Main fluctuations within the Ethereum (ETH) market yesterday triggered a wave of reactions throughout social media, with one Ethereum co-founder claiming that sure giant holders—or “whales”—had been intentionally pushing the asset’s value downward.

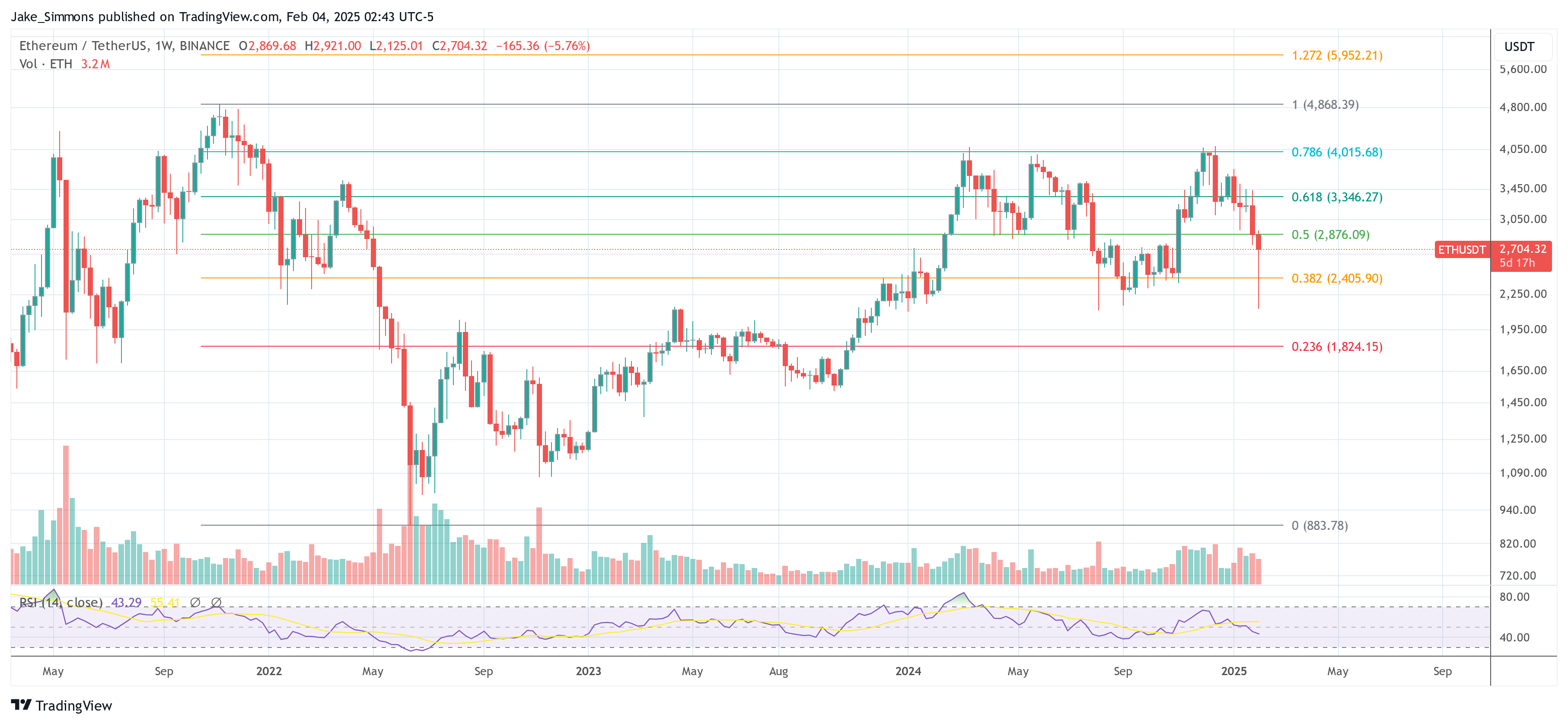

The exercise reached a fever pitch on Monday, February 4, when the ETH value swung from round $2,900 to as little as $2,120 earlier than bouncing again sharply. Regardless of the intraday plunge, Ether in the end closed the day sporting a 26% inexperienced wick—an unusual value rebound in such a brief window.

Ethereum Value Manipulated By Whales?

Analysts attributed the dramatic motion to exterior macroeconomic forces, most notably the US commerce struggle below President Donald Trump. After imposing tariffs on Mexico and Canada early within the day, the president later struck an association that spurred a fast restoration throughout international markets, together with cryptocurrency.

Associated Studying

The turbulence led one observer, recognized merely as “intern” (@intern), the director of development at Monad, to put up a stark sentiment on X: “ETH is dying proper in entrance of us. actually by no means thought this is able to occur.”

In response, Ethereum co-founder and ConsenSys CEO Joseph Lubin supplied a composed outlook, underscoring that some of these value swings will not be uncommon for the digital asset: “It occurs commonly. Then it surges. What we’re seeing is whales benefiting from financial turmoil and destructive sentiment to shake out weak arms, run stops, after which purchase again after they can run that very same playbook in reverse.”

Lubin’s assertion presents a cyclical understanding of crypto volatility, implying that bigger gamers capitalize on market nervousness—typically exacerbated by macro developments—to stress much less resilient traders into promoting.

A number of outstanding crypto merchants additionally commented on the occasions, particularly on accusations of whale-led manipulation.

One well-known determine, Hsaka (@HsakaTrades), suggested newcomers to not assume ETH’s decline was pushed purely by natural market sentiment: “Expensive noobs, Ethereum is NOT naturally taking place. It’s being pushed down through whales putting spoofy promote orders on exchanges to make noobs and threat managers promote to ‘purchase again decrease’. They’re stealing your baggage and can make you purchase again at the next value.”

Associated Studying

The notion of a concerted “spoofing” technique—the place giant promote orders are positioned after which canceled or solely partially crammed—has lengthy circulated inside crypto communities. The tactic reportedly goals to set off panic sells, thereby letting so-called whales accumulate positions at extra favorable value ranges.

Distinguished dealer Pentoshi (@Pentosh1) supplied a short however pointed response, highlighting how ETH has underperformed relative to Bitcoin (BTC) over the previous three years: “3 yr shake out thus far. Hope you’re proper.”

The query of why whales would single out Ether particularly was raised by group member EVMaverick392.eth (@EVMaverick392): “Perhaps I’ll sound naive, however why do whales carry out this maneuver completely on ether?”

Lubin responded by drawing a parallel to standard financial institution robberies and suggesting that the latest wave of unease surrounding the Ethereum ecosystem has made the asset a major goal: “Why do financial institution robbers rob banks— or used to? The (unjustified) FUD towards the Ethereum ecosystem is at present most pronounced.”

At press time, ETH traded at $2,704.

Featured picture created with DALL.E, chart from TradingView.com