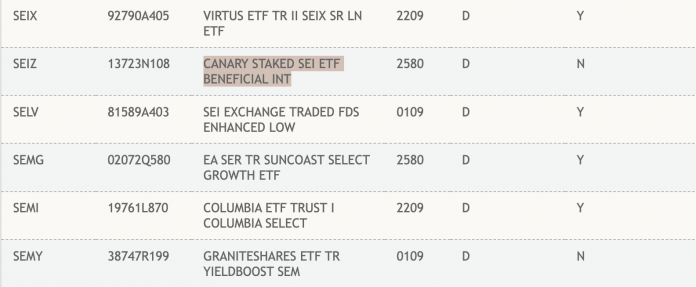

The Canary Staked SEI exchange-traded fund ETF has been formally registered on the Depository Belief & Clearing Company (DTCC) platform.

The itemizing doesn’t represent approval by the US Securities and Alternate Fee (SEC). Nonetheless, it’s a important operational milestone and is commonly seen as a constructive signal.

Sponsored

Sponsored

Canary’s Staked SEI ETF Joins DTCC Checklist

In keeping with DTCC information, the product at the moment seems below the “energetic and pre-launch” class. This classification signifies that the ETF is technically arrange for future digital buying and selling and clearing, pending approval by the SEC.

Importantly, the ETF can’t but be created or redeemed, which means it stays non-operational regardless of its inclusion in DTCC’s system. Nonetheless, the itemizing is a customary step within the ETF deployment course of, typically interpreted by market contributors as an indication of issuer confidence.

“DTCC handles the behind-the-scenes clearing and settling for many US shares and ETFs. Which means this places the SEI ETF into the same old pipeline earlier than it exhibits up on brokerage platforms. As soon as the market sentiment turns round, SEI goes to be a giant runner,” an analyst famous.

Canary Capital filed an S-1 earlier this 12 months to introduce a staked SEI ETF. On the time, the SEC maintained a cautious stance towards staking mechanisms inside exchange-traded merchandise. The regulatory outlook has shifted now.

BeInCrypto reported that the US Treasury and Inside Income Service issued Income Process 2025-31, establishing a transparent safe-harbor framework for crypto ETFs and trusts wishing to interact in staking and distribute rewards to traders.

This process mandates strict situations, together with holding just one kind of digital asset plus money, utilizing certified custodians for key administration, sustaining SEC-approved liquidity insurance policies, and limiting actions to holding, staking, and redeeming belongings with out discretionary buying and selling.

Sponsored

Sponsored

Furthermore, these pointers resolve prior tax ambiguities. This might doubtlessly pave the best way for SEC approval of staking-inclusive merchandise, such because the Canary’s SEI ETF.

Apart from Canary, Rex-Osprey has additionally filed for a staked SEI ETF. Lastly, 21Shares is searching for SEC approval for an ETF centered on the SEI. This displays broader institutional curiosity in gaining publicity to the Sei Community.

SEI Climbs in Web Flows At the same time as TVL Suffers

In the meantime, this comes as Sei experiences sturdy capital motion. In keeping with Artemis Analytics, the community at the moment ranks second in web flows over the previous 24 hours, with inflows making up the bulk. This development means that traders are rotating into SEI regardless of broader market volatility.

Analysts are additionally more and more optimistic about SEI’s worth potential. ZAYK Charts famous that the altcoin is finishing one other falling-wedge cycle, arguing {that a} breakout may set off a 100–150% rally.

Nonetheless, on-chain information paints a extra advanced image. Figures from DefiLlama reveal a steep contraction within the community’s whole worth locked (TVL) throughout November, representing the biggest decline in practically two years.

Roughly 1 billion SEI tokens have been unstaked, reflecting an accelerated charge of consumer exits from the ecosystem.

Thus, for now, the itemizing serves as a procedural however significant sign that the pathway towards institutional SEI publicity is starting to take form—towards a backdrop of each recovering inflows and lingering challenges throughout the community.