The altcoin market in December not exhibits the heavy losses seen final month. It’s now shifting into a brand new sideways part. A number of altcoins with distinctive catalysts and information flows have pushed many derivatives merchants to take one-sided positions.

Nevertheless, this week additionally brings a number of vital macro occasions. These occasions could expose their positions to vital liquidation dangers.

Sponsored

1. Zcash (ZEC)

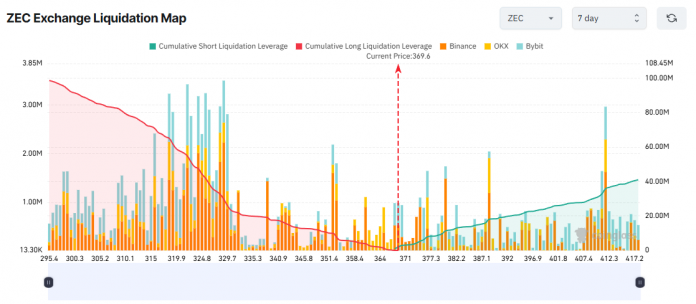

From the all-time excessive of $748 set final month, ZEC has dropped by 50%. Such a deep decline tends to draw traders who consider they missed earlier alternatives. This sentiment encourages derivatives merchants to anticipate a rebound in December. Because of this, collected liquidation quantity on the Lengthy aspect has surged.

Merchants additionally gained another excuse to guess on Lengthy positions. Zooko Wilcox, the founding father of Zcash, will be a part of a December 15 dialogue hosted by the SEC on crypto, monetary oversight, and privateness. Traders anticipate his look to amplify help for privateness altcoins, together with ZEC.

If Lengthy positions stay overly assured with out stop-loss plans, Lengthy merchants could withstand $98 million in liquidations if ZEC falls towards $295 this week.

A current evaluation by BeInCrypto exhibits that ZEC stays in a broader downtrend after the sooner FOMO rally. Its technical construction continues to resemble a bubble sample.

Sponsored

2. Aster (ASTER)

Aster, a number one derivatives DEX on BNB Chain, benefited from hovering buying and selling exercise throughout the Perpetual DEX increase in September. Nevertheless, its worth has since dropped by greater than 60% and now fluctuates under $1.

Liquidation maps present that complete energetic liquidation quantity for Quick positions exceeds that of Lengthy positions. Even so, Quick sellers could face appreciable danger this week.

Aster just lately introduced an accelerated buyback program beginning December 8, 2025. The brand new day by day buyback tempo is about $4 million, up from the earlier $3 million.

This growth might help a worth improve this week. If ASTER rises to $1.07, the entire Quick-side liquidation quantity could exceed $32 million.

Sponsored

Technically, analysts additionally be aware that the value has reached a powerful help zone and has damaged above a one-month trendline.

3. Bittensor (TAO)

The liquidation map for Bittensor (TAO) exhibits a extreme imbalance. Lengthy-side liquidation quantity far exceeds that of the Quick aspect.

If TAO drops to $243.50, Lengthy merchants could face almost $17 million in losses. Conversely, an increase to $340 might liquidate roughly $5 million in Quick positions.

Sponsored

Why are so many merchants betting on Lengthy positions? Many anticipate the value to rise forward of TAO’s first halving.

Based on BeInCrypto, round December 14, Bittensor’s first halving will cut back day by day issuance from 7,200 TAO to three,600 as soon as complete provide reaches 10.5 million.

“This discount in provide will decrease emissions to community contributors and improve TAO’s shortage. Bitcoin’s historical past exhibits that lowered provide can improve community worth regardless of smaller rewards, as its community safety and market worth have strengthened by 4 successive halvings. Equally, Bittensor’s first halving marks a key milestone within the community’s maturation because it progresses towards its 21 million token provide cap.” – Grayscale defined.

Grayscale’s report has strengthened bullish sentiment amongst Lengthy merchants. With out strict stop-loss planning, a “sell-the-news” impact could set off widespread liquidations.

Moreover, the second week of December is the week the Federal Reserve publicizes its rate of interest determination. Traditionally, this announcement has far better market impression than most inner crypto information. Even when merchants appropriately predict the Fed’s transfer, they might nonetheless fail to keep away from excessive volatility that triggers liquidations for each Lengthy and Quick positions.