Bitcoin has just lately confronted a slowdown in its upward trajectory after reaching over $105,000 earlier this week. The cryptocurrency had proven indicators of a possible breakout, however key indicators have come into focus because the market evaluates its subsequent transfer.

The most recent insights from analysts have raised questions on whether or not Bitcoin’s market momentum can overcome the resistance stage at $108,000, its earlier all-time excessive.

Analyzing Bitcoin’s Market Indicators

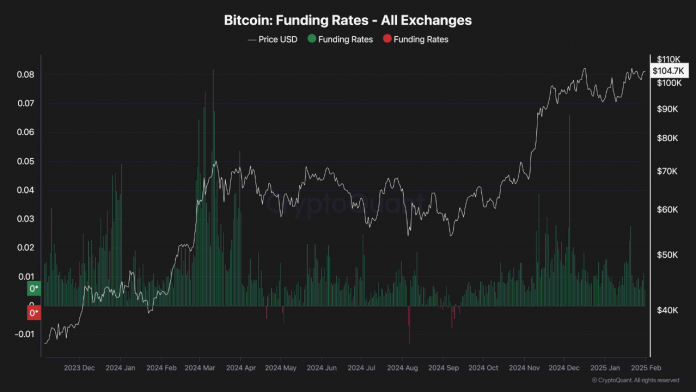

Amid the worth efficiency from BTC, CryptoQuant analyst ShayanBTC has supplied insights on the challenges and potentialities forward for Bitcoin. Shayan famous that regardless of Bitcoin’s latest worth will increase, the funding charges—a crucial on-chain indicator—have began to say no.

This bearish divergence means that demand in perpetual markets could also be weakening, casting doubt on whether or not the present bullish momentum is adequate to push Bitcoin above its all-time excessive.

Notably, one of many main hurdles for Bitcoin’s worth to surpass $108,000 is the shortage of robust market enthusiasm, as mirrored within the funding charges. In keeping with Shayan, sometimes, rising funding charges point out a rise in lengthy positions and market optimism.

Nonetheless, the present decline in these charges indicators that merchants are hesitant to guess on additional worth will increase. Shayan emphasised that and not using a important increase in optimism and a larger inflow of lengthy positions, Bitcoin’s resistance at $108,000 might maintain agency, probably resulting in a consolidation part or perhaps a non permanent worth rejection. The analyst wrote:

For Bitcoin to decisively breach $108K, the funding charges should rise additional, signaling a rise in optimism and a larger inflow of lengthy positions. With out this market-wide enthusiasm, the resistance at $108K might maintain, resulting in potential consolidation or a short lived rejection.

Indication from Lengthy-Time period Holders Metric

Alternatively, long-term holders—buyers who’ve maintained their Bitcoin holdings for seven years or extra—have proven no inclination to promote their property. One other CryptoQuant analyst reporting this in a put up on the QuickTake platform famous:

Holders who’ve held bitcoin for seven years or extra offered a few of their holdings earlier than the top of the earlier bull market. Lengthy-term bitcoin holders haven’t but moved their holdings to exchanges.

This conduct highlights a development seen in earlier market cycles: long-term holders typically stay resilient by means of worth fluctuations, offering a gradual base of help for the cryptocurrency.

The choice of those holders to maintain their Bitcoin off exchanges suggests confidence within the asset’s long-term worth, at the same time as short-term market sentiment fluctuates.

Featured picture created with DALL-E, Chart from TradingView