- Japan launched information displaying strong wage development.

- A pause in US tariffs weakened the buck.

- US employment figures revealed a drop in job development and decrease unemployment.

The USD/JPY weekly forecast is bearish amid rising bets for a Financial institution of Japan charge hike, boosting the yen.

Ups and downs of USD/JPY

The USD/JPY pair ended the week decrease because the yen rallied in opposition to the greenback as a result of a surge in BoJ charge hike expectations. On the identical time, a pause in US tariffs weakened the buck.

–Are you curious about studying extra about STP brokers? Test our detailed guide-

BoJ charge hike bets rose after Japan launched information displaying strong wage development.

In the meantime, the greenback eased as market contributors grew to become extra satisfied that Trump’s tariffs had been only a negotiation tactic. He paused tariffs on Canada and Mexico, plunging the greenback. Moreover, employment figures revealed a drop in job development and decrease unemployment, portray a blended image of the labor sector.

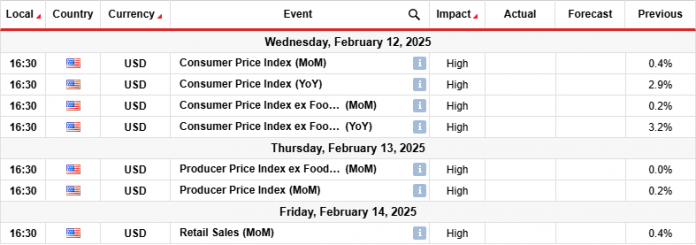

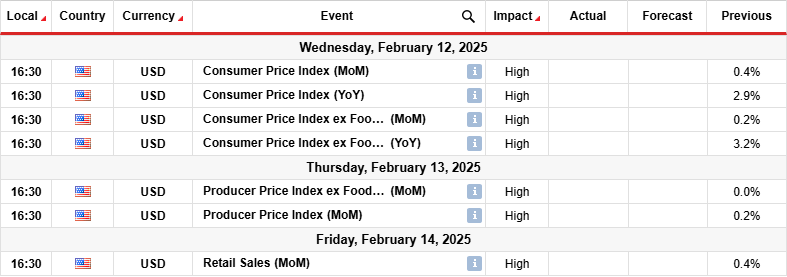

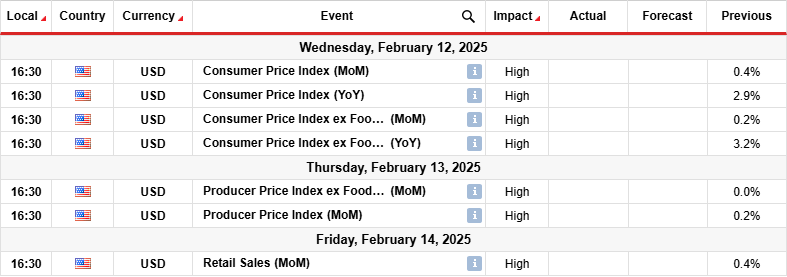

Subsequent week’s key occasions for USD/JPY

Subsequent week, merchants will give attention to information from the US, together with shopper inflation, producer inflation and retail gross sales. The inflation figures will present the state of value pressures, shaping the outlook for Fed charge cuts.

Final month, inflation got here in at 2.9%, nearing the Fed’s 2% goal. Nonetheless, policymakers have remained cautious as a result of it has paused close to this stage. Consequently, the central financial institution has been ready for extra progress earlier than signaling additional charge cuts. In the meantime, the retail gross sales report will present the state of shopper spending within the US.

USD/JPY weekly technical forecast: Value targets the 150.06 help

On the technical facet, the USD/JPY value is approaching the 150.06 help stage after breaking beneath its bullish trendline. The worth trades far beneath the 22-SMA, displaying a robust lead for bears. On the identical time, the RSI trades close to the oversold area, indicating strong bearish momentum.

–Are you curious about studying extra about earning money with foreign exchange? Test our detailed guide-

Bulls paused the earlier transfer when the worth received to the 158.54 resistance stage. Furthermore, though the worth made increased highs and lows, it broke beneath the 22-SMA, indicating a corrective transfer. On the identical time, the RSI didn’t enter the overbought area, an indication that both bulls had been holding again, or bears had been robust too.

After the corrective transfer, USD/JPY would possibly make an impulsive leg. Subsequently, the worth would possibly break beneath the 150.06 help to succeed in the 145.00 help. Nonetheless, the worth would possibly retest the 22-SMA as resistance earlier than persevering with decrease.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you may afford to take the excessive threat of dropping your cash.