The drought in Hedera’s currently-active exchange-traded funds (ETFs) has handed on the altcoin’s Spot market value. With a 5.6% upswing in 24 hours, Hedera Hashgraphs’ native crypto foreign money is buying and selling at $0.1429, nonetheless beneath key resistance ranges.

Sluggish ETF Motion Takes Toll On HBAR’s Value

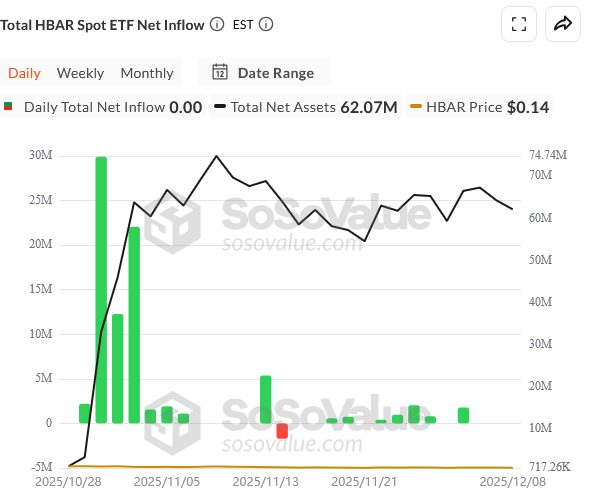

That is largely pushed by the imprecise buying and selling exercise in Hedera’s ETF markets. In line with the real-time knowledge compiled from SoSoValue, the general inflows stand at simply above $82 million.

Regardless of seeing substantial buying and selling motion through the debut days in late October, Hedera’s Wall Avenue enchantment has plunged to low ranges, dealing with zero inflows for consecutive days. Although the slowed adoption of HBAR on Wall Avenue is probably going attributable to the stagnant ecosystem progress and the broader geopolitical tensions, HBAR’s Community noticed a resurgence in USDC utilization.

With stablecoin regulation at its clearest level in years, Circle USD (USDC) stands out as one of many most-compliant stablecoins pegged to the US Greenback. In Hedera’s case, the whole worth locked (TVL) now hosts $93.3 million in USDC liquidity, accounting for 99.7% of all HBAR stablecoin liquidity, in accordance with DefiLlama’s real-time blockchain statistics.

Uncover DailyCoin’s standard crypto information right this moment:

Bitcoin Slips to $90K, Fragile Restoration Beneath Stress

Sanction-Evading Russia’s VTB Financial institution Pilots Crypto Buying and selling

Individuals Additionally Ask:

HBAR is up 5.6% right this moment, buying and selling at $0.1429. This rebound comes after latest dips, exhibiting some short-term shopping for curiosity regardless of broader market jitters.

HBAR has struggled to achieve traction because of stale inflows into spot HBAR ETFs. Buying and selling volumes & contemporary investments stay low, conserving upward momentum in examine even because the community grows.

USDC provide on Hedera has surged 23% just lately, hitting over $172 million as of late October. This displays rising adoption for quick, low-cost stablecoin transactions on the community.

It’s a giant win for ecosystem utility—extra USDC means elevated DeFi exercise, funds, and liquidity. This might not directly increase HBAR demand over time, even when ETF flows keep quiet.

It relies on your danger tolerance. The value bounce is optimistic, however ETF stagnation provides warning. Look ahead to sustained USDC momentum as a bullish sign for long-term holders.

DailyCoin’s Vibe Verify: Which means are you leaning in the direction of after studying this text?