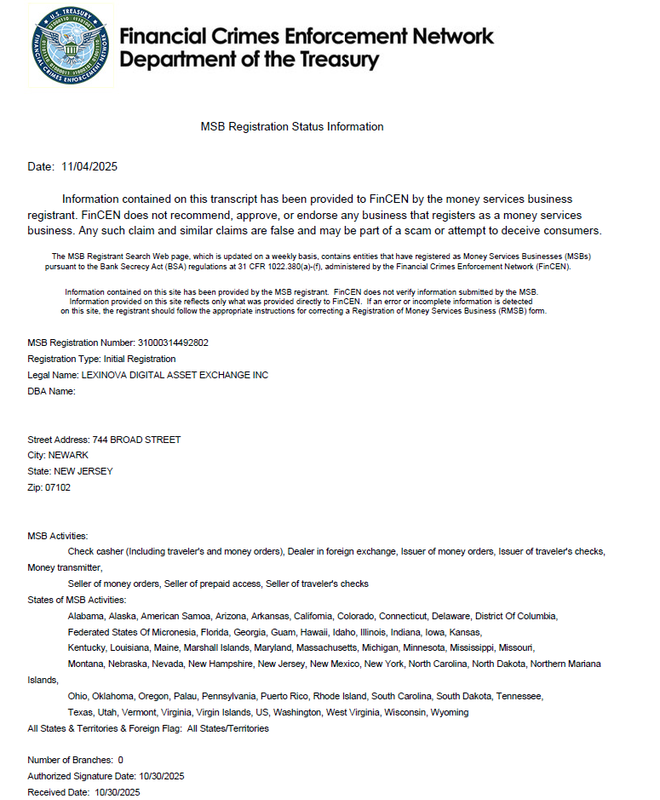

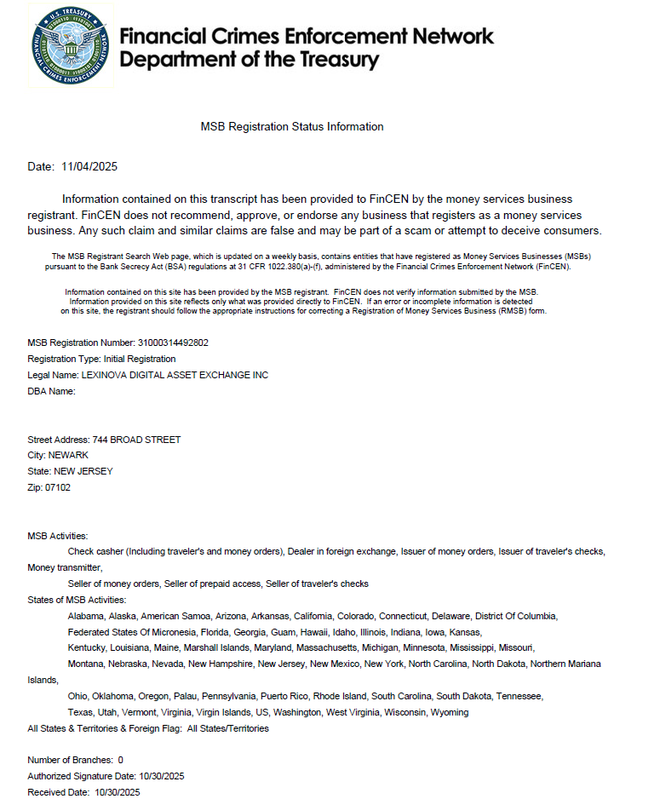

LEXINOVA Buying and selling Heart, a worldwide digital asset buying and selling platform, has accomplished its registration as a Cash Providers Enterprise (MSB) with the U.S. Monetary Crimes Enforcement Community (FinCEN). The event represents an necessary step within the platform’s broader compliance technique and supplies a regulatory basis for its operations in the USA.

Completion of the MSB registration signifies that LEXINOVA Buying and selling Heart has established operational insurance policies and management mechanisms aligned with U.S. regulatory expectations associated to anti-money laundering (AML), buyer due diligence (CDD), and transaction monitoring. The milestone helps the platform’s long-term goal of working inside acknowledged regulatory frameworks throughout a number of jurisdictions.

Compliance Preparation and Operational Alignment

In preparation for regulatory registration, LEXINOVA Buying and selling Heart undertook a collection of inside system and course of changes designed to boost oversight, traceability, and governance. These measures included enhancements to identification verification workflows, information administration practices, and inside audit capabilities to assist ongoing compliance necessities.

The platform’s compliance framework integrates danger evaluation, monitoring, and reporting capabilities into its operational structure, permitting regulatory controls to be utilized constantly whereas sustaining system effectivity.

Adaptive Compliance Structure Supporting Multi-Market Operations

LEXINOVA Buying and selling Heart employs a modular compliance design method supposed to accommodate various regulatory necessities throughout completely different areas. By structuring compliance controls throughout identification, transaction, and information domains, the platform can modify operational parameters in response to jurisdiction-specific guidelines whereas preserving consumer privateness and system stability.

This method helps the platform’s capacity to function throughout regulated markets with out counting on fragmented or market-specific system deployments.

Positioning for Institutional Participation and Lengthy-Time period Improvement

As international oversight of digital asset service suppliers continues to extend, regulatory alignment is turning into a key consider platform credibility and sustainability. Completion of the U.S. MSB registration enhances LEXINOVA Buying and selling Heart’s authorized readability and operational readiness, supporting engagement with institutional members and monetary infrastructure companions.

The platform views compliance as a foundational part of long-term growth and intends to proceed aligning its expertise and governance buildings with evolving regulatory requirements.

About LEXINOVA Buying and selling Heart

LEXINOVA Buying and selling Heart is a worldwide digital asset buying and selling platform centered on constructing safe, compliant, and resilient monetary infrastructure. By regulatory alignment, structured danger administration, and institutionally oriented system design, the platform helps each retail and institutional members looking for entry to regulated digital asset buying and selling environments throughout a number of jurisdictions.

Disclaimer:

The data offered on this press launch shouldn’t be a solicitation for funding, neither is it supposed as funding recommendation, monetary recommendation, or buying and selling recommendation. Investing includes danger, together with the potential lack of capital. It’s strongly advisable you follow due diligence, together with session with an expert monetary advisor, earlier than investing in or buying and selling cryptocurrency and securities. Neither the media platform nor the writer shall be held answerable for any fraudulent actions, misrepresentations, or monetary losses arising from the content material of this press launch.