- The EUR/USD weekly forecast stays bearish round 1.1500 amid combined Eurozone knowledge.

- US greenback stays resilient regardless of combined labor market knowledge, holding EUR/USD beneath strain.

- Markets await key macro releases from either side to gauge market momentum.

The EUR/USD weekly forecast displays a modest downtrend as the value closed round 1.1500 deal with. The pair struggled to search out course earlier as markets had been on edge, awaiting delayed US financial releases following the federal government shutdown. After the information launch, the EUR/USD discovered little respite close to acquainted ranges.

-Are you searching for the very best AI Buying and selling Brokers? Verify our detailed guide-

The US labor markets revealed combined knowledge, because the 4-week ADP common confirmed a lack of 2,500 jobs within the personal sector, indicating a cooling of hiring momentum in October. Weekly jobless claims stayed between the vary of 220k and 232k, signaling delicate strain.

In the meantime, the September NFP knowledge rose by 119k, effectively above expectations, however the unemployment price ticked barely as much as 4.4%. The greenback response was restricted, as markets are extra interested by seeing the October knowledge, which might be partially mirrored within the November knowledge. In the meantime, the US PMI confirmed a slight enchancment, however it was not sufficient to impress the patrons.

Throughout Europe, financial alerts keep muted as Eurozone inflation got here at 2.1% YoY, with core CPI at 2.4%, reinforcing the ECB to carry charges unchanged in December. In the meantime, Eurozone client sentiment slipped to -14.2. The PMI knowledge additionally exhibits a lack of momentum in manufacturing, with the Composite PMI easing to 52.4.

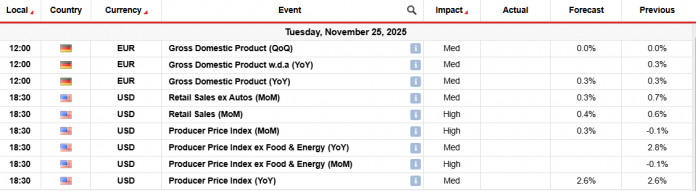

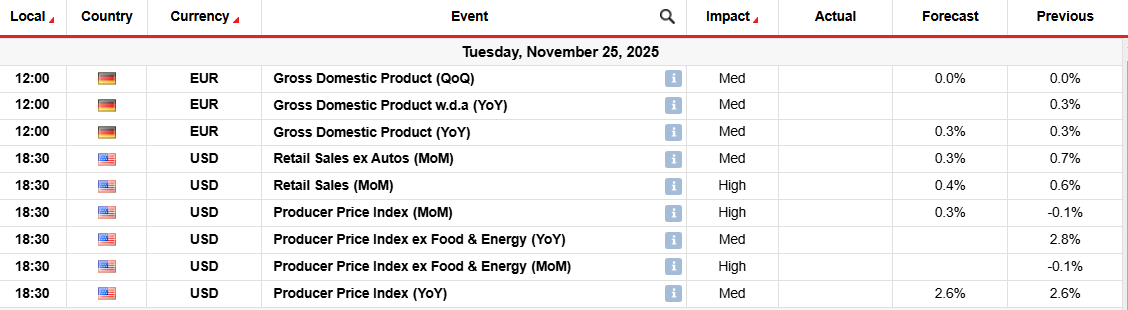

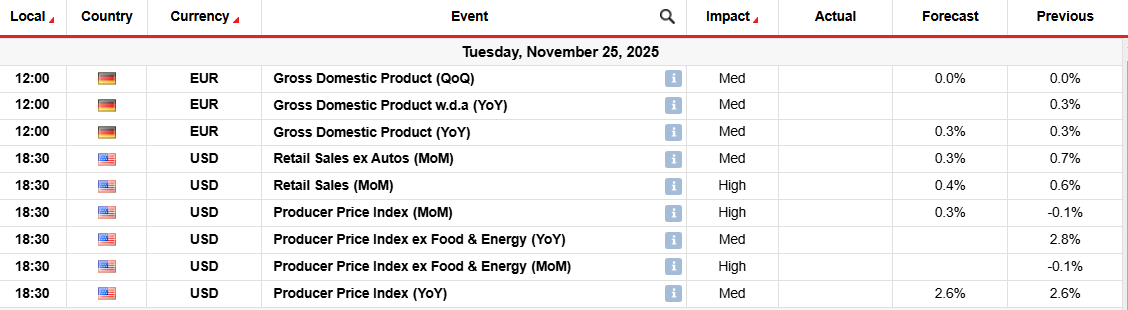

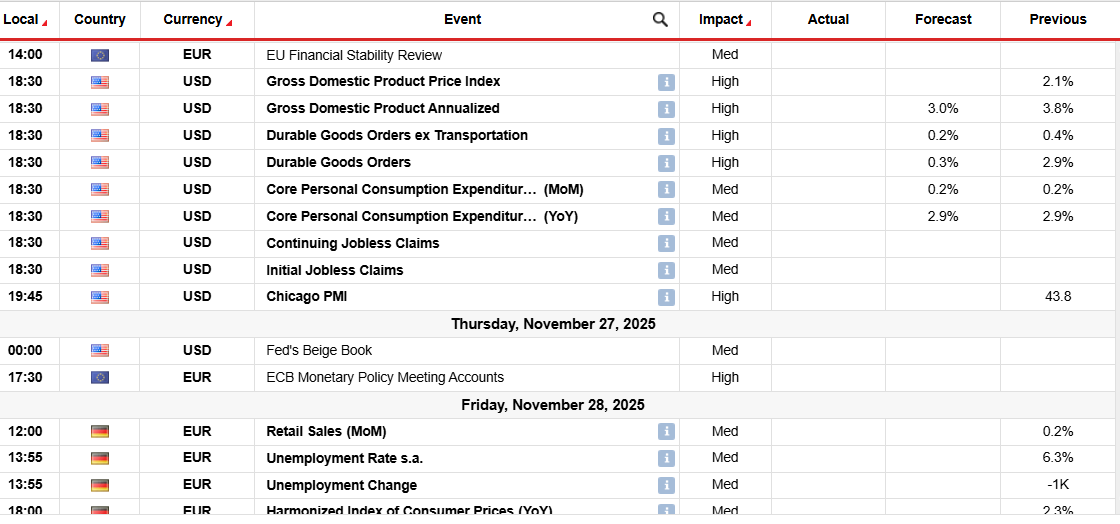

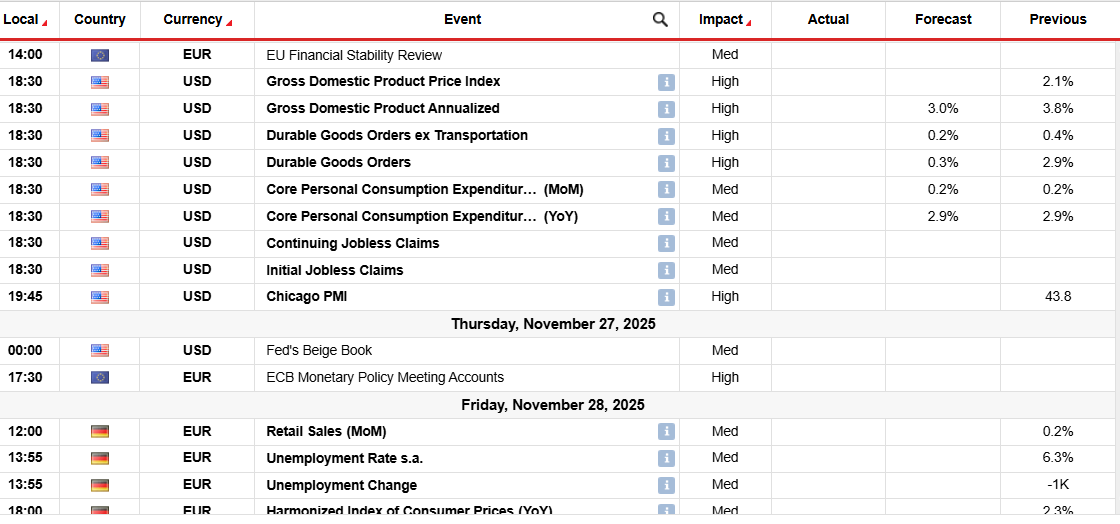

EUR/USD Key Occasions Subsequent Week

Trying forward, the EUR/USD will take cues from the packed European calendar:

- Eurozone Q3 GDP knowledge

- Retail Gross sales

- HICP

- Unemployment Charge

However, the US calendar can be heavy:

- Retail Gross sales

- Sturdy Items

- Weekly Jobless Claims

- Core PCE Index

- Produce Value Index

Since either side are awaiting clearer financial alerts, EUR/USD is prone to stay range-bound, with modest draw back dangers if US knowledge reasserts greenback power.

EUR/USD Weekly Forecast: 200-MA to Shield Draw back

The EUR/USD day by day chart reveals a dismal image because it stays effectively under the important thing MAs like 20-, 50-, and 100-day MAs. Nevertheless, the 200-day MA, round 1.1400, might present stable help, coinciding with a horizontal degree. Nonetheless, the present value is greater than 100 pips above this help degree, indicating bearish dominance. The RSI is presently round 40, shifting downwards, and likewise exhibits a downtrend bias.

-Are you searching for the very best MT5 Brokers? Verify our detailed guide-

However, the pair wants to shut above the 20-day MA, presently at 1.1565, to alleviate bearish strain. In that case, shopping for strain might emerge and push to check the 1.1600 spherical quantity forward of a 50- and 100-day MAs cluster close to 1.1650.

Seeking to commerce foreign exchange now? Make investments at eToro!

75% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you may afford to take the excessive threat of dropping your cash.