Bitcoin has skilled subdued value motion over the previous few days, ranging between $94,700 and $98,500 since final Friday. This lack of volatility has added to the speculative setting, with each bulls and bears struggling to take decisive management of the market. Whereas bulls have didn’t push the worth above the essential $100K mark, bears have been equally unable to tug BTC beneath $94,700, holding the worth locked in a decent vary.

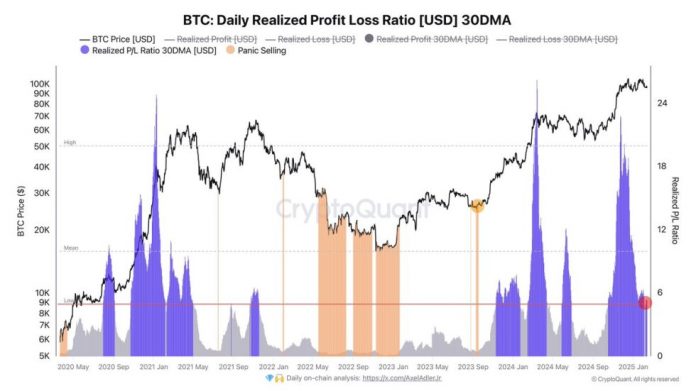

CryptoQuant analyst Axel Adler shared key metrics that present helpful insights into this cycle’s distinctive traits. Adler identified that in this cycle, there was just one main panic sell-off in September 2023. Past that occasion, holders have been realizing extra income than losses, indicating a market pushed extra by managed profit-taking than widespread panic promoting.

This profit-oriented habits underscores a comparatively secure cycle regardless of the present uncertainty. It additionally means that long-term holders and whales stay assured in Bitcoin’s potential, whilst short-term course stays unclear. If BTC can escape of its present vary, the worth might both retest the $90K assist zone or push previous $100K to check greater provide ranges. Till then, the speculative setting is predicted to persist as merchants await a transparent sign.

Bitcoin Bull Cycle Stays Secure

Bitcoin continues to guide the market amid ongoing volatility and uncertainty, demonstrating resilience whereas most altcoins wrestle beneath promoting stress. Regardless of the challenges, BTC has maintained energy above essential demand ranges, with bulls efficiently pushing the worth above the $95K mark. This stability has stored the broader bullish construction intact, whilst short-term value motion stays indecisive.

The market’s short-term course stays unclear, as BTC fluctuates inside a variety, and volatility dominates each day buying and selling exercise. Bulls face the essential job of reclaiming the $100K stage to reestablish momentum, whereas bears are equally unable to drive the worth beneath key assist ranges. This tug-of-war displays the broader market setting, the place Bitcoin’s dominance gives a way of stability in comparison with struggling altcoins.

Key metrics from CryptoQuant, shared by analyst Axel Adler on X, spotlight a defining characteristic of this cycle. Adler factors out that there was just one main panic sell-off in September 2023. Since that occasion, holders have constantly realized extra income than losses, showcasing the market’s resilience and maturity. This knowledge underpins the sustainability of the present bull cycle, even amid fluctuating value motion.

With holders avoiding vital losses and long-term confidence remaining intact, Bitcoin’s outlook suggests room for progress within the coming months. Nevertheless, breaking via key resistance ranges and sustaining demand at present assist zones can be essential in figuring out the following leg of this cycle. As altcoins proceed to wrestle, Bitcoin’s skill to carry its floor positions it because the market’s anchor amid uncertainty. The approaching weeks will possible reveal whether or not this stability can translate right into a breakout or if consolidation will persist.

Testing Essential Liquidity Ranges

Bitcoin is buying and selling at $95,800 after a number of days of indecision, with value motion confined to a slim vary between $95K and $98K. The dearth of motion highlights the continued wrestle between bulls and bears, as neither aspect has been capable of achieve management of the market. This extended consolidation suggests {that a} large transfer might be on the horizon.

For bulls, reclaiming the $100K mark is the important thing to igniting a brand new rally. A profitable push above this essential psychological stage would possible result in a surge into all-time highs (ATH) and will set the stage for an additional bullish part. This could reinforce the present bullish construction and restore confidence amongst buyers who’ve been ready for a breakout.

Alternatively, dropping the $95K mark would sign potential weak spot, opening the door for BTC to retest decrease demand zones across the $89K stage. Such a transfer might set off additional promoting stress, placing bulls in a tough place to defend the market’s total uptrend.

With value motion caught in a decent vary, the market stays speculative, and volatility is more likely to return quickly. Merchants are carefully anticipating a breakout in both course, which can outline Bitcoin’s short-term trajectory.

Featured picture from Dall-E, chart from TradingView