The long-awaited altcoin season (alt season) has arrived, based on CryptoQuant CEO Ki Younger Ju.

Nevertheless, the analyst says this one performs by completely different guidelines, not like earlier cycles pushed by a transparent Bitcoin-to-altcoin capital rotation.

Analyst Calls Altcoin Season—However Not as Anticipated

Ju’s newest observations counsel that stablecoin holders, not Bitcoin merchants, gasoline selective altcoin features whereas market liquidity stays constrained.

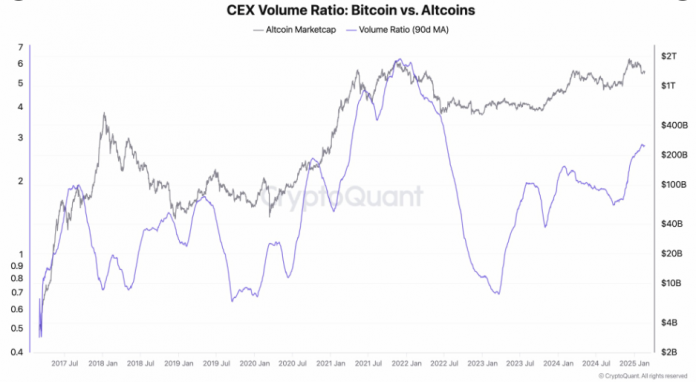

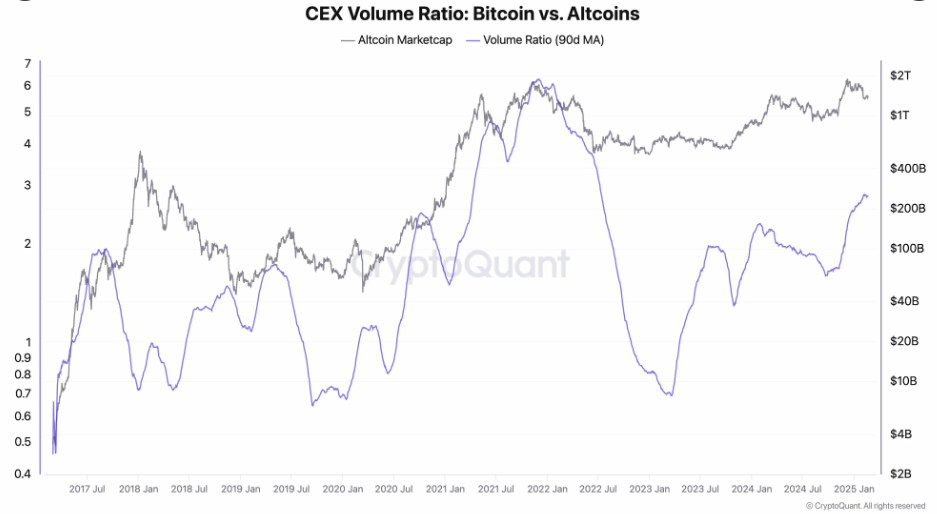

In a current put up on X (previously Twitter), Ju declared that alt season has begun, citing a pointy enhance in altcoin buying and selling volumes. In accordance with the analyst, the altcoin buying and selling quantity is now 2.7 occasions that of Bitcoin. Nevertheless, Ju additionally famous that this isn’t a broad-based rally.

“It’s a really selective alt season…Only some cash are pumping. With no recent liquidity, it looks like a PvP struggle over a hard and fast pie,” he wrote.

This assertion aligns along with his earlier warnings. In January, Ki cautioned that the altcoin market stays a zero-sum sport, with capital circulating amongst belongings quite than seeing new inflows. In December, he additionally predicted that this alt season can be “bizarre and difficult,” favoring solely choose belongings.

“Altcoins used to maneuver collectively primarily based on their correlation with BTC, however that sample has now damaged. Only some are beginning to present unbiased traits as they entice new liquidity,” Ki had written.

Whereas some merchants are excited, others stay unconvinced. RobW, a consumer on X, questioned Ju’s definition of alt season.

“A couple of tokens are pumping, so it should be alt season? Not one of the typical metrics apply, however it’s alt season for those who choose actually fastidiously, doesn’t sound like an alt season,” RobW challenged.

Equally, DeimosWeb3 urged that whereas some altcoins are performing nicely, the market has not but entered a full-fledged alt season.

China’s Fiscal Strikes and Crypto Markets

A parallel dialogue within the crypto group includes China’s current fiscal maneuvers. Some speculate that China’s financial insurance policies may inject liquidity into world markets, benefiting crypto.

Nevertheless, analysts urge warning, declaring that China has not injected new capital however recalculated its M1 cash provide to incorporate demand deposits and pay as you go funds.

“They didn’t inject new capital. They “recalculated” it to incorporate different deposits and funds. There isn’t any recent print,” a consumer on X articulated.

Native media confirms this, indicating that the Folks’s Financial institution of China, the nation’s central financial institution, will embrace these components beginning in 2025.

Crypto and DeFi researcher NFT Bear highlighted that this alteration led to a dramatic 67.59% enhance in reported M1 provide. Nevertheless, he emphasised that it doesn’t equate to recent liquidity hitting monetary markets.

Historic comparisons to the US’s 2020 money-printing frenzy have additionally surfaced. The US rapidly elevated its M1 cash provide again then, fueling a 16x surge in altcoin market capitalization.

Whereas China’s present actions differ, some merchants speculate that even a fraction of recent liquidity flowing into crypto may set off one other bull run.

“Whether or not or not this interprets into one other explosive crypto rally stays to be seen. However one factor’s for certain: when a serious world economic system infuses liquidity—regardless of the way it’s measured—monetary markets are likely to take discover, and crypto is commonly on the heart of that dialog,” NFT Bear indicated.

Regardless of the uncertainty, some altcoins have outperformed. Initiatives like Sei (SEI), Sui (SUI), Zksync (ZK), and Story (IP) have attracted consideration, probably signaling rising narratives within the house.

Whether or not these features are sustainable or merely short-term surges in a fragmented market stays to be seen. Nonetheless, analysts agree that the standard altcoin season metrics not apply.

The crypto market is altering, with Bitcoin performing as a paper-based asset by way of ETFs (exchange-traded funds) and institutional funds. As a substitute of a broad BTC-to-alt capital rotation, altcoins seem like carving out unbiased narratives and utility to draw capital.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.