Zcash (ZEC), a privacy-focused altcoin constructed on zero-knowledge proofs, continues to dominate group discussions in November. The token is exhibiting impartial momentum that stands other than the broader damaging market sentiment.

Many specialists predict that ZEC might attain $1,000 this 12 months, primarily based on a number of components. The next evaluation breaks these drivers down intimately.

Sponsored

Sponsored

Why Zcash Might Attain $1,000

First, ZEC is now not behaving like a short-term speculative asset. It’s evolving right into a strategic reserve asset.

Cypherpunk Applied sciences Inc., which is backed by Winklevoss Capital, lately introduced the acquisition of an extra 29,869.29 ZEC, valued at roughly $18 million. This acquisition enhances the corporate’s earlier buy of 203,775.27 ZEC. Because of this, Cypherpunk now holds a complete of 233,644.56 ZEC, with a median entry worth of $291.04 per unit.

Due to this fact, analysts count on extra corporations to comply with this development and accumulate ZEC as a strategic reserve. Some even anticipate the approval of a ZEC ETF.

“The Winklevoss twins have began the primary ZEC DAT. I’d count on the next mNAV and stronger purchase strain for a privacy-coin DAT as a result of it isn’t authorized to carry in lots of areas. An ETF is probably going as effectively. Shielded/unshielded will act as a malicious program for privateness at planetary scale.” – Mert, CEO of Helius, predicts.

Second, Zcash is proving its independence from Bitcoin. Its actions are now not dictated by the volatility of the “king of crypto.”

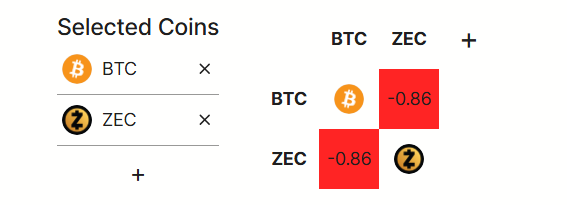

Over the previous month, Zcash and Bitcoin have maintained a damaging correlation. When Bitcoin fluctuates, ZEC typically strikes in the wrong way or stays extra steady.

Sponsored

Sponsored

Information from DeFiLlama confirms this damaging correlation. This means that ZEC has its personal drivers and isn’t depending on Bitcoin’s volatility.

Bitcoin normally leads altcoin traits. Nevertheless, Zcash is breaking this sample because of its deal with privateness. In a interval of damaging BTC volatility, sustaining a damaging correlation turns into a big benefit for ZEC.

Third, the rise in social dialogue round Zcash is outpacing that of Bitcoin, indicating rising curiosity from retail buyers.

LunarCrush knowledge reveals that Bitcoin stays the chief in complete mentions, with 17.97 million. Zcash recorded 346.72 thousand mentions. But ZEC’s dialogue progress price over the previous 12 months reached +15,245%. Bitcoin’s progress was solely +190%.

Lastly, technical indicators recommend breakout potential.

In response to analyst Ardi on X, the ZEC chart is forming an inverse head-and-shoulders sample on the 4-hour timeframe. This setup suggests a goal of between $800 and $1,000 if ZEC breaks above the neckline at $680–$700.

Moreover, current evaluation from BeInCrypto helps this outlook. A each day shut above $748 opens a path to $1,010 and $1,332. A drop beneath $488 would invalidate the setup and reset the construction.