Costco Wholesale (COST -0.37%) is likely one of the most iconic and recognizable retailers on this planet. Its large warehouses are sometimes filled with prospects, and its treasure hunt expertise inevitably leaves customers spending way more than they deliberate. That is evident with the corporate’s robust and spectacular progress through the years.

And with a lot room to increase, particularly in worldwide markets, it is arduous to not like Costco as a long-term funding. However does it have sufficient upside to probably flip a $25,000 funding into $1 million over the subsequent 25 years?

Costco’s progress has been sturdy

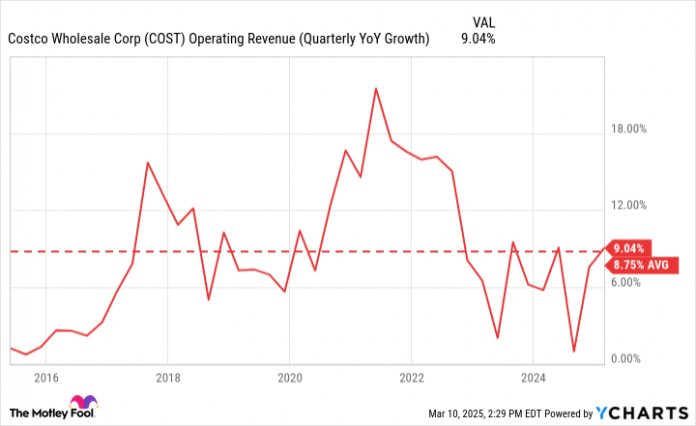

What’s spectacular about Costco’s enterprise is that it at all times appears to do nicely. It generated implausible numbers through the pandemic and even amid inflation. Whether or not customers have been loading up on necessities, discretionary purchases, or making an attempt to save cash, there at all times appears to be loads of site visitors at its shops. The corporate has been in a position to constantly develop its high line over the previous decade at a reasonably excessive charge — near double digits.

COST Working Income (Quarterly YoY Development) knowledge by YCharts

The majority of its warehouses, nevertheless, are nonetheless in North America; america, Canada, and Mexico account for 767 of its 897 warehouses. The corporate has been rising its presence in China, however with simply seven warehouses there, it is barely scratching the floor. And it is the huge long-run alternatives in worldwide markets that may make this a high progress inventory to personal for not solely years, however a long time.

Over the previous 10 years, the inventory has risen a formidable 520%. The one potential downside, nevertheless, is that its excessive valuation might make it tough for it to copy these forms of returns within the years forward.

The inventory trades at a large premium

Costco is a beloved enterprise and inventory, however to personal a bit of it, you must be ready to pay an enormous premium. As we speak, it is buying and selling at greater than 50 occasions trailing earnings. That is costly, given its single-digit progress charge. The hazard when paying such a excessive a number of for the enterprise is that sky-high expectations are priced in, and if the corporate does not ship, there may very well be a pointy drop in its share worth.

COST PE Ratio knowledge by YCharts

Buyers have been paying an elevated a number of for the inventory for the reason that pandemic started and when its progress charge took off. However now as that progress charge is coming down and staying round extra regular ranges, I’d count on to see the price-to-earnings a number of to additionally come down, which is why I would not be terribly optimistic that this generally is a millionaire-making inventory to carry, even over the long run.

Costco is an efficient purchase, however buyers ought to mood their expectations

Whereas Costco has delivered some nice features for buyers lately, for it to show a $25,000 funding into $1 million, it might should be a 40-bagger; its market cap would wish to finally attain $16.6 trillion. So much can occur over 25 years, however I would not count on Costco to turn into 40 occasions extra beneficial than it’s right this moment, because it appears to be like to be overdue for a large correction.

That is nonetheless a great inventory to purchase and maintain, however buyers ought to be cautious to not assume that the inventory’s spectacular features lately will proceed for many years.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Costco Wholesale. The Motley Idiot has a disclosure coverage.