Bitcoin briefly surged above $89,000 on Thursday as a sharply cooler-than-expected U.S. inflation report got here in.

On the time of writing, the bitcoin worth was buying and selling close to $88,374, down roughly 2% over the previous 24 hours, in response to market knowledge. The pullback leaves BTC about 2% under its latest seven-day excessive of $90,165 and roughly 4% above its week’s low close to $85,374. Bitcoin’s market capitalization stands at roughly $1.77 trillion, with 19.96 million BTC at present in circulation.

The preliminary rally was sparked by recent Shopper Value Index (CPI) knowledge from the U.S. Bureau of Labor Statistics, which confirmed inflation cooling quicker than economists anticipated. Headline CPI rose 2.7% yr over yr in November, nicely under consensus expectations of round 3% and down from earlier readings. Core CPI, which strips out meals and vitality, fell to 2.6%—its lowest degree since early 2021.

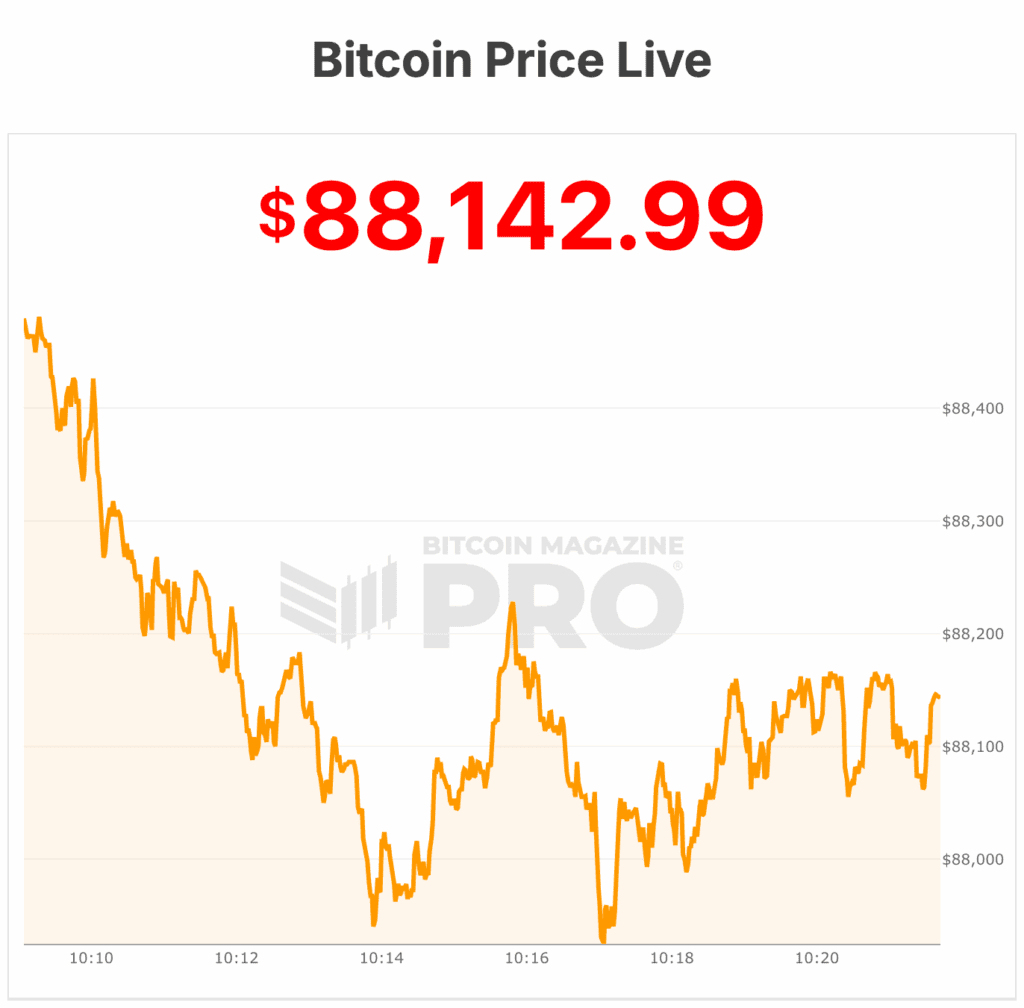

The bitcoin worth reacted swiftly across the time of the information, leaping from intraday lows close to $86,000 to briefly problem the psychologically necessary $89,000 degree, in response to Bitcoin Journal professional knowledge.

The transfer mirrored renewed optimism that easing inflation may give the Federal Reserve larger room to chop rates of interest in 2026, a backdrop that has traditionally supported danger belongings, together with bitcoin.

Based on CME FedWatch knowledge, odds of a price reduce by March edged greater following the discharge, although expectations for a January transfer stay muted.

Bitcoin worth motion

Nonetheless, the rally proved short-lived. The bitcoin worth didn’t reclaim $90,000 decisively and slipped again because the session wore on, at present sitting close to $88,000. This has been a market dynamic that has turn into acquainted in latest weeks: sharp, data-driven bursts greater adopted by speedy retracements.

One key headwind stays sustained outflows from the U.S.-listed spot bitcoin exchange-traded funds. After serving as a serious supply of demand earlier within the yr, ETFs have seen regular web redemptions, eradicating a layer of institutional help that beforehand helped take up promoting strain. Market individuals say the absence of constant ETF inflows has made it tougher for bitcoin to maintain breakouts, even on optimistic macro information.

Macro alerts stay combined past inflation. Earlier this week, delayed U.S. labor market knowledge confirmed unemployment rising to 4.6%, its highest degree since 2021, whereas job progress remained uneven. The information complicates the Federal Reserve’s outlook, reinforcing expectations that policymakers will proceed cautiously regardless of cooling inflation.

Political uncertainty can also be lingering within the background. President Donald Trump has publicly known as for considerably decrease rates of interest and indicated he plans to appoint a Federal Reserve chair who helps extra aggressive easing. Whereas markets have to date handled the feedback as noise, they add one other variable to an already complicated coverage panorama.

Zooming out, bitcoin’s worth seems to be consolidating slightly than trending. Regardless of remaining close to file highs on a historic foundation, worth motion has tightened, with resistance forming just under $90,000 and robust provide reported above that degree from buyers who gathered throughout earlier rallies.

Analysts at Bitwise not too long ago launched a report suggesting Bitcoin may break free from its historic four-year market cycle, doubtlessly attaining new all-time highs in 2026 whereas exhibiting decrease volatility and lowered correlation with equities.

The Bitwise report argues that the Bitcoin worth’s historic four-year cycle, tied to halvings and marked by positive factors adopted by pullbacks, might not maintain. The agency additionally challenged the long-standing criticism that BTC is just too risky for mainstream buyers.

Based on Bitwise, BTC was much less risky than Nvidia inventory all through 2025, a comparability Hougan says underscores the asset’s ongoing maturation.

Market in ‘excessive concern’

On the time of writing, the Bitcoin Concern and Greed Index sits at 17/100, signaling excessive concern amongst market individuals. Traditionally, readings on this vary have typically coincided with undervalued market circumstances, suggesting a contrarian shopping for alternative for these keen to navigate the emotional volatility.

Two days in the past, the market sat close to 11/100 regardless of the next bitcoin worth level.

For now, bitcoin’s response to softer inflation highlights its continued sensitivity to macroeconomic knowledge, however the incapacity to maintain positive factors above $89,000 suggests conviction stays restricted. On the time of writing, the bitcoin worth is $88,142.