IREN inventory worth has slumped by over 55% from its highest level this 12 months amid elevated jitters on the synthetic intelligence bubble.

Abstract

- IREN shares have plunged by 55% from the year-to-date excessive.

- It has dropped to its lowest stage since September this 12 months.

- There are issues concerning the ongoing AI bubble.

After hovering to a report excessive of $76 in November, the inventory has tumbled to $35 immediately. This crash has coincided with that of different firms comparable to CoreWeave, Nebius, and Bitfarms.

IREN’s stoop has accelerated following final week’s earnings stories from prime AI firms comparable to Oracle and Broadcom. Oracle’s outcomes confirmed that the extremely indebted firm made a adverse free money circulate because it spends closely on knowledge facilities. Its inventory has now crashed by over 50% from its peak this 12 months.

There are additionally lingering issues about its funding. Only recently, the corporate raised over $2 billion by means of a mix of fairness and convertible debt. This funding is important because it boosts its presence within the AI trade, the place it lately acquired a $9.7 billion order from Microsoft.

Competitors within the trade can also be rising as extra Bitcoin (BTC) mining firms transfer to the enterprise. For instance, Hut 8 secured a $10 billion order from Anthropic immediately. Different neocloud firms gaining market share embody Lambda Labs, Nebius, and CoreWeave.

As such, potential prospects now have higher negotiating energy, a improvement that will have an effect on its pricing and margins.

IREN inventory can also be falling as Bitcoin stays below stress. It has dropped from $126,250 in October to the present $87,000. That is necessary as a result of, though IREN is considered a neocloud infrastructure firm, it presently derives most of its income from Bitcoin mining. As such, the decline in Bitcoin’s worth might cut back its income.

IREN inventory worth technical evaluation

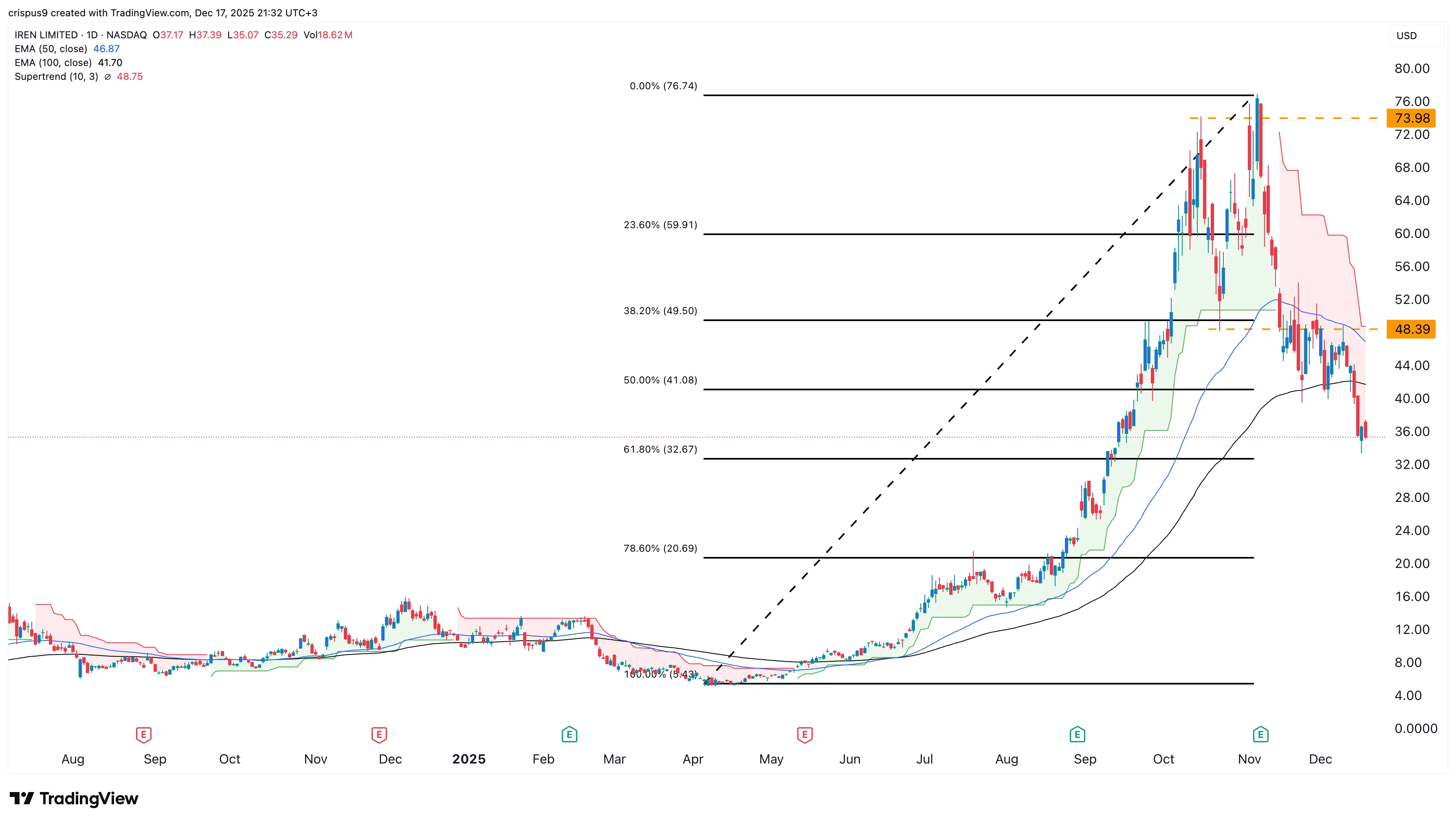

The day by day chart signifies that the IREN share worth has declined sharply over the previous few days. It has dropped from $77 to $35, which is under the 50% Fibonacci Retracement stage.

IREN stays under the 50-day and 100-day Exponential Transferring Averages, an indication that bears have prevailed. It has dropped under the Supertrend indicator and the important thing assist at $48.40, its lowest level on Oct. 23.

Due to this fact, the inventory will seemingly proceed falling as sellers goal the important thing assist at $20. A transfer above the $48 resistance stage will invalidate the bearish outlook.