Properly, the hopes and goals of the bulls have been dashed this week after Bitcoin closed the week out at $94.290, beneath the important thing $96,000 weekly assist degree. Within the weeks forward, we must always anticipate extra bearish value motion as key assist ranges have been misplaced. Bounces again up could come, however they’re unlikely to lead to recapturing any significant value ranges.

Key Help and Resistance Ranges Now

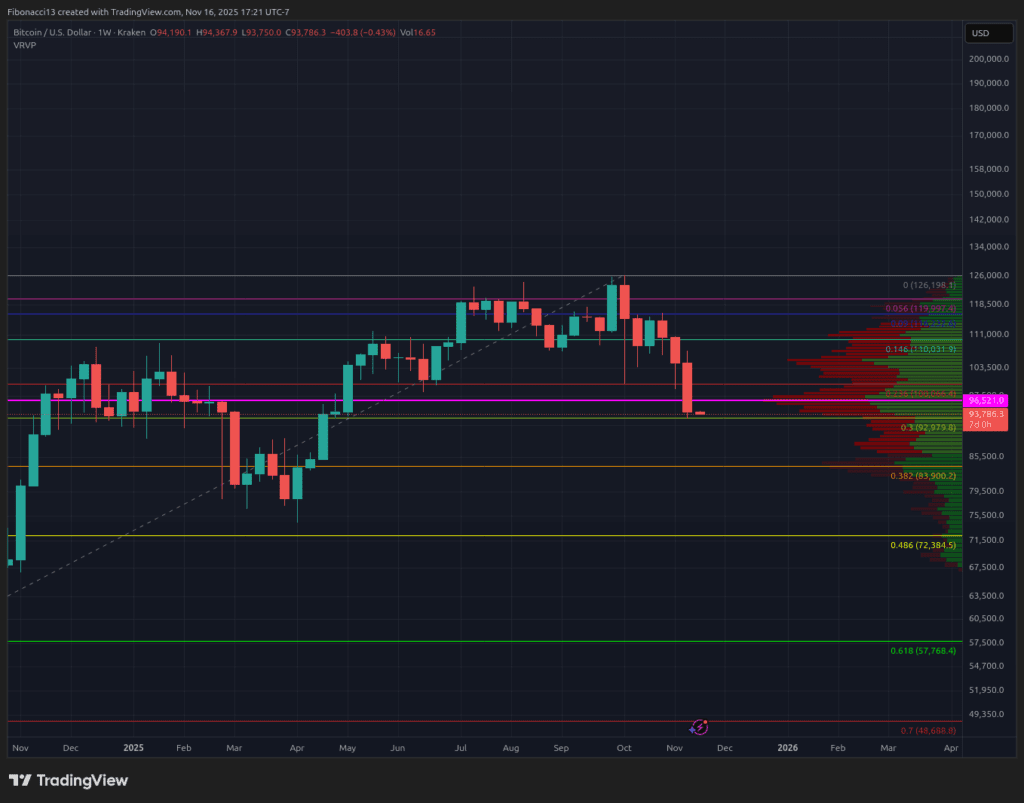

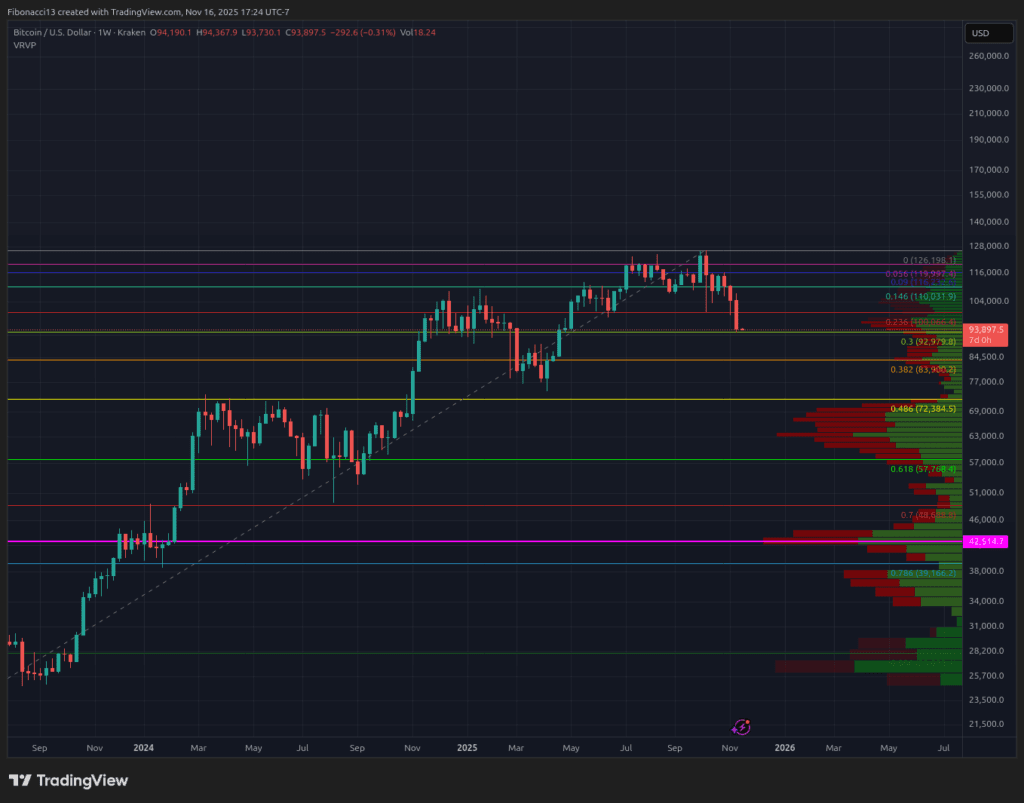

Bitcoin value closed beneath the $96,000 assist degree recognized on this article in prior weeks. Closing close to the lows beneath this degree supplies little or no likelihood, if any, for the worth to get well and resume a bull market anytime quickly. Wanting decrease, we’ve our subsequent main assist degree beneath on the 0.382 Fibonacci Retracement from the 2022 backside to October 2025 excessive, and one other excessive quantity node sitting within the $83,000 to $84,000 space. Beneath right here, we might look to the highs of the 2024 consolidation zone between $69,000 and $72,000.

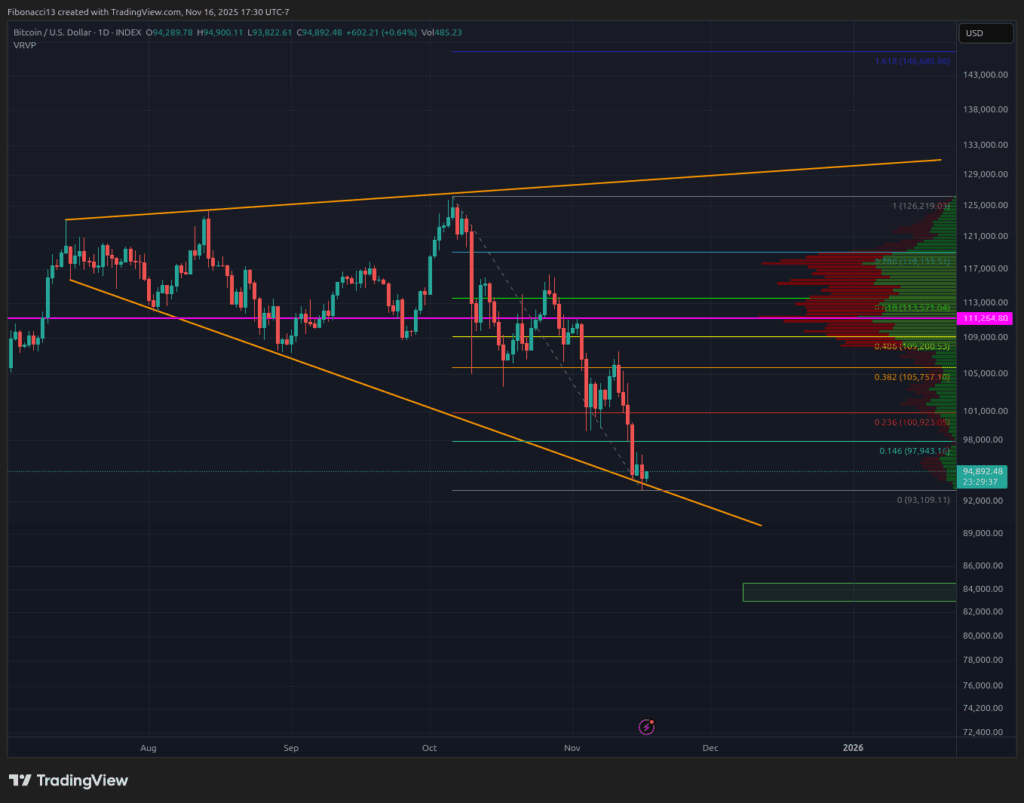

Resistance above $94,000 is thick now. With the worth closing so low, we must always not anticipate a lot of a bounce at this degree, if any. If value does see any type of bounce this week, we are going to look to the $98,000 degree to carry as resistance. A brief squeeze could possibly push the worth previous right here to $101,000. Above this degree, we’ve the equal of a brick wall within the $106,000 to $109,000 zone. Past the wall lies $114,000 as important resistance, and $116,000 as a ultimate reinforcement for the bears. If value closes above $116,000, if bulls can bash all the best way up there, we would want to re-examine the market construction because it may flip bullish up there.

Outlook For This Week

Do you consider in miracles? You have to to know for those who anticipate the bitcoin value to see any type of significant rally this week. There’s a tiny little bit of hopium for the bulls in that the broadening wedge sample has not definitively damaged bearish. If we stretch it out as little as it will probably go (adjusted from prior weeks), the worth is barely supported on the backside at present lows. It’s a tall activity for bulls, although, to make any significant beneficial properties with all of the resistance ranges outlined above. The very best that bulls ought to anticipate is a bounce to $106,000, with the worth more likely to roll over to new lows from anyplace South of there. Extra seemingly, the broadening wedge will break to the draw back in some unspecified time in the future this week as bears are clearly in full management.

Market temper: Extraordinarily Bearish – The bulls are down and out. Sitting at round $94,000, bitcoin has fallen over 25% from the October highs. Little hope stays for any significant rally or new highs after shedding main assist ranges.

The subsequent few weeks

Inspecting all angles of the 4-year bitcoin cycle concept, the excessive has most probably already taken place. Timing for this was anticipated to happen someday between September and December 2025, however with the worth so low and a lot resistance overhead, it’s extremely unlikely any type of rally will maintain sufficient energy to carry the worth to new highs earlier than the top of this yr. Is the 4-year cycle over? Properly, seemingly not, for the reason that value made a excessive in early October and has primarily gone straight down from there. May we see a late 4-year cycle excessive in Q1 2026? Properly, certain, it’s attainable, however nonetheless extremely inconceivable given bitcoin’s lack of energy in latest weeks, whereas the inventory market has remained robust. With the standard inventory market showing to have a bearish outlook for the foreseeable future, it’s unlikely that bitcoin will see any significant rally throughout this era as nicely.

Terminology Information:

Bulls/Bullish: Patrons or buyers anticipating the worth to go larger.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Help or assist degree: A degree at which the worth ought to maintain for the asset, no less than initially. The extra touches on assist, the weaker it will get and the extra seemingly it’s to fail to carry the worth.

Resistance or resistance degree: Reverse of assist. The extent that’s more likely to reject the worth, no less than initially. The extra touches at resistance, the weaker it will get and the extra seemingly it’s to fail to carry again the worth.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Quantity Profile: An indicator that shows the full quantity of buys and sells at particular value ranges. The purpose of management (or POC) is a horizontal line on this indicator that exhibits us the worth degree at which the very best quantity of transactions occurred.

Broadening Wedge: A chart sample consisting of an higher pattern line appearing as resistance and a decrease pattern line appearing as assist. These pattern traces should diverge away from one another in an effort to validate the sample. This sample is a results of increasing value volatility, usually leading to larger highs and decrease lows.