Bitcoin is buying and selling under the $100,000 mark, with bulls unable to reclaim this key stage for over three weeks. The worth has remained above crucial demand zones, however market uncertainty and volatility proceed to weigh on sentiment. Traders are rising impatient, as BTC’s worth motion has remained indecisive, fluctuating between makes an attempt to interrupt above provide and dangers of a deeper correction.

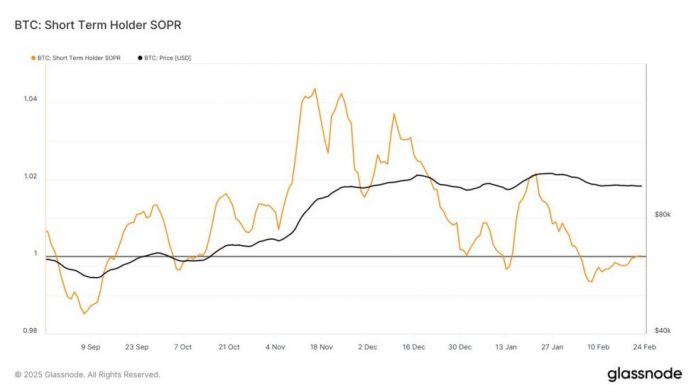

Essential knowledge from Glassnode reveals that Bitcoin’s Quick-Time period Holder Spent Output Revenue Ratio (STH-SOPR) on a 7-day Easy Transferring Common (SMA) is as soon as once more testing the breakeven stage at 1.0. This indicator measures whether or not short-term holders are promoting at a revenue or loss. Traditionally, a clear breakout above 1.0 confirms a shift in market momentum, usually resulting in robust rallies. Nonetheless, failure to carry above this stage has often resulted in renewed promoting stress and additional worth declines.

The following few days will likely be crucial as Bitcoin checks this key metric. If BTC can reclaim $100K whereas the STH-SOPR breaks above 1.0, a bullish pattern reversal could also be confirmed. Nonetheless, if rejection happens, the market may face one other wave of promoting, pushing BTC into decrease demand ranges.

Bitcoin Worth Motion Stays Unsure

Bitcoin has struggled under the $100K mark since late January, with bulls failing to verify a restoration rally regardless of a number of makes an attempt. On the similar time, bears have been unable to push BTC under key demand ranges round $90K, retaining the market locked in a good consolidation part. This extended interval of indecision has left traders pissed off, as they anticipate a serious transfer in both path.

The short-term outlook for Bitcoin stays unsure, with worth motion exhibiting indicators of consolidation. Whereas long-term traders proceed to carry, short-term merchants are in search of affirmation of the following pattern. Glassnode’s knowledge shared on X reveals that Bitcoin’s Quick-Time period Holder Spent Output Revenue Ratio (STH-SOPR) on a 7-day Easy Transferring Common (SMA) is as soon as once more testing the breakeven stage at 1.0. This metric measures whether or not short-term holders are promoting at a revenue or loss, offering key insights into market sentiment.

Traditionally, a breakout above the 1.0 stage has confirmed a shift in momentum, usually resulting in robust bullish traits. Nonetheless, failure to carry above this stage has often resulted in renewed promoting stress. The final try in early January was profitable however short-lived, making this take a look at a crucial second for Bitcoin’s subsequent transfer.

If BTC holds above key ranges whereas the STH-SOPR pushes greater, a breakout towards $100K and past may comply with. Conversely, one other rejection may set off contemporary draw back, placing key demand ranges to the take a look at as soon as once more.

BTC Holds Tight Vary As Bulls Battle

Bitcoin is buying and selling at $95,500 after days of indecisive worth motion, struggling between key demand and provide ranges. Bulls have been unable to reclaim the $100K mark, going through robust resistance each time BTC approaches this psychological stage. On the similar time, bears have did not push the value under $94K, retaining the market in a slim vary.

This extended consolidation suggests {that a} main transfer is on the horizon. Traditionally, when Bitcoin trades in such a good vary for an prolonged interval, a major breakout follows. If present demand ranges maintain and BTC finds momentum, a push above the $100K mark is probably going within the coming days. Breaking this resistance may result in an aggressive rally into worth discovery.

Alternatively, if bears handle to take management and drive the value under $94K, BTC may take a look at decrease demand zones, with $90K being a vital stage to look at. For now, all eyes are in the marketplace as merchants anticipate Bitcoin’s subsequent huge transfer. One factor is definite—as soon as BTC breaks out of this vary, will probably be an enormous breakout in both path.

Featured picture from Dall-E, chart from TradingView