You’ve in all probability learn buying and selling articles that speak about how your “winners have to be higher than your losers”, it’s used a lot that it’s change into cliché. It’s NOT so simple as having a collection of trades and simply retaining your threat at 1r and your common revenue goal of 2r, that’s by no means going to be the case in actual world buying and selling. There are a number of conditions the place maths is utilized to trades I personally take that may dramatically improve the risk-reward, which will increase the general risk-reward throughout a big pattern of trades.

You’ve in all probability learn buying and selling articles that speak about how your “winners have to be higher than your losers”, it’s used a lot that it’s change into cliché. It’s NOT so simple as having a collection of trades and simply retaining your threat at 1r and your common revenue goal of 2r, that’s by no means going to be the case in actual world buying and selling. There are a number of conditions the place maths is utilized to trades I personally take that may dramatically improve the risk-reward, which will increase the general risk-reward throughout a big pattern of trades.

I’m going to current three concepts on cash administration involving easy maths which you can apply to your trades proper now. After studying at the moment’s lesson, you’re going to stroll away with three ideas (One in all which you may know and two you in all probability don’t), that most individuals not often speak about or execute in their very own buying and selling plan.

Listed below are the ideas in no specific order: 1. Understanding the danger vs reward revenue ratio in your buying and selling. 2. Utilizing profitable streaks to ‘reverse martingale or pyramid throughout trades. 3. Utilizing pyramiding in a single commerce place to enlarge positive aspects.

This text received’t talk about commerce setups in any element, reasonably it’s focus is on how easy maths may be utilized to your cash administration. In case you don’t have the persistence to learn and perceive this lesson, you actually aren’t able to study the worth motion patterns I commerce with. Do the work and perceive the capital administration and place sizing ideas earlier than you begin in search of the ‘holy grail commerce entry technique’.

1. The Cash Administration Cliché We Must Truly Perceive…

Winners have to be larger than losers.

Sorry to repeat what you already know, nevertheless it’s an unavoidable undeniable fact that to generate income over the long-run, your common profitable commerce must be larger than your common loser.

In a nutshell, the one approach to obtain that is having your threat be small on every commerce and your revenue goal being bigger than your threat, often two to a few occasions or extra. Over time, you’ll common round 1.5 to 1 and a pair of to 1 throughout a big pattern of trades if you happen to’re doing properly.

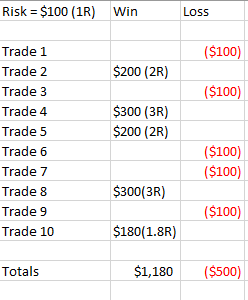

Here’s a desk that presents 10 hypothetical trades, every with a relentless threat of 1r and numerous targets.

Some trades misplaced and a few trades received, the tip outcome reveals the common winner at approx. 2 occasions the common threat.

Straightforward for instance however in the actual world more durable to do clearly. For higher understanding, try the next articles:

Threat reward and cash administration in buying and selling

A case examine of random entry and threat reward

2. Pyramiding in a single commerce

The ability of snowballing place measurement inside a single commerce..

Pyramiding a commerce permits you to ‘snowball’ it into doubtlessly an enormous winner by including to a profitable place at predefined intervals. We will flip an preliminary 1R threat into doubtlessly an enormous R revenue by including a brand new place onto the commerce because it strikes in our favour, which primarily permits us to commerce with the markets cash since we aren’t taking up any new threat. The result’s a snowball impact which builds a small commerce right into a a lot bigger winner if the commerce continues in your favour.

For a higher understanding of this, try this text on pyramiding trades for giant earnings.

3. Profitable commerce streaks utilizing ‘reverse martingale’ (one thing most individuals by no means speak about)

Compounding earnings throughout a number of trades…

In case you’re available in the market lengthy sufficient you’ll know while you’re on a profitable streak and when a market is ripe for the choosing. Sure, that assertion is bigoted to the technical minded and intestine really feel is certainly utilized to this idea.

I’m going to debate this idea on the most simple degree to reveal the facility of making use of some fancy but easy cash administration maths throughout profitable streaks…

The thought is much like including to a profitable commerce in a single place (as mentioned in level 2 above), however on this case, we’re doubling and thus compounding our threat per commerce throughout a number of trades. Earlier than I talk about this idea, let me make clear that this isn’t martingale technique whereby a dealer doubles up on losses, it’s the truth is, reverse martingale, the place a dealer makes use of earnings from one commerce and re-invests them within the subsequent commerce, primarily doubling the place measurement on the following commerce. Mainly, we’re utilizing the markets cash since you aren’t risking something over your 1R funding on the primary commerce.

The thought is straightforward; we’re doing the other of normal ‘martingale’ wherein a dealer would merely proceed to double his threat per commerce till he wins. As a substitute, the reverse martingale is a technique we apply after we anticipate a streak of wins in optimum market situations and we then double up our place throughout a number of trades provided that we win the earlier commerce. This technique can supercharge an account, and keep in mind, we’re buying and selling with the markets cash, not our personal!

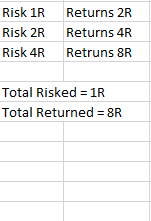

To reveal the maths on this idea, we are going to place three instance trades, all with a threat reward revenue goal of 2r, nonetheless, the danger will probably be elevated on every commerce because the streak performs out, as defined under…

Commerce #1:

1R threat, to return 2R revenue. Commerce wins and also you earn 2R.

Now you’re in a constructive mindset a few trending interval available in the market and the latest sign that has paid off, so that you’re anticipating a streak. You’ll now do the next…

Commerce #2:

Re-invest the earlier win (2R) on the following commerce. Commerce wins, you earn 4R.

Now you keep the identical view because the prior commerce, you’re in a trending interval and the alerts are working properly, you are ready to roll the entire earlier earnings (4R) into the third and remaining commerce of the streak…

Commerce #3:

Threat 4R commerce wins, you earn 8R.

Complete results of streak

————————

Most risked at any time = 1R

Complete return = 8R

8 to 1 complete threat / reward)

Right here’s desk exhibiting our instance trades and the way the returns double every time we re-invest the earlier commerce’s winnings:

The above instance reveals us a superb case of utilizing the market’s cash and easy maths to commerce a small preliminary threat into an enormous return.

Now, I’m certain a few of you might be pondering “How do I do know when the streak will happen?” and so forth. You don’t know for sure however there are certainly market durations and situations the place the dealer with expertise is aware of the seemingly hood of streaks are larger. Even with a random stroll, the place you randomly apply this idea of re-investing / compounding earnings, you might be sure to have some respectable wins. It will solely enhance as your confidence and buying and selling talents enhance over time via correct buying and selling training and expertise.

The maths above is extremely easy, nevertheless it’s important to grasp and if understood can actually take your buying and selling outcomes from mediocre to excellent, in a short time.

In closing…

These are the exact same place sizing and cash administration strategies that I personally apply to every worth motion commerce setup I execute. These are additionally the identical cash administration strategies that I train my college students to use to the worth motion methods, all of which is contained inside my superior worth motion buying and selling course.

Trial the concepts on a demo buying and selling account or in case your already buying and selling reside, trial the concepts on smaller positions till you excellent the ideas.

Good buying and selling, Nial