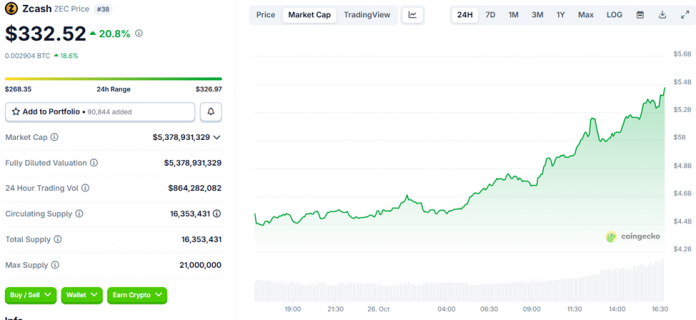

The Zcash (ZEC) value has surged by greater than 750% up to now three months, with token holders gaining over 20% within the final 24 hours.

The dormant privateness coin from crypto’s early years began stealing the highlight in October, after practically 9 years of relative dormancy following its launch in 2016.

Sponsored

Sponsored

Arthur Hayes Reawakens a Zcash Worth Rally

CoinGecko knowledge exhibits ZEC is up by 20.8% to commerce for $332.52 as of this writing. It follows a latest submit from Arthur Hayes, after the BitMEX co-founder and former CEO known as a $10,000 value goal for ZEC, the powering token for the Zcash ecosystem.

The submit from Hayes, recognized for his contrarian macro views and market-moving feedback, reinvigorated curiosity within the altcoin after the Black Friday crash did not cease ZEC.

“…after an extended interval of silence, it [ZEC] was immediately endorsed by a legendary Silicon Valley investor, driving everybody to observe the pattern and take part, subsequently triggering a full month’s FOMO market frenzy,” stated analyst AB Kuai Dong.

Zcash has seen periodic spikes through the years however has largely light into obscurity amid tighter regulation and waning developer exercise.

Over the previous few weeks, it has been again on merchants’ radars, and never only for nostalgia. In opposition to this backdrop, the analyst likened the ZEC value rally to the early Bitcoin and Ethereum mania, with a number of structural catalysts now aligning.

Sponsored

Sponsored

“ZEC completely blew my thoughts. Worth pumped +755% in 3 months, testing the $305 “ATH” resistance. Greyscale launched a Zcash belief this month, a Hyperliquid itemizing, an upcoming halving, and the “BTC vs. Zcash” dialogue triggered explosive momentum,” stated crypto analyst Lennaert Snyder.

In the identical tone, technical analyst Clifton FX highlighted an ascending triangle sample for the ZEC value on the 8-hour chart, suggesting potential for one more 100–150% upside on breakout.

Nonetheless, not everyone seems to be satisfied. Ignas DeFi, a well-liked DeFi analyst, known as Zcash the right case research for a way narratives emerge and go viral. The analyst warned that many could change into exit liquidity for coordinated pumps.

Additional, Ignas DeFi described a reflexive loop through which merchants see ZEC content material on X (Twitter) and purchase in to keep away from lacking out. The FOMO amplifies the hype as group members interact with extra ZEC posts, feeding the cycle additional.

Mert Helius, CEO of Helius Labs, expressed skepticism, referencing ZEC’s valuation relative to larger-cap altcoins.

Sponsored

Sponsored

Zcash Worth Outlook: Why ZEC Holders Ought to Watch $281.35

With the ZEC value buying and selling for $333.77 as of this writing, curiosity attracts to the $281.35 help stage, the provision zone’s imply threshold (midline) between $270.95 and $292.22.

In hindsight, each time the worth examined this order block, it met intense sell-pressure that halted the upside, at the very least earlier than the latest breakout.

From a technical standpoint, the ZEC value is buying and selling inside an ascending parallel channel. For so long as an asset’s value stays throughout the confines of this technical formation, it’s primed for extra beneficial properties.

Sponsored

Sponsored

With the RSI (Relative Energy Index) nonetheless climbing, momentum continues to rise and, with it, the Zcash value may see additional upside, probably reaching $360. Such a transfer would represent a 6% climb above present ranges.

Conversely, if the higher boundary of the ascending channel holds as a resistance stage, the ZEC value may drop. A slip beneath the channel’s midline at $298.35 would exacerbate the correction, with the help because of the 9-day SMA (Easy Transferring Common) prone to break as a help stage.

Nonetheless, solely a decisive candlestick shut beneath the imply threshold of $281.35 would affirm the correction, with promoting strain prone to prolong. Slipping beneath this stage would toss the ZEC value into bearish fingers able to promote.

Promoting strain may trigger the Zcash value to spiral to $240, successfully breaking out of the bullish technical formation.

In a dire case, the ZEC value may drop beneath the $200 psychological stage, with prospects for extra losses.

The RSI’s place at 79 additionally raises considerations, suggesting that the ZEC token is already massively overbought and will quickly undergo a correction because of purchaser exhaustion.