The US Securities and Trade Fee (SEC) and international crypto change Binance have filed a joint movement to halt the continued authorized battle for 2 months, citing the continued adjustments within the regulatory company.

SEC Vs Binance To Take A Pause

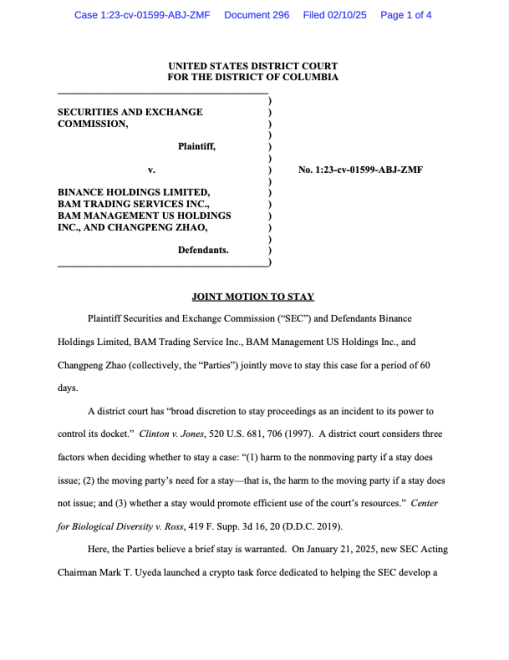

On Tuesday, FOX Enterprise journalist Eleanor Terrett reported that the US SEC and Binance had requested a 60-day pause on the regulator’s case in opposition to the worldwide crypto change. The joint movement, dated February 10, 2025, argues that the litigation warrants a keep as a result of creation of the SEC’s Crypto Job Drive, led by SEC Commissioner Hester Peirce.

The 2 events take into account that the Job Drive, created by the Fee’s appearing chair, Mark Uyeda, to assist develop a regulatory framework for crypto belongings, might “impression and facilitate the potential decision of this case.”

SEC and Binance's joint movement to remain. Supply: Courtroom Listener

In June 2023, the SEC filed a lawsuit in opposition to the crypto change, arguing that Binance, its US affiliate, BAM Buying and selling Companies Inc., and the change’s former CEO, Changpeng Zhao, supplied the sale of unregistered securities and had operated illegally within the US.

The US watchdog argued that the dearth of registration enabled Binance to allegedly run an unregulated buying and selling platform that uncovered US buyers to vital dangers and misled prospects in regards to the safety and regulatory oversight of their belongings.

The change filed a movement to dismiss the lawsuit, alleging that the SEC had exceeded its authorized authority, however Decide Amy Berman Jackson dominated in opposition to the movement in July 2024. Nonetheless, the choose granted Binance a partial victory after rejecting a number of the Fee’s foremost claims.

The courtroom ruling dismissed the claims associated to the secondary market gross sales of BNB tokens, the classification of Binance USD (BUSD) stablecoin as an funding contract, and “the assertion that crypto tokens themselves are securities.”

Regardless of this, Decide Jackson allowed the case to proceed with claims in regards to the change’s staking program, BNB’s Preliminary Coin Providing (ICO) gross sales, and anti-fraud violations of the Securities Act.

Extra Joint Motions To Come?

In accordance with the Monday courtroom doc, the regulatory company proposed a short stick with Binance, which the crypto change agreed to, contemplating it “acceptable and within the curiosity of judicial financial system.”

Furthermore, the joint movement affirms the keep might “save the events assets” if an early decision is reached, eradicating the necessity to proceed the deserves discovery.

Additional, this temporary keep will promote the environment friendly use of the Courtroom’s assets, as a decision would obviate the necessity for the Courtroom to resolve the Defendants’ pending Motions to Dismiss the Amended Grievance.

Following the 60-day keep, Binance and the SEC plan to submit a joint standing report, together with whether or not a continuation of the keep is warranted.

Terret alleges that the joint keep movement is the primary requested pause on crypto litigation within the courts since Uyeda grew to become appearing chair on January 20. The journalist added that she expects to see different non-fraud causes, corresponding to Ripple, Coinbase, and Kraken, comply with swimsuit and request a movement keep.

Binance Coin (BNB) trades at $634.76 within the one-week chart. Supply: BNBUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com