When Donald Trump returned to the White Home, a lot of the crypto market anticipated a well-known script. Professional-crypto rhetoric, friendlier regulation, institutional inflows, and renewed danger urge for food have been all supposed to mix right into a defining bull market.

As a substitute, as 2025 attracts to an in depth, the crypto market is ending the 12 months markedly decrease, sitting at simply 20% of its peak from the Biden period.

Even with Trump, Crypto Market Is Nonetheless Simply 20% of Biden-Period Ranges

That contradiction is on the coronary heart of a rising debate over whether or not crypto is caught in a tough section, or whether or not one thing extra elementary has damaged.

Sponsored

Sponsored

“It’s time to acknowledge and admit the crypto market is damaged,” said Ran Neuner, analyst and host of Crypto Banter.

The analyst highlighted an unprecedented disconnect between fundamentals and costs. In accordance with Neuner, 2025 had “all of the requirements for a bull market”:

“Even with all of the above,” Neuner stated, “we’re ending 2025 decrease and solely 20% the place we have been with Biden.”

This means that conventional explanations now not maintain. Theories round four-year cycles, trapped liquidity, or an IPO second for crypto really feel more and more like post-hoc rationalizations quite than real solutions.

In accordance with Neuner, the result’s a market with solely two believable paths ahead:

- A hidden structural vendor or mechanism is suppressing costs, or

- Crypto is organising for what he calls “the mom of all catch-up trades” as markets ultimately revert to equilibrium.

Not Everybody Agrees That Something Is Damaged

Market commentator Gordon Gekko, a well-liked person on X, pushed again, arguing that the ache is intentional and structural, however not dysfunctional.

“Nothing is damaged; that is simply how market makers meant. Sentiment is at its lowest in years; leverage merchants are dropping all the things. It isn’t purported to be straightforward; solely the sturdy shall be rewarded,” he wrote.

Sponsored

Sponsored

That divide displays a deeper shift in how crypto behaves in comparison with earlier cycles. Below Trump’s first time period, from 2017 to 2020, crypto thrived in a regulatory vacuum.

Retail hypothesis dominated, leverage was unchecked, and reflexive momentum drove costs far past their elementary worth.

Below Biden, against this, the market turned institutionalized. Enforcement-first regulation constrained risk-taking, whereas ETFs, custodians, and compliance frameworks reshaped capital allocation and stream.

Satirically, lots of crypto’s most anticipated tailwinds arrived throughout this extra constrained period:

- ETFs unlocked entry, however primarily for Bitcoin

- Establishments allotted, however usually hedged and rebalanced mechanically.

- Liquidity existed, however flowed into TradFi wrappers quite than on-chain ecosystems.

The result’s scale with out reflexivity.

Bitcoin Holds Whereas Altcoins Break within the New Crypto Regime

This structural shift has been particularly painful for altcoins, with analysts and KOLs like Shanaka Anslem, amongst others, arguing that the unified crypto market now not exists.

Sponsored

Sponsored

As a substitute, 2025 has cut up into “two video games”:

- Institutional crypto: Bitcoin, Ethereum, and ETFs with crushed volatility and longer time horizons, and

- Consideration crypto: The place hundreds of thousands of tokens compete for fleeting liquidity and most collapse inside days.

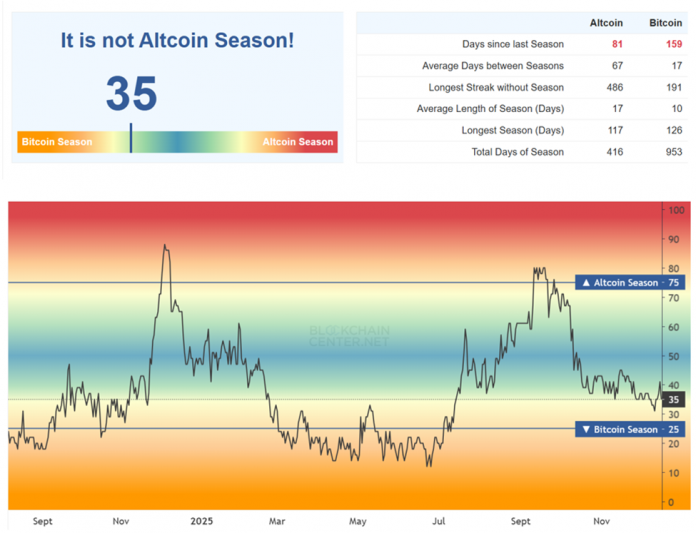

Capital now not rotates easily from Bitcoin into alts, the colloquial altcoin season, or alt season. It flows on to whichever mandate it’s designed to serve.

“…Your solely selections now: Play Institutional Crypto with endurance and macro consciousness. Or play Consideration Crypto with velocity and infrastructure,” wrote Anslem.

In accordance with this opinion chief, holding altcoins on thesis for months is now the worst attainable technique.

“You aren’t early to the altseason. You’re ready for a market construction that now not exists,” he added.

Maybe, that is the idea of a dealer’s conviction, figuring out the place to look. Lisa Edwards helps this thesis, calling for market members to grasp liquidity flows.

Sponsored

Sponsored

“Issues shift, cycles change, cash strikes in new methods. If you’re ready for the outdated altseason, you’ll miss the stuff that’s truly operating proper in entrance of you,” she said.

Quinten François echoes that view, noting that 2025’s token rely dwarfs earlier cycles. With greater than 11 million tokens in existence, the concept of a broad-based altseason akin to 2017 or 2021 might merely be out of date.

Between Repricing and Restoration: Crypto’s Put up-Institutional Check

In the meantime, macro pressures proceed to weigh on sentiment. Nic Puckrin, funding analyst and co-founder of Coin Bureau, notes that Bitcoin’s slide towards its 100-week shifting common (MA) displays renewed AI bubble fears, uncertainty round future Fed management, and year-end tax-loss promoting.

“This all makes for a lacklustre finish to 2025,” he stated in an e-mail to BeInCrypto, warning that BTC may briefly dip beneath $80,000 if promoting accelerates.

It’s anyone’s guess whether or not crypto is damaged or merely reworking, and traders ought to conduct their very own analysis.

Nonetheless, what is evident is that Trump-era expectations are colliding with a Biden-era market construction, and the outdated playbook now not applies.

Discussions between economists and traders on mainstream desks counsel a brutal repricing or a violent catch-up rally, probably defining the post-institutional identification of crypto.