Why is that this inventory’s value drop not as dangerous because it appears? Try the hidden alternative behind this innovator’s mildly disappointing numbers.

Some buyers took one have a look at The Commerce Desk‘s (TTD -1.64%) fourth-quarter outcomes and slammed the promote button. The digital promoting professional missed Wall Avenue’s consensus income goal for the primary time because the firm went public in 2016. The inventory closed 33% decrease the subsequent day, erasing a yr’s price of market-beating good points. Proper now, The Commerce Desk’s inventory is down 50% from its annual peak.

Discount alert: The Commerce Desk is on sale!

In my eyes, that is a wide-open invitation to purchase this top-quality development inventory. It is nonetheless not an affordable inventory, buying and selling at 90 instances trailing earnings and 14 instances gross sales. However that is approach down from current peaks, with price-to-earnings (P/E) ratios typically hovering above 200 and price-to-sales (P/S) figures briefly peeking above 30. So, from a historic viewpoint, The Commerce Desk’s shares look fairly inexpensive proper now.

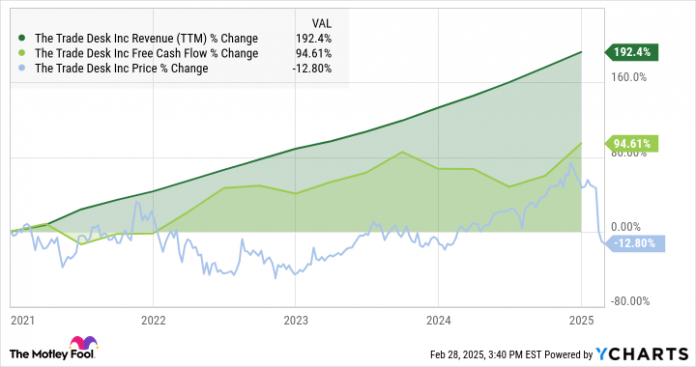

And you may’t neglect in regards to the firm’s large development potential. Keep in mind the inflation disaster that led to a bear market in 2022? The Commerce Desk’s inventory adopted the market decrease, however you would not have guessed that when you have been wanting on the firm’s enterprise outcomes. The blue value chart within the graph beneath exhibits you the market motion, however do you even see a slowdown in The Commerce Desk’s gross sales development? In the meantime, its money earnings continued to pattern upward:

TTD Income (TTM) information by YCharts. TTM = trailing 12 months.

A 15-step restoration plan

So, The Commerce Desk’s annual free money flows have roughly doubled in 4 years, whereas revenues have almost tripled. The inventory is 12% cheaper over the identical span.

Sure, the corporate upset buyers with gradual gross sales development and modest forward-looking steering within the final earnings report. The brutal market response appears misplaced, although. The uncommon income miss was a 22.3% year-over-year income bounce, falling simply in need of a 25.2% development goal.

Administration did precisely the appropriate factor. CFO Laura Schenkein took “full possession” of the income miss on the This fall earnings name. It wasn’t a missed alternative however a interval of comparatively weak execution. In response, The Commerce Desk laid out an in depth 15-point plan to kick the stalled gross sales development into increased gear. The factors of motion embody partnerships, audio advertisements, hirings within the gross sales division, and a tweaked course of for product growth.

The Commerce Desk is just not taking this slowness in stride. The corporate is taking resolute motion to get again on monitor.

Paying a premium for an distinctive firm

I can not promise that The Commerce Desk’s challenges will fade out in 2025, and a few buyers would say the inventory stays too costly even now. Nonetheless, you are paying a premium for a high-octane development inventory. This one earns an additional gold star for its constructive earnings and money flows — many companies with the pedal to the metallic are inclined to accumulate bottom-line losses till they’re able to decelerate and gather earnings.

The Commerce Desk is rising quick and making a revenue on the identical time. This mix alone deserves a major value premium. Furthermore, the corporate stays an innovator within the digital promoting know-how area. Its Unified ID 2.0 (or UID2) commonplace is gaining help throughout the web, serving to advertisers and ad-spot sellers put together for a radically modified advert market as Alphabet (GOOG 1.18%) (GOOGL 1.06%) is compelled to restrict the utility of its ad-tracking companies.

So, I do not thoughts paying a reasonably penny for The Commerce Desk’s inventory. Sooner or later, I’d keep in mind the spring of 2025 as a time when this improbable development inventory was obtainable at a reduction. This top-shelf development inventory ought to serve you effectively in the long term, particularly when you begin your place at as we speak’s pretty modest value.

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Alphabet and The Commerce Desk. The Motley Idiot has positions in and recommends Alphabet and The Commerce Desk. The Motley Idiot has a disclosure coverage.