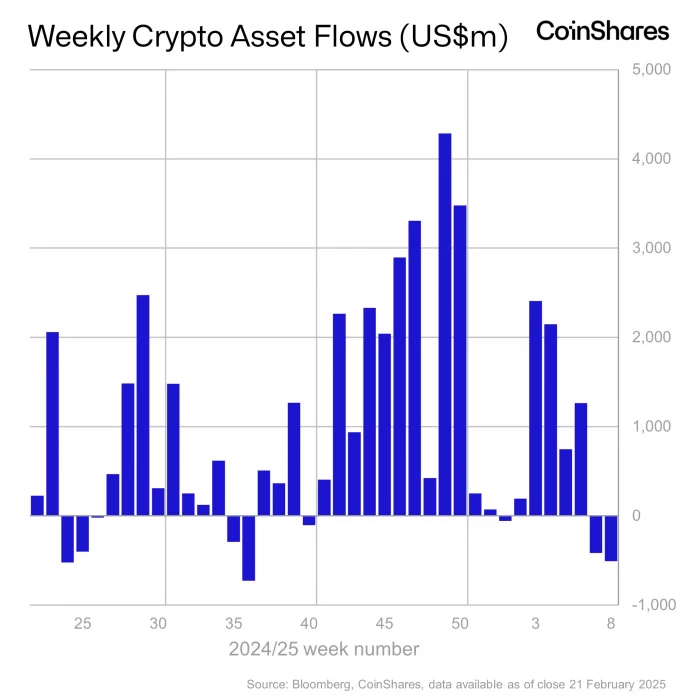

Crypto asset administration agency CoinShares says institutional whales pulled a whole lot of thousands and thousands of {dollars} out of crypto funding autos final week.

In response to CoinShares’ newest Digital Asset Fund Flows Weekly Report, final month’s US presidential inauguration had a adverse influence on investor sentiment final week.

“Digital asset funding merchandise noticed outflows totaling US$508m final week, bringing the final two weeks of outflows to US$924m, following an 18-week run totaling US$29bn.

We imagine traders are exercising warning following the US Presidential inauguration and the resultant uncertainty round commerce tariffs, inflation and financial coverage. That is additionally evident in buying and selling turnover, which has fallen significantly from US$22bn 2 weeks in the past to US$13bn final week.”

In response to CoinShares, XRP merchandise noticed probably the most important inflows of any crypto product, together with Bitcoin (BTC), which normally takes the lion’s share of inflows. Whereas BTC merchandise suffered $571 million in outflows, XRP merchandise raked in $38.3 million in inflows.

“XRP has now seen US$819m of inflows since mid-November 2025, reflecting investor hopes that the SEC will drop its lawsuit. Solana, Ethereum and Sui adopted with inflows of US$8.9m, US$3.7m and US$1.47m, respectively.”

Regionally, the US led all areas in outflows at $560 million. Germany and Switzerland led all areas in inflows with $30.5 million and $15.8 million in inflows.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Zaleman/INelson