- Banxico’s 50-bps charge lower displays a cautiously optimistic inflation forecast, with a doable extra lower mentioned.

- Deputy Governor Jonathan Heath favored a extra conservative 25-bps lower, highlighting inner variations.

- The central financial institution notes vital MXN volatility in response to US-Mexico tariff negotiations.

The Banco de Mexico (Banxico) lowered curiosity charges by 50 foundation factors (bps) as anticipated by analysts, although the choice was not unanimous as Deputy Governor Jonathan Heath voted for a 25-bps charge lower.

Banxico cuts on a break up determination

Banxico’s financial coverage assertion revealed that the central financial institution might proceed calibrating financial coverage and take into account an extra 50 bps lower in subsequent conferences. In line with the board, the inflationary atmosphere would permit the financial institution to proceed easing coverage, albeit sustaining a restrictive stance.

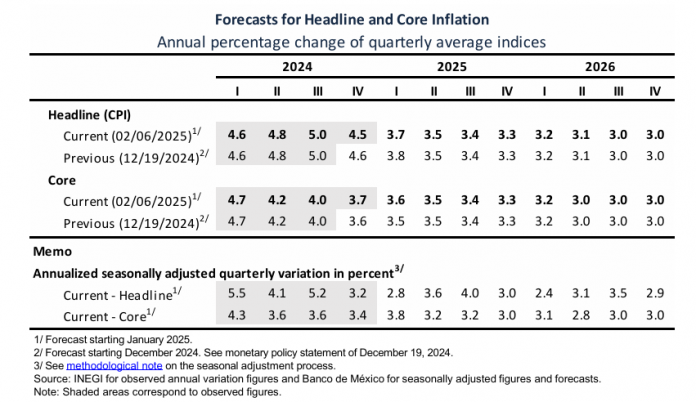

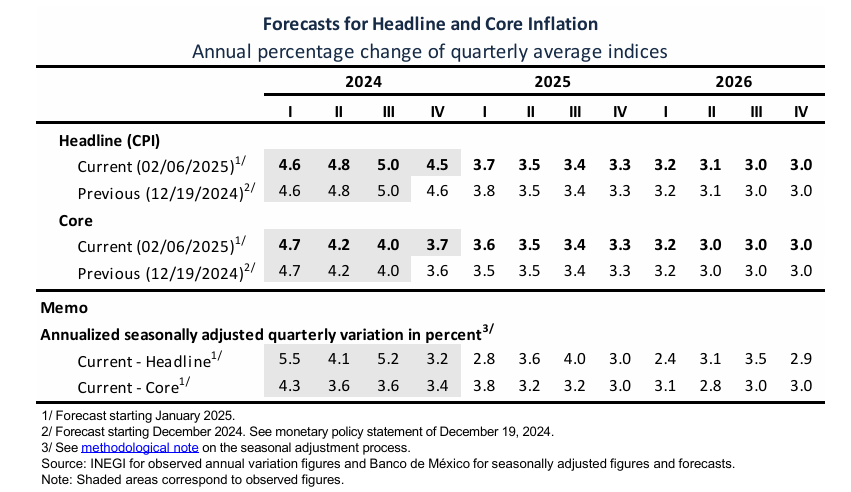

The Mexican Establishment Governing Council added that headline inflation is projected to converge to Banxico’s 3% aim in Q3 2026. In line with current statements, the board sees inflation dangers remaining skewed to the upside.

Relating to tariffs, the board acknowledged that the Mexican Peso (MXN) depreciated considerably and reverted as soon as the USA (US) and Mexico agreed to pause tariffs.

Forecasts for inflation

Supply: Banxico

USD/MXN Response to Banxico’s determination

The USD/MXN pair has recovered some floor after reaching a day by day low of 20.41 forward of the choice, with the change vary meandering inside the 20.45 – 20.55 vary. The primary key resistance stage eyed by merchants could be the February 5 excessive of 20.71, which, as soon as cleared, might pave the way in which to check the January 17 excessive of 20.90. On the draw back, if sellers push the change charge under the 50-day SMA at 20.41, they might drive it in direction of the 100-day SMA at 20.22.

Banxico FAQs

The Financial institution of Mexico, also referred to as Banxico, is the nation’s central financial institution. Its mission is to protect the worth of Mexico’s forex, the Mexican Peso (MXN), and to set the financial coverage. To this finish, its important goal is to take care of low and secure inflation inside goal ranges – at or near its goal of three%, the midpoint in a tolerance band of between 2% and 4%.

The principle instrument of the Banxico to information financial coverage is by setting rates of interest. When inflation is above goal, the financial institution will try and tame it by elevating charges, making it dearer for households and companies to borrow cash and thus cooling the financial system. Increased rates of interest are usually constructive for the Mexican Peso (MXN) as they result in greater yields, making the nation a extra enticing place for traders. Quite the opposite, decrease rates of interest are inclined to weaken MXN. The speed differential with the USD, or how the Banxico is predicted to set rates of interest in contrast with the US Federal Reserve (Fed), is a key issue.

Banxico meets eight occasions a yr, and its financial coverage is significantly influenced by selections of the US Federal Reserve (Fed). Subsequently, the central financial institution’s decision-making committee often gathers per week after the Fed. In doing so, Banxico reacts and generally anticipates financial coverage measures set by the Federal Reserve. For instance, after the Covid-19 pandemic, earlier than the Fed raised charges, Banxico did it first in an try and diminish the probabilities of a considerable depreciation of the Mexican Peso (MXN) and to forestall capital outflows that would destabilize the nation.