This week our foreign money strategists centered on the New Zealand This fall 2024 CPI Report for potential high-quality setups within the New Zealand greenback pairs.

Out of the 4 state of affairs/value outlook discussions this week, just one dialogue arguably noticed each fundie & technical arguments triggered to grow to be potential candidates for a commerce & danger administration overlay.

Watchlists are value outlook & technique discussions supported by each basic & technical evaluation, an important step in direction of making a top quality discretionary commerce concept earlier than engaged on a danger & commerce administration plan.

In case you’d prefer to comply with our “Watchlist” picks proper when they’re printed all through the week, you’ll be able to subscribe to BabyPips Premium.

NZD/CHF: Tuesday – January 21, 2025

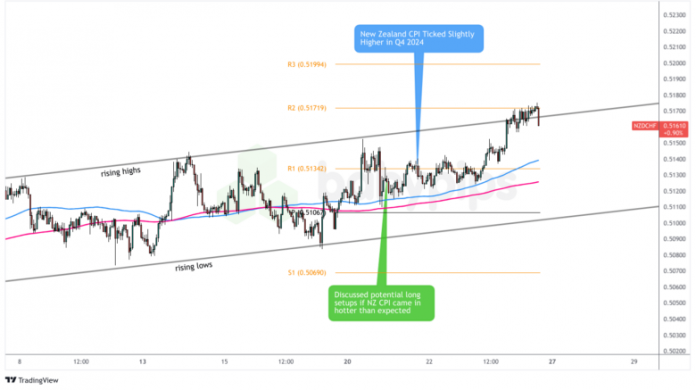

NZD/CHF 1-Hour Foreign exchange Chart by TradingView

On Tuesday, our strategists had their sights set on the This fall 2024 New Zealand CPI report and its potential affect on the New Zealand greenback. Primarily based on our Occasion Information, expectations had been for quarterly inflation to tick up from 0.4% q/q to 0.5% q/q, with the annual charge holding regular at 2.2%. With these expectations in thoughts, right here’s what we had been considering:

The “Kiwi Climb” State of affairs:

If the CPI got here in hotter than anticipated, we anticipated this might dampen expectations of near-term RBNZ charge cuts. We centered on NZD/CHF for potential lengthy methods if danger sentiment was web constructive, particularly given SNB Chairman Schlegel’s current feedback about chopping charges and curbing franc power. If danger sentiment turned detrimental, GBP/NZD shorts seemed promising given the BOE’s current dovish shift and weak UK information.

The “Kiwi Collapse” State of affairs:

If New Zealand’s inflation information got here in under expectations, we thought this might gasoline RBNZ easing expectations. On this case, we thought-about AUD/NZD for potential lengthy methods in a risk-positive surroundings, notably given the RBA’s current hawkish stance. If danger sentiment leaned detrimental, NZD/JPY quick made sense given the excessive expectations of a BOJ charge hike and the yen’s “secure haven” standing among the many buying and selling neighborhood.

What Truly Occurred:

The This fall 2024 New Zealand CPI report got here in barely above expectations:

- Quarterly inflation rose 0.5% q/q as anticipated

- Annual inflation held regular at 2.2% y/y, marginally above the RBNZ’s 2.1% forecast

- Core inflation remained elevated at 3.0% yearly

- Transportation prices had been a significant driver, with worldwide air transport costs up 6.6%

- Housing prices continued to indicate strain with rental costs up 0.8% q/q

- Non-tradeable inflation eased to 4.5% y/y from 4.9% in Q3

Market Response:

This final result basically triggered our NZD bullish situations, and with danger sentiment leaning constructive after as there was some stage of Trump tariff worry easing, we although that NZD/CHF had the very best odds of probably constructive outcomes.

Wanting on the NZD/CHF chart, the pair truly consolidated after the NZ CPI occasion, even after SNB President Schlegel’s feedback about an openness to detrimental rates of interest if want seemingly added some strain on the franc. It wasn’t till the Thursday session when risk-on belongings started taking a bid, correlating with Trump’s feedback at Davos, the place he referred to as for an finish to the Russia-Ukraine battle, for decrease oil costs, and for the Fed to decrease rates of interest.

Broad risk-on Sentiment carried on via the top of the week, the place NZD/CHF closed just below its intraweek highs.

The Verdict:

So, how’d we do? The elemental set off of above-forecast inflation dampened rapid RBNZ charge reduce expectations, and the pair moved increased with rising broad risk-on sentiment as anticipated. Our technical evaluation precisely recognized the R1 and R2 targets as potential areas of resistance, each of which had been examined earlier than the top of the week.

For merchants who merely lengthy positions after the CPI beat the place spent little or no time in detrimental territory and the rise increased was fairly easy, leading to no need for very energetic commerce administration. For our Premium members, we determined to create an instance commerce construction primarily based on a swing time-frame as a information on alternative ways to consider danger and lift consciousness on doubtlessly influential occasions forward, and the end result to this point has been web constructive.

General, we predict our authentic dialogue was “extremely seemingly” supportive of a web constructive final result and we hope that was the case for all merchants on the market watching this pair!