Indiana lawmakers are taking a daring step towards embracing bitcoin. A brand new proposal would let the state put money into digital belongings like Bitcoin by way of regulated funds whereas blocking native governments from limiting crypto corporations.

The measure, Home Invoice 1042, displays rising political and monetary curiosity in crypto. Digital belongings as soon as seen as fringe now have backing from prime U.S. leaders, together with President Donald Trump, and main monetary establishments.

Congress additionally handed its first main crypto invoice earlier this yr.

Indiana desires in. Lawmakers gave HB 1042 an early listening to as they juggle redistricting, signaling the difficulty is a prime precedence for Republicans.

“Digital belongings are rapidly turning into a part of on a regular basis funds, and Indiana ought to be prepared to have interaction in a sensible, accountable approach,” mentioned invoice creator Rep. Kyle Pierce, R-Anderson. “This invoice offers Hoosiers extra funding decisions whereas establishing guardrails and serving to us discover how blockchain and digital asset know-how can profit communities throughout our state.”

A cautious bitcoin and crypto strategy

The Indiana invoice would let public funding funds acquire publicity to digital belongings, however solely not directly. It doesn’t enable direct crypto purchases.

As a substitute, it authorizes cryptocurrency exchange-traded funds, or ETFs. These funds observe crypto costs and function beneath federal oversight.

ETFs provide extra stability than holding tokens immediately, however dangers stay. The SEC has warned that crypto markets nonetheless lack robust safeguards and are susceptible to fraud and manipulation.

That concern surfaced in testimony from Tony Inexperienced, deputy government director of the Indiana Public Retirement System. He mentioned INPRS was impartial on the invoice however would need clear disclaimers about volatility. He additionally famous members have proven little curiosity in crypto choices.

Beneath the invoice, a number of main packages in Indiana should provide a minimum of one crypto ETF. That checklist consists of the 529 schooling financial savings plan, the Hoosier START plan, and retirement methods for lecturers, public staff, and lawmakers.

Different state funds would additionally acquire authority to put money into crypto ETFs. The state treasurer may place belongings in stablecoin ETFs as effectively.

Guardrails and a job pressure

The invoice goes past investments. It will prohibit how Indiana state companies and native governments regulate digital belongings. Pierce mentioned the purpose is equity. The measure bars native guidelines that concentrate on crypto use, mining operations, or self-custody.

It additionally protects personal keys as privileged info.

The proposal creates a Blockchain and Digital Belongings Activity Power. The group would research potential authorities and shopper makes use of of the know-how. It will additionally advocate pilot initiatives throughout the state.

Bitcoin is a nationwide development

States are more and more exploring crypto in pension funds and public accounts. The push comes as Bitcoin positive aspects traction as a possible retailer of worth for governments. Some federal proposals have even floated utilizing Bitcoin reserves to offset nationwide debt.

Final week, Texas turned the primary U.S. state to buy Bitcoin by way of a spot ETF, shopping for $5 million value through BlackRock’s iShares Bitcoin Belief, in response to Texas Blockchain Council President Lee Bratcher.

The acquisition is the state’s first transfer beneath its new Strategic Bitcoin Reserve, created by laws signed in June.

Texas plans to finally self-custody its BTC however used IBIT for the preliminary allocation whereas the procurement course of continues. The acquisition highlights rising state and institutional curiosity in Bitcoin as a reserve asset.

Harvard College not too long ago tripled its IBIT holdings to $442.8 million, whereas Emory College and Abu Dhabi’s Al Warda Investments have additionally boosted publicity.

Texas had beforehand explored a Bitcoin reserve proposal that known as for chilly storage, resident donations, and annual audits.

In the meantime, New Hampshire authorized a $100 million Bitcoin-backed municipal bond, the primary of its form globally, requiring debtors to over-collateralize with BTC.

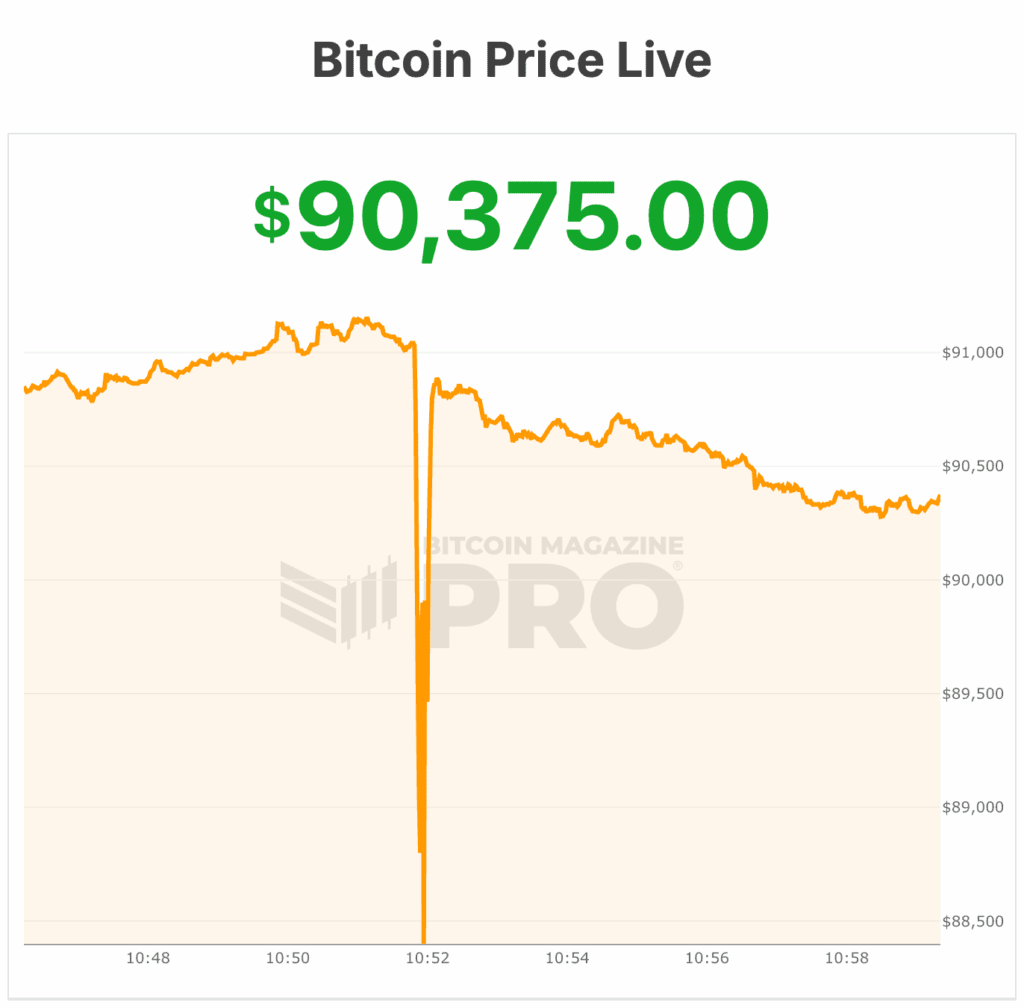

On the time of writing, the bitcoin value is flirting with $90,000.