The Indian Rupee (INR) rises additional towards the US Greenback (USD) on Wednesday. The USD/INR pair falls to close 90.00 because the Indian Rupee features additional, with the start of two-day commerce talks between america (US) and India on Wednesday. US Deputy Commerce Consultant Rick Switzer was scheduled to go to India on December 10-11, whereas India’s international ministry described Switzer’s conferences as a “familiarisation” journey, Reuters reported.

Officers from India would look to push for decreasing tariffs on exports to the US, which at the moment stands at 50%, one of many highest amongst Washington’s buying and selling companions.

Indicators from the assembly that the US and India have made progress in direction of reaching a consensus could be favorable for the Indian Rupee, which has misplaced vital curiosity from abroad buyers because of commerce deal uncertainty.

Thus far in December, Overseas Institutional Buyers (FIIs) have turned out to be web sellers on all buying and selling days, and have offloaded stake price Rs. 14,819.29 crores. FIIs have additionally remained web sellers within the final 5 months.

On the home entrance, buyers will deal with the retail Shopper Worth Index (CPI) information for November, which can be launched on Friday. In response to a December 4-8 Reuters ballot, India’s retail inflation grew at an annualized tempo of 0.7%, sooner than 0.25% in October.

Every day digest market movers: The Fed is anticipated to chop rates of interest by 25 bps to three.50%-3.75%.

- An additional restoration within the Indian Rupee towards the US Greenback can be pushed by warning amongst buyers forward of the Federal Reserve’s (Fed) financial coverage, which can be introduced at 19:00 GMT.

- As of writing, the US Greenback Index (DXY), which gauges the Dollar’s worth towards six main currencies, ticks down to close 99.20

- The CME FedWatch software exhibits that the likelihood of the Fed reducing rates of interest by 25 foundation factors (bps) to three.50%-3.75% within the December coverage assembly is 87.6%. This would be the third rate of interest lower by the Fed in a row. Agency Fed dovish expectations are pushed by weak United States (US) labour market circumstances.

- Currently, a major variety of Federal Open Market Committee (FOMC) members additionally supported the necessity of additional coverage growth amid draw back employment dangers. In late November, New York Fed Financial institution President John Williams acknowledged that there’s room for additional rate of interest cuts within the close to time period because the coverage remains to be modestly restrictive, whereas warning that the “financial development has slowed and the labour market has steadily cooled”.

- Because the Fed is sort of sure to convey borrowing charges down additional, the key driver for the US Greenback’s outlook can be Fed’s steering on rates of interest. Buyers wish to know whether or not the Fed will announce a pause to the continuing monetary-easing marketing campaign or lean in direction of a data-dependent strategy.

- Monetary market contributors may even deal with the Fed’s dot plot, which exhibits the place policymakers collectively see the Federal Funds Charge heading within the near-to-longer time period.

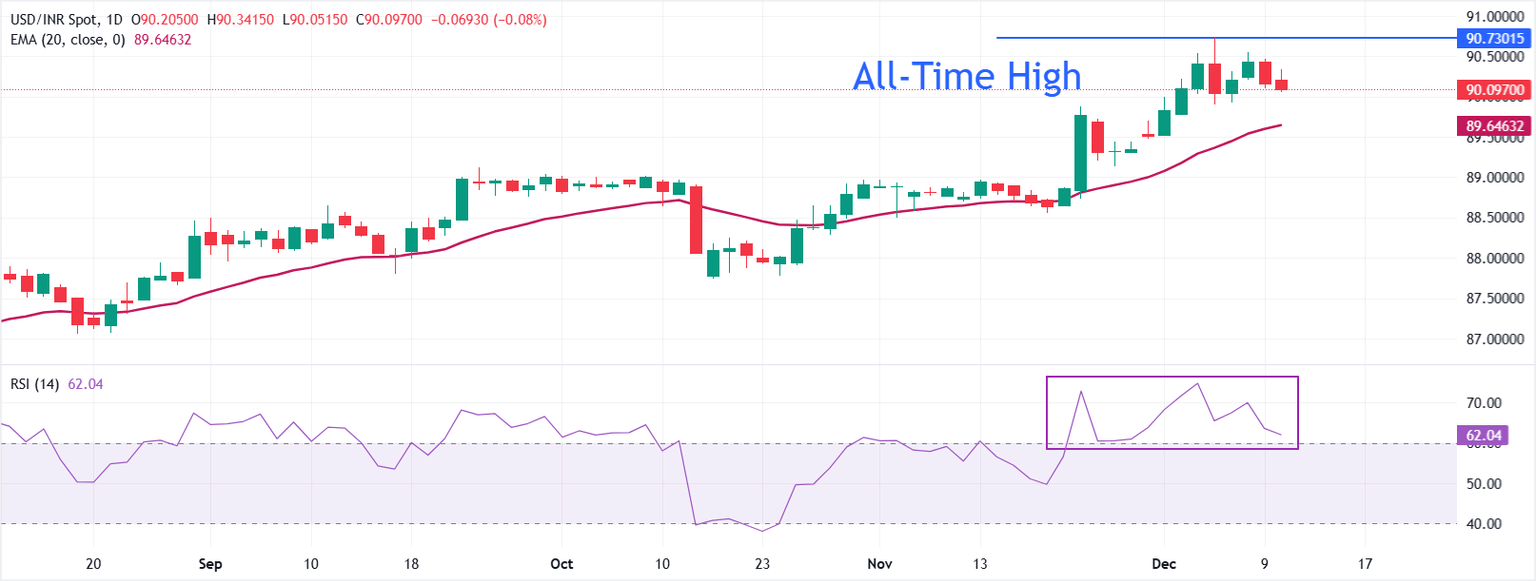

Technical Evaluation: USD/INR stays above 20-day EMA

USD/INR trades close to 90.00 within the opening session on Wednesday. The upward-sloping 20-day Exponential Transferring Common (EMA) at 89.6463 underscores a gradual uptrend, with the spot holding above it.

The 14-day Relative Energy Index (RSI) at 62 has eased from earlier overbought readings, indicating agency but moderating momentum.

Pattern power would stay in place whereas value stays above the 20-day EMA, the place pullbacks might discover help. A renewed push in momentum towards the RSI 70.00 band might prolong features, whereas a drop towards 50.00 would sign consolidation. Consumers defending the 20-day EMA would hold the trail larger intact, whereas a detailed under it might open a deeper correction towards the November 13 excessive at 88.97.

(The technical evaluation of this story was written with the assistance of an AI software)

Financial Indicator

Fed Curiosity Charge Choice

The Federal Reserve (Fed) deliberates on financial coverage and decides on rates of interest at eight pre-scheduled conferences per yr. It has two mandates: to maintain inflation at 2%, and to keep up full employment. Its foremost software for attaining that is by setting rates of interest – each at which it lends to banks and banks lend to one another. If it decides to hike charges, the US Greenback (USD) tends to strengthen because it attracts extra international capital inflows. If it cuts charges, it tends to weaken the USD as capital drains out to nations providing larger returns. If charges are left unchanged, consideration turns to the tone of the Federal Open Market Committee (FOMC) assertion, and whether or not it’s hawkish (expectant of upper future rates of interest), or dovish (expectant of decrease future charges).

Subsequent launch:

Wed Dec 10, 2025 19:00

Frequency:

Irregular

Consensus:

3.75%

Earlier:

4%

Supply:

Federal Reserve