Be part of Our Telegram channel to remain updated on breaking information protection

US spot Bitcoin ETF buyers fell into the pink on common yesterday simply as a brand new spherical of crypto ETF launches approaches.

Bloomberg estimates present cumulative spot ETF inflows carry a median value foundation close to $89,600, whereas Bitcoin briefly traded beneath that stage yesterday earlier than recovering above $91,000 early Tuesday.

The shift comes simply as issuers finalize preparations for a brand new wave of crypto ETF launches, together with merchandise tied to Dogecoin, Solana and XRP.

Spot Bitcoin ETFs Bleed $2.8 Billion In November

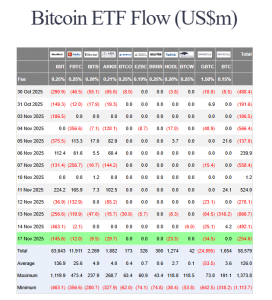

The hunch within the BTC worth has coincided with accelerating redemptions, with about $2.8 billion withdrawn from spot Bitcoin ETFs thus far in November and web outflows extending to 4 straight periods, in response to Bloomberg and Farside knowledge.

The largest of these outflows occurred on Nov. 13, when a complete of $866.7 million exited the funding merchandise in a single day.

Within the newest buying and selling session, the BTC merchandise noticed web day by day outflows of $254.6 million. Nearly all of these outflows had been posted by BlackRock’s IBIT, which noticed $145.6 million outflows on the day.

US spot BTC ETF flows (Supply: Farside Buyers)

Market Prepares For Launch Of A number of Altcoin ETFs

The market may quickly obtain a liquidity increase from the upcoming launches of mulitiple spot crypto ETFs.

With the US authorities shutdown lastly over, ETF issuers are dashing to get ready for his or her product launches. Within the subsequent few days, analysts predict that ETFs for Dogecoin (DOGE), Solana (SOL) and XRP will launch out there, and 4 XRP ETFs could launch within the subsequent seven days.

VanEck’s VSOL ETF has made its market debut, and Constancy’s FSOL fund is anticipated to debut at this time.

BREAKING: VSOL from @vaneck_us is reside, a brand new Solana staking ETF 🔥 pic.twitter.com/nV3wMBMXF2

— Solana (@solana) November 17, 2025

Diamond-Hand Buyers Are Shopping for Up Provide As The Bitcoin Value Drops

Whereas institutional buyers proceed to withdraw funds from spot Bitcoin ETFs, long-term buyers who’ve held on to their crypto via wild worth swings, usually known as “diamond-hand” buyers, have been shopping for the dip.

Based on an evaluation by the on-chain intelligence agency CryptoQuant, the variety of BTC purchased by everlasting holder addresses has soared from 159,000 BTC to 345,000 BTC since Oct. 6. That is the best stage of accumulation seen in latest cycles.

”Lengthy-term capital is stepping in aggressively, whereas short-term sentiment is capitulating,” it mentioned.

When that occurs, it often units the stage for one in all two outcomes: both a significant rally, or a remaining leg down, the evaluation mentioned.

One factor that’s positive, it added, is that both end result ”tends to resolve with pressure.”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection