed steps on how one can stake your tokens. Keep related with us on Telegram, Twitter, Fb and Instagram for the most recent updates and neighborhood discussions.

Comply with Us on:

FAQ

Q1: What’s AGF Token?

AGF is the native token of the Agrifi platform, providing fractional farmland possession, crop-backed staking rewards, and governance participation.

Q2. The place can I purchase AGF Tokens?

AGF is presently accessible on LBank and Bitbulls centralized exchanges. It’s also possible to purchase AGF immediately by means of Agrifi’s official DEX platform at https://dex.agrifi.app utilizing a Polygon-compatible pockets like MetaMask.

Q3. What do I want to start out?

You’ll want a Web3 pockets comparable to MetaMask.

- To swap by way of dex.agrifi.app, join your MetaMask pockets and commerce utilizing USDT or MATIC.

- To purchase by way of exchanges like LBank or Bitbulls, you possibly can switch USDT out of your current change (e.g., Binance) and commerce for AGF.

This autumn. What’s the minimal funding quantity?

The minimal funding sometimes begins from simply $10, relying on the change’s buying and selling guidelines.

Q5. Is AGF thought-about a Actual-World Asset (RWA)?

Sure. AGF represents fractional possession of farmland and its corresponding crop output, making it a blockchain-powered Actual-World Asset with measurable financial and environmental worth.

Q6: Is AGF Token safe?

Sure. It runs on the Polygon blockchain with good contracts managing staking, governance, and agri-data integration.

Q7: What makes AGF completely different from different DeFi tokens?

In contrast to many tokens, AGF is anchored to actual agricultural output, offering tangible yield and ESG advantages.

Q8. Is AGF accessible globally?

Sure. As a Polygon-based asset, it’s accessible by way of most Web3 wallets and DeFi platforms globally.