On-chain analytics agency Santiment has shared the information about how Bitcoin, Ethereum, and different prime cash examine in Whole Quantity of Holders.

Ethereum Beats Bitcoin, Dogecoin, & Others In Whole Quantity Of Holders

In a brand new submit on X, Santiment has talked about the place the Whole Quantity of Holders indicator stands for Bitcoin, Dogecoin, and different cash within the cryptocurrency sector as we speak. This metric measures, as its identify suggests, the whole variety of addresses carrying a non-empty steadiness on a given community.

When the worth of this indicator rises, it may be an indication that new buyers are becoming a member of the blockchain and/or outdated buyers who offered earlier are making a return. The pattern may also come up from current holders creating a number of wallets for accounting or privateness functions.

Basically, all of those components may be assumed to concurrently be in motion at any time when the Whole Quantity of Holders registers a rise. As such, some web adoption of the cryptocurrency may be thought-about to have occurred.

Then again, the metric happening implies some buyers have cleaned out their pockets balances, doubtlessly as a result of they’ve determined to exit the blockchain.

Now, right here is the chart shared by Santiment that reveals the pattern within the Whole Quantity of Holders for eight totally different cryptocurrencies:

As displayed within the above graph, Ethereum is probably the most dominant cryptocurrency when it comes to the Whole Quantity of Holders, with the metric sitting at 167.96 million. Bitcoin, the subsequent largest community, solely hosts a userbase that’s a 3rd of ETH’s (about 57.62 million addresses).

Ethereum’s dominance could possibly be all the way down to the truth that the blockchain hosts a vibrant ecosystem of layer two blockchains and decentralized finance (DeFi) functions, made attainable by its smart-contracts system.

The gulf between Bitcoin and third place is once more huge, with the stablecoin USDT having 9.63 million non-empty wallets. From USDT on, nonetheless, the altcoins are a lot nearer to one another.

Dogecoin and XRP are the cryptocurrencies with the fourth and fifth largest holder counts on the checklist with the indicator having a worth of 8.13 million and seven.41 million, respectively.

From the chart, it’s seen that whereas Bitcoin has seen a roughly flat trajectory within the Whole Quantity of Holders over the last 12 months, Ethereum has solely been witnessing progress, extending its lead.

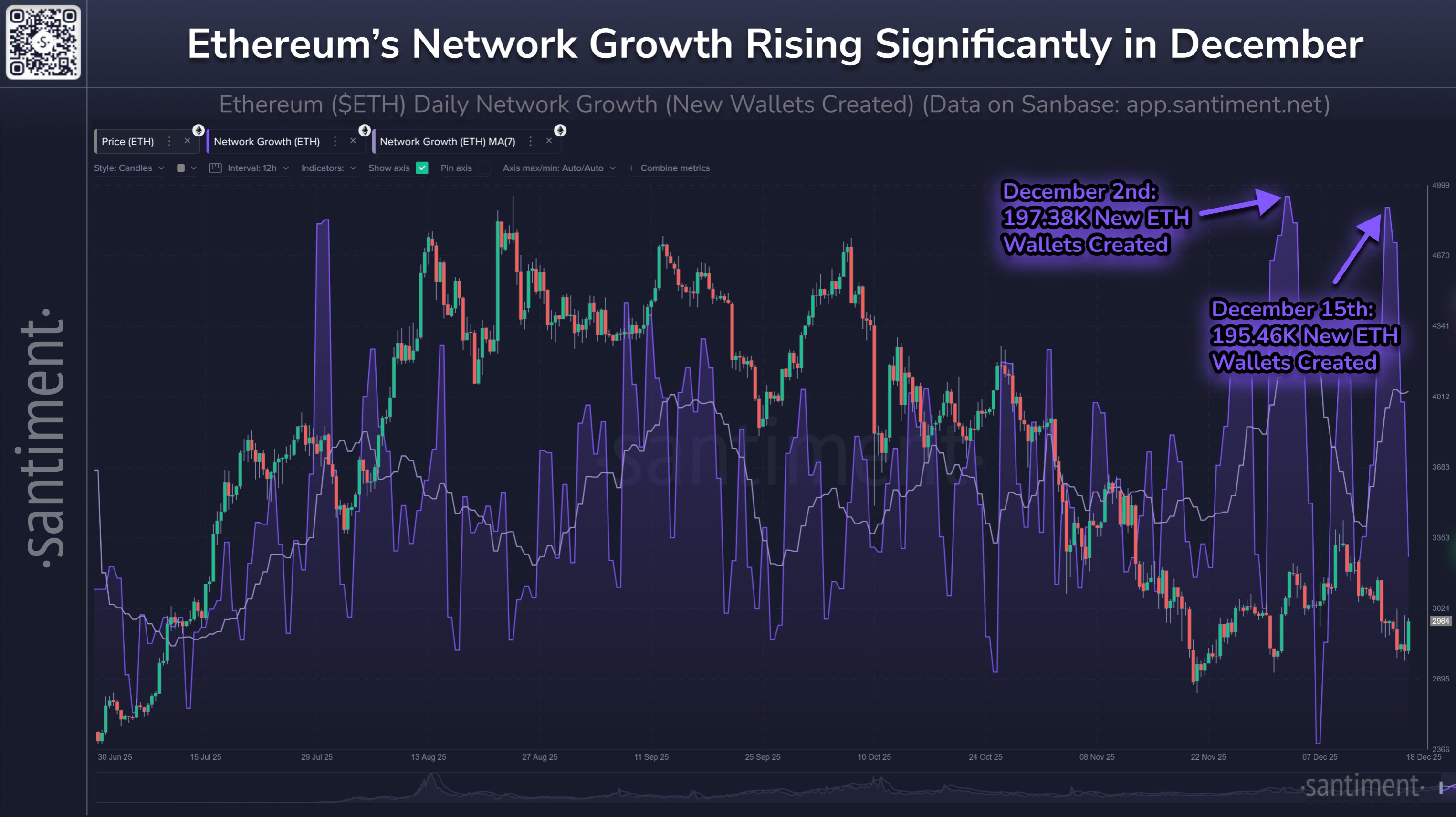

The adoption pattern for ETH can be seen from one other indicator shared by the analytics agency, often called the Community Progress. This metric retains observe of the brand new addresses showing on the blockchain.

As is obvious from the chart, the Ethereum Community Progress has spiked not too long ago. “The #2 market cap is seeing a mean of 163K new addresses per day, in comparison with 124K in July,” famous Santiment.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $87,500, down 2% over the past week.