Be a part of Our Telegram channel to remain updated on breaking information protection

Giant Ethereum (ETH) purchases occurred throughout a turbulent week for digital belongings because the cryptocurrency market reacted to shifts in worldwide commerce insurance policies. Ethereum’s worth dropped to $2,150 on Monday, mirroring declines throughout the broader market. Nevertheless, it shortly recovered inside the similar buying and selling session.

The current acquisitions by BlackRock and Constancy have strengthened investor confidence, with many viewing them as indicators of an upcoming market rally. Optimism is rising amongst crypto fanatics, who anticipate a surge in altcoins. This outlook is fueled by broader trade developments and the political panorama, notably following Donald Trump’s return to the U.S. presidency. In the meantime, traders are trying to find inexpensive tokens, notably the finest low cost crypto to purchase now underneath 1 greenback.

5 Greatest Low-cost Cryptocurrencies to Purchase Beneath 1 Greenback

XDC is priced at $0.09225, reflecting a 4.05% rise over the previous 24 hours. Ethena (ENA) has skilled notable buying and selling exercise. IOTA Rebased continues to advance its know-how, introducing updates to reinforce effectivity, safety, and accessibility.

UXLINK just lately revealed two key partnerships that would impression its development and adoption inside the Web3 ecosystem. In the meantime, Solaxy has drawn curiosity as a meme coin in 2025, with its SOLX token presale approaching the $20 million milestone. Moreover, MicroStrategy has rebranded as Technique and reported a rise in its bitcoin holdings for the fourth quarter.

1. XDC Community (XDC)

XDC Community has just lately built-in with the Australian Digital Greenback ($AUDD), which may improve blockchain-based commerce, real-time funds, and interoperability within the Asia-Pacific area. This collaboration is predicted to contribute to tokenizing commerce belongings whereas facilitating extra environment friendly and safe transactions for companies and customers.

With this integration, transaction prices could lower, whereas safety and processing pace may enhance. Moreover, it aligns with the Mannequin Regulation on Digital Transferable Data (MLETR), which helps regulatory compliance in digital commerce. Because of this, cross-border funds could turn into extra seamless, benefiting each enterprises and particular person customers.

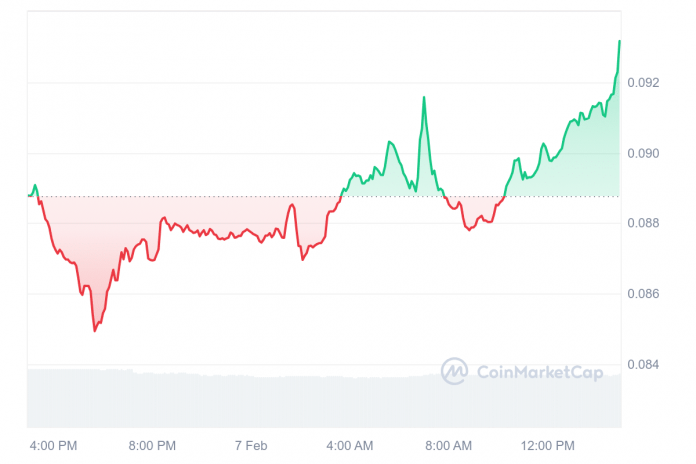

XDC is buying and selling at $0.09225, marking a 4.05% improve up to now day. Over the past yr, its worth has surged by 113%, outperforming 75% of the highest 100 cryptocurrencies. Moreover, XDC is buying and selling considerably above its 200-day easy shifting common (SMA) of $0.04864, highlighting a robust worth pattern. The asset additionally demonstrates excessive liquidity with a market capitalization of $1.37 billion.

Market predictions counsel potential worth development within the coming months. By February 2025, XDC may expertise a worth improve of as much as 7.21%, reaching a median of $0.098819. Additional development is anticipated in March, with a projected rise of 28.64%, probably peaking at $0.19643. If these tendencies persist, long-term merchants could discover promising alternatives with a possible return on funding (ROI) of 113.11%.

2. Ethena (ENA)

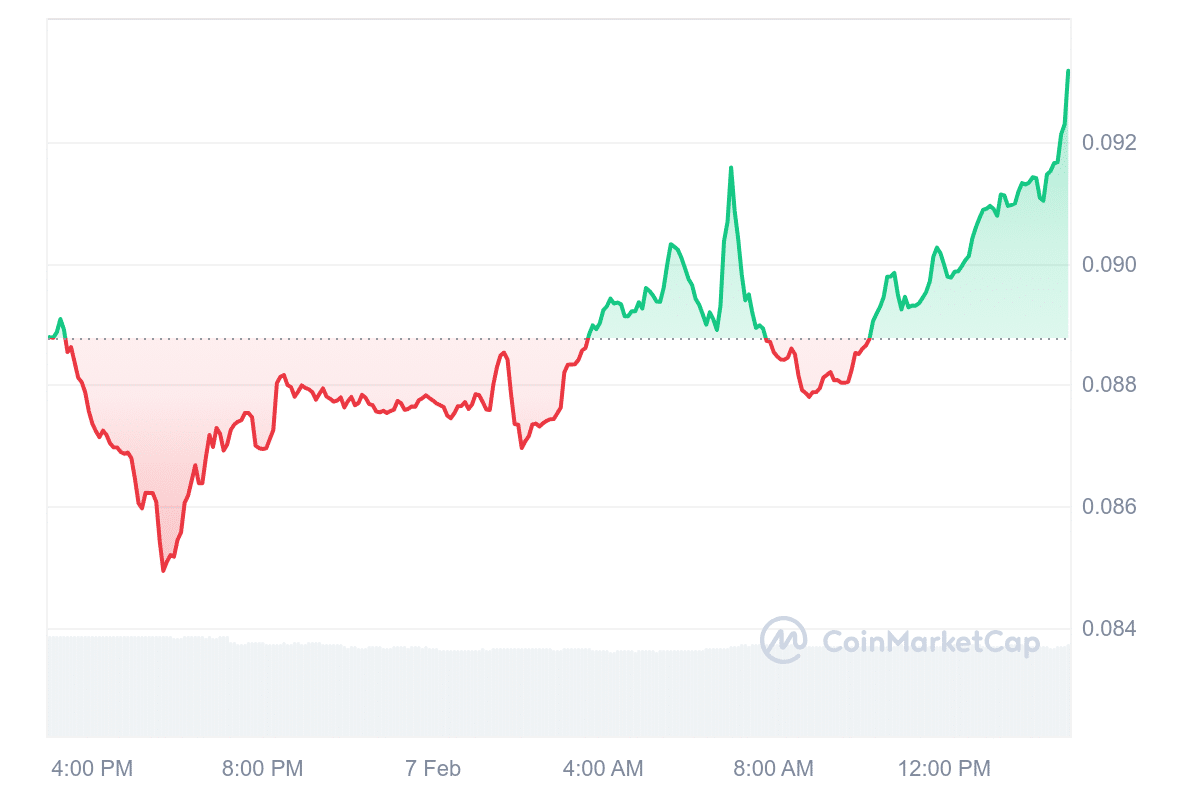

Ethena (ENA) has proven important market exercise. It’s priced at $0.5433, reflecting a 1.83% improve within the final 24 hours. The asset holds a $1.69 billion market capitalization, whereas every day buying and selling quantity has risen 43.95% to $409.58 million. Its totally diluted valuation is $8.14 billion, with a volume-to-market cap ratio of 23.97%. These indicators counsel sturdy buying and selling participation.

Market forecasts for February point out a doable development of 87.42%, with an anticipated common worth of $1.0108. Value fluctuations may vary between $0.5346 and $1.8262. If this pattern materializes, the potential return on funding (ROI) may attain 238.61%. This means doable alternatives for traders looking for worth appreciation.

USDe and sUSDe are each enjoying vital roles in rising DeFi ecosystems

Tomorrow, @concretexyz will probably be launching a USDe vault and sUSDe vault to energy Ethena’s development within the @movementlabsxyz ecosystem, capped to $50 million apiece https://t.co/m1X7vNRFwm

— Ethena Labs (@ethena_labs) February 2, 2025

Looking forward to March, analysts anticipate additional positive factors. ENA’s worth may improve by 292.71%, reaching a median of $2.12, fluctuating between $1.6618 and $2.54. If these projections maintain, the estimated ROI could rise to 371.22%. Given the optimistic efficiency in February, this outlook suggests a continued upward pattern.

3. IOTA (IOTA)

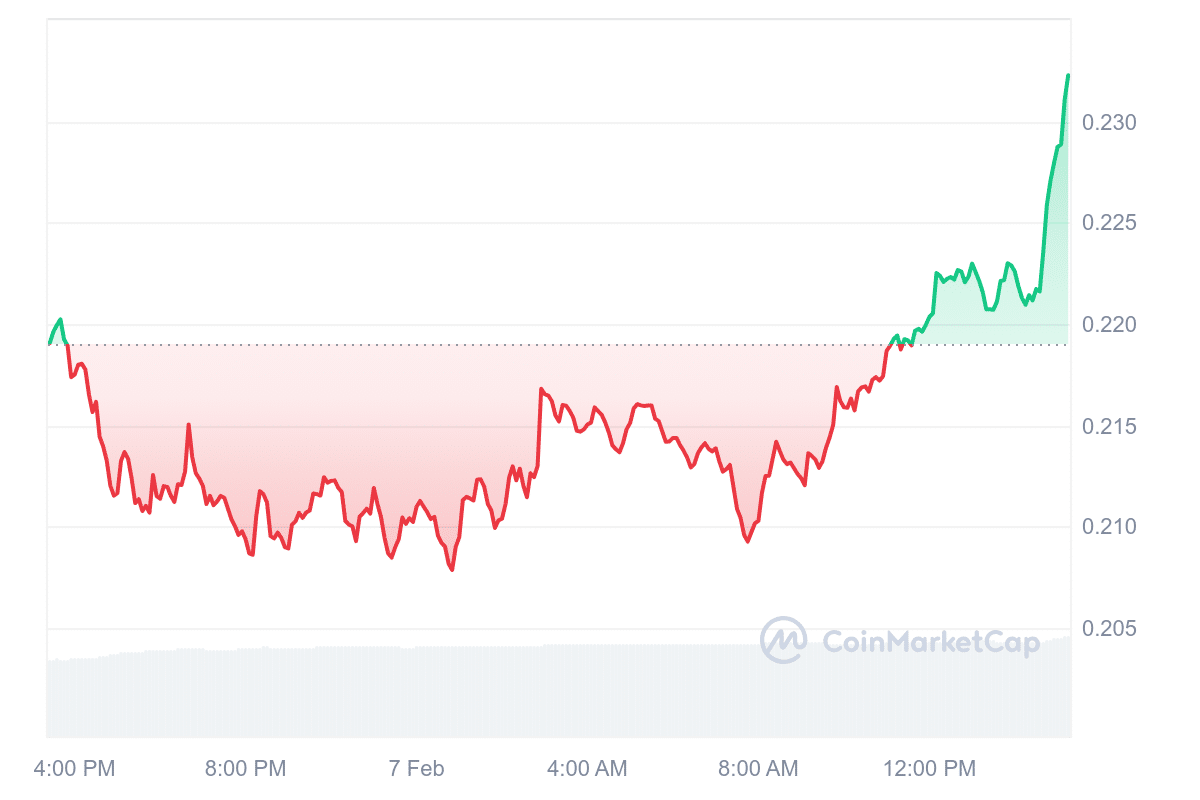

IOTA Rebased is making regular progress by enhancing its know-how with key updates to enhance effectivity, safety, and accessibility. Latest developments emphasize a safer and efficient consensus mechanism, localized payment markets, predictable transaction prices, and truthful validator choice. Moreover, multi-virtual machine (MultiVM) Layer 1 assist, together with EVM compatibility, strengthens its adaptability.

The undertaking has additionally welcomed a number of established validators, staking service suppliers, and infrastructure companions to its check community. These trade contributors, identified for managing important digital belongings, contribute to the reliability and trustworthiness of IOTA’s validation course of. Their presence reinforces IOTA’s efforts to determine enterprise-grade safety.

One other noteworthy integration is the addition of Keyring, a {hardware} pockets supplier that enhances asset administration and staking inside the IOTA ecosystem. This integration simplifies transactions whereas sustaining a steadiness between safety and comfort.

IOTA Rebased builds on established tech with our personal enhancements:

✅ Safe, environment friendly consensus

✅ Native payment markets

✅ Feeless sponsored TXs

✅ Predictable fuel charges

✅ Honest validator choice

✅ MultiVM L1 assist (EVM & extra).Dive in at https://t.co/hncXNcfJB5 pic.twitter.com/0f8j53Ps1s

— IOTA (@iota) February 7, 2025

IOTA’s market efficiency has additionally proven resilience. Its worth is at the moment buying and selling above the 200-day easy shifting common, which signifies optimistic sentiment and excessive liquidity, supported by elevated buying and selling quantity.

Total, IOTA Rebased continues to strengthen its basis with incremental enhancements, strategic partnerships, and rising market confidence. Whereas additional developments will form its long-term success, its trajectory suggests regular progress towards a extra strong ecosystem.

4. UXLINK (UXLINK)

UXLINK has just lately introduced two notable collaborations that would affect its adoption and usefulness within the Web3 house. The primary partnership is with AEON Group, a blockchain-based fee protocol. This collaboration will combine UXLINK’s token ($UXLINK) into AEON Pay, enabling in-store funds in numerous nations, notably Southeast Asia. This might improve the token’s real-world utility and assist its broader adoption in digital transactions.

Moreover, UXLINK has teamed up with SOON, a undertaking centered on blockchain scalability. SOON goals to reinforce Layer 1 efficiency via its roll-up know-how, making blockchain adoption extra environment friendly. This partnership aligns with UXLINK’s goal of increasing Web3 purposes.

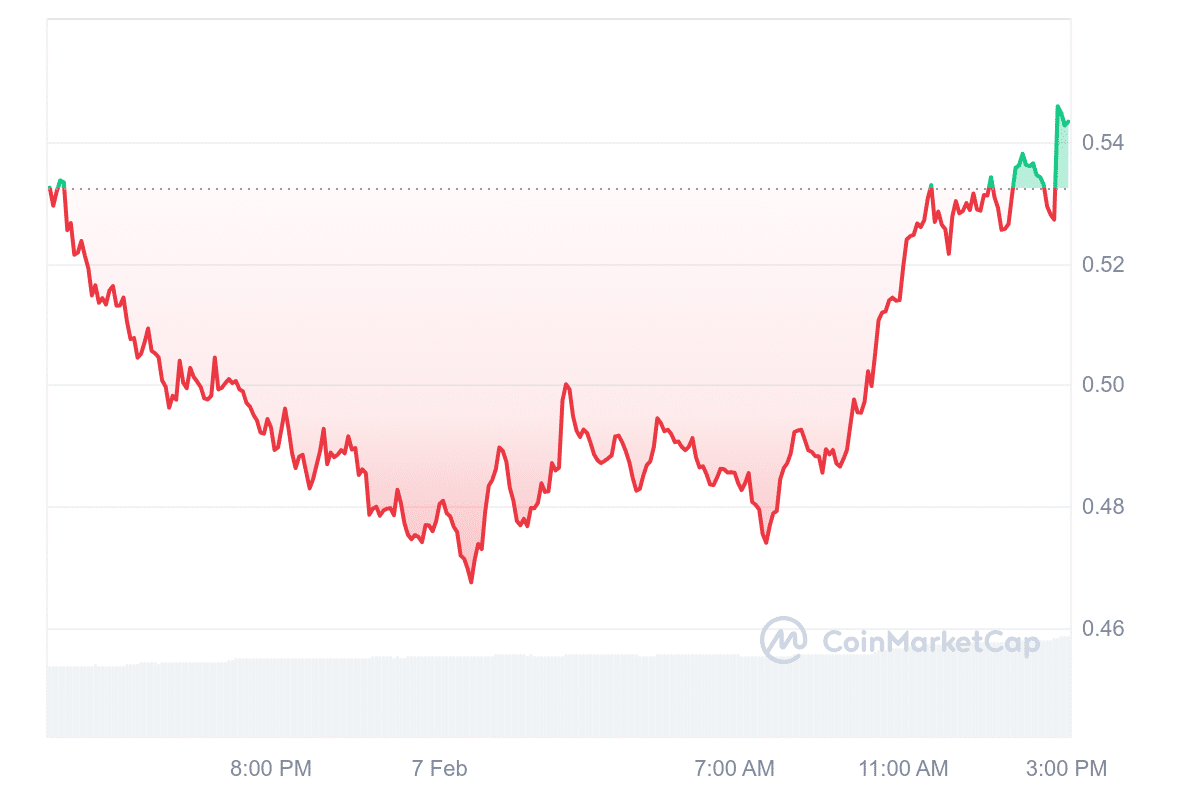

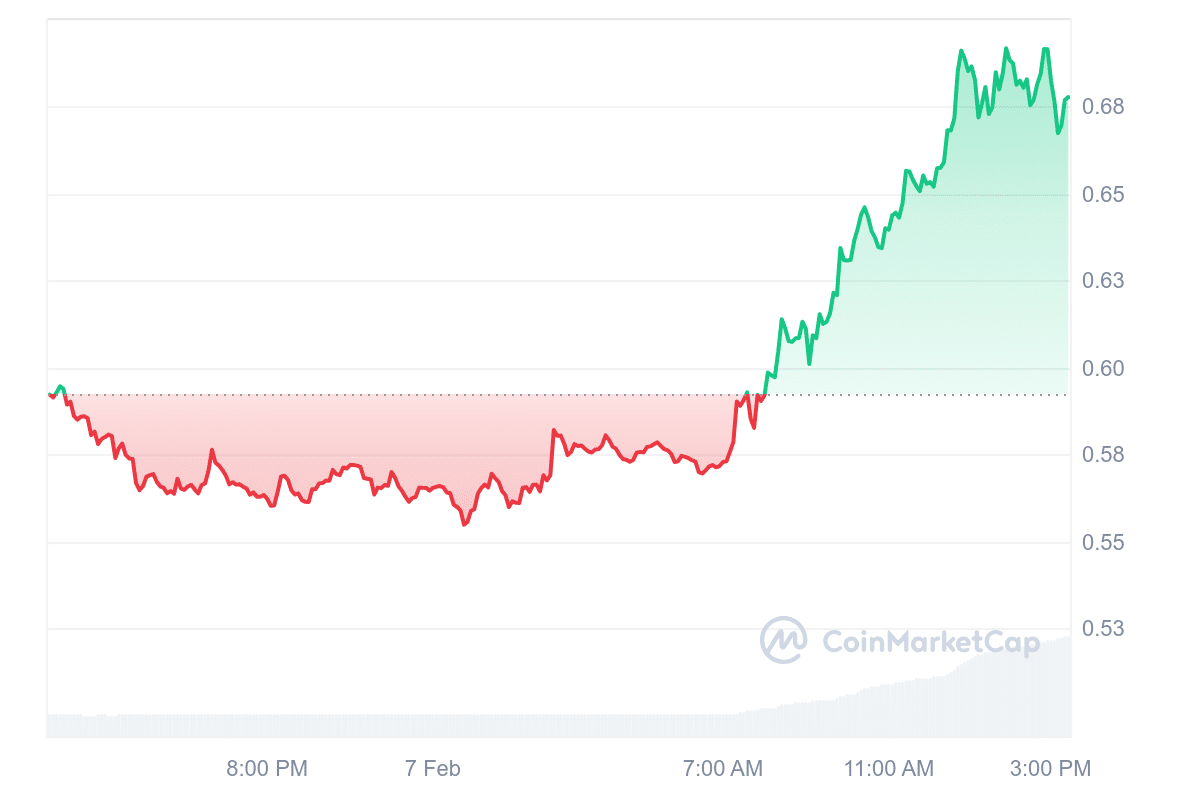

By way of market exercise, $UXLINK has skilled important motion. On the time of reporting, it’s valued at $0.6727, reflecting a 14.12% improve inside the previous day. The token’s market capitalization has reached $227.51 million, whereas its 24-hour buying and selling quantity has surged by 341.05% to roughly $153.18 million.

🫡Glad to be partnership with @AEON_Community, a number one #WEB3 fee protocol. $UXLINK will probably be supported by #AEON Pay and tens of thousands and thousands #UXLINKfams may use their token to make in-store fee in actual world in dozens of nations particularly in South East Asia.

UXLINK… https://t.co/SD2DgteH3K

— UXLINK (@UXLINKofficial) February 7, 2025

These developments counsel that UXLINK focuses on rising its token’s usability and scalability. Nevertheless, as with every digital asset, the long-term impression of those partnerships will depend upon adoption charges and market circumstances.

5. Solaxy ($SOLX)

Solaxy gained consideration in 2025 as a meme coin undertaking, with its SOLX token presale nearing the $20 million mark. Regardless of market fluctuations, it continues to draw traders. A number of components contribute to its speedy progress. Since its launch, Solaxy has been in comparison with platforms like Arbitrum and Optimism attributable to its concentrate on layer-2 options. Nevertheless, it stands out by incorporating meme tradition into its framework. The undertaking blends humor with science, that includes a frog mascot impressed by Einstein. This fusion makes it interesting to a broad viewers.

Whereas Solaxy actively engages customers via social media, it goals for greater than short-term hype. The undertaking maintains a robust on-line presence, with round 66,000 followers on Twitter and 6,000 members on Telegram. Its advertising technique depends on daring visuals and narratives, which assist construct a loyal neighborhood.

The mix of technical innovation and cultural attraction has attracted important curiosity. This strategy has contributed to its increasing viewers and rising investor confidence. Nevertheless, whether or not this momentum results in long-term stability stays unsure. The undertaking should ship on its guarantees to maintain its success.

Solaxy’s presale highlights the potential of merging blockchain developments with web tendencies. Whereas its advertising and neighborhood assist have fueled its development, its future will depend upon continued improvement and real-world utility. Buyers will probably watch intently to see if it may keep its present trajectory.

Study Extra

Our Earlier Greatest Low-cost Cryptocurrencies to Purchase Beneath 1 Greenback Publish

Be a part of Our Telegram channel to remain updated on breaking information protection