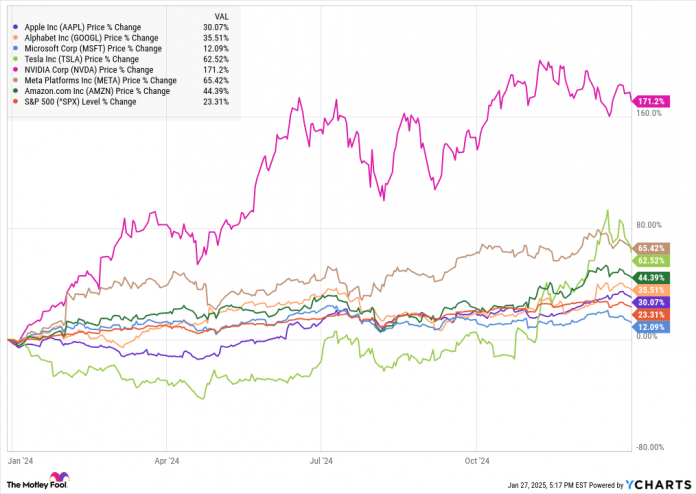

The “Magnificent Seven” group of shares dominated 2024, main the tech sector to a different banner yr. As you’ll be able to see from the chart under, just about each Magnificent Seven inventory beat the S&P 500 final yr.

Microsoft was the one inventory within the bunch to underperform the S&P 500 final yr, and a basket of Magnificent Seven shares would have returned about 60% final yr, largely due to Nvidia‘s (NVDA -3.67%) outperformance.

I feel Nvidia is an efficient wager to be the highest performer within the Magnificent Seven once more this yr even after the launch of Chinese language synthetic intelligence (AI) chatbot DeepSeek R1 rocked the AI and tech sectors, sending Nvidia inventory down 17% in a single session on Monday. Let’s check out that problem earlier than tackling the general case for Nvidia to outperform this yr.

Picture supply: Getty Photographs.

Why the DeepSeek risk to Nvidia seems to be overblown

DeepSeek has made a chatbot DeepSeek R1 that gives comparable outcomes to ChatGPT or Alphabet‘s Gemini, however makes use of a lot much less energy, and would not have the superior chips, lots of that are from Nvidia, that American start-ups like OpenAI depend on.

Silicon Valley enterprise capitalist Marc Andreessen known as it “AI’s Sputnik second” in a social media submit, a reference to the Russian area shuttle that was the primary on the planet to be launched, kicking off the area race between the 2 superpowers.

Nvidia even tipped its cap to DeepSeek, calling it “a wonderful AI development.”

Wiping out a sixth of Nvidia’s worth appears to be largely a knee-jerk response from the market because it’s unclear what the implications are from DeepSeek, particularly at a time of rising tensions between the U.S. and China in an rising tech chilly battle.

Nevertheless, even in the event you settle for that DeepSeek is a transparent development for AI, that does not essentially make Nvidia a loser. Reducing the price of entry into generative AI features like coaching and inference would democratize the trade, permitting extra entrants. Costs for Nvidia parts would possibly fall, however there would seemingly be extra patrons. Moreover, the corporate has confirmed its potential to evolve previously, going from serving the online game trade to crypto to AI, and the functions and demand for its chips are more likely to proceed increasing, particularly as industries like autonomous autos ramp up.

Why Nvidia can nonetheless be the highest “Magnificent Seven” inventory this yr

It should take time for the DeepSeek disruption to play out, however at this level, clients in the course of constructing methods primarily based on Nvidia GPUs like Tesla, Meta Platforms, OpenAI, and Oracle are unlikely to immediately change course. It is also price noting that DeepSeek is utilizing Nvidia chips. It is simply utilizing an older model of them that it obtained earlier than restrictions on superior chip exports went into place.

That appears to indicate that Nvidia chips will be extra highly effective than beforehand identified, which might be a boon to the corporate. Within the meantime, its momentum stays robust as income jumped 94% within the third quarter, and administration has stated a number of occasions that demand continues to outpace provide.

Moreover, Nvidia seems to be like a very good wager to maintain gaining as a result of the valuation nonetheless seems to be enticing. Estimates may change primarily based on the DeepSeek risk, however the inventory at the moment trades at a ahead price-to-earnings ratio of simply 27, which basically matches the S&P 500. For a corporation that’s nonetheless main the AI revolution and rising quickly, that appears like a cut price, despite any danger going through the inventory.

Lastly, whether or not or not DeepSeek upsets the AI market, the race to synthetic basic intelligence (AGI) will proceed, and the stakes stay simply as excessive as they had been earlier than the DeepSeek launch. Because the chief in AI chips, it is a good wager that Nvidia will proceed to play a job in that race and the subsequent frontier of know-how. That ought to gas the inventory increased this yr regardless of the DeepSeek scare.

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jeremy Bowman has positions in Meta Platforms and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.