Ali Martinez, a outstanding market analyst, just lately tweeted a couple of potential worth rebound for GameStop Corp. GME, citing a purchase sign on the TD Sequential indicator.

What Occurred: On Thursday, Martinez shared his observations on GameStop’s inventory efficiency on X. He identified that the TD Sequential indicator, a instrument used to foretell pattern reversals in inventory costs, was exhibiting a purchase sign for the online game retailer. The inventory additionally climbed 1.37% in the course of the in a single day buying and selling session on Robinhood.

Since 2020, GameStop has been extremely risky as a meme inventory, primarily fueled by retail investor enthusiasm on platforms like Reddit. Retail traders on Reddit’s r/WallStreetBets sparked the 2021 GameStop “meme inventory” frenzy by way of a brief squeeze, considerably affecting hedge funds that had wagered towards it. Though its fundamentals are weak, Martinez’s evaluation signifies that merchants could count on a worth rebound after a interval of decline.

See Additionally: Vodafone Shares Rise After Securing Community Enlargement Deal With Nokia: What’s Going On?

Why It Issues: GameStop’s inventory has been underneath stress just lately because of broader market issues. The corporate’s shares moved decrease on Monday amid recession worries and uncertainty relating to tariffs and commerce coverage.

Earlier this month, President Donald Trump imposed vital tariffs on imports from Canada, Mexico, and China, inflicting market instability. Regardless of these challenges, Martinez’s submit means that GameStop could be establishing for a worth rebound, providing a glimmer of hope for traders forward of its fourth quarter outcomes on March 25.

February stories concerning the addition of Bitcoin BTC/USD and different cryptocurrencies to GameStop’s steadiness sheet helped the inventory surge. CEO Ryan Cohen‘s assembly with Technique MSTR co-founder Michael Saylor additionally added to the hypothesis. Notably, Martinez in a earlier submit urged traders to monitor the $74,000 stage of Bitcoin intently and indicated a ‘potential pattern shift’.

Value Motion: GameStop inventory closed on Thursday at $21.95, marking a decline of 19% over the previous 30 days, in accordance with information from Benzinga Professional.

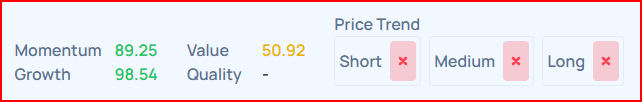

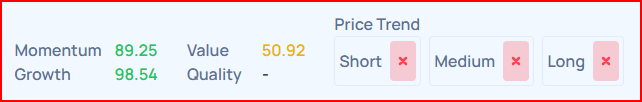

In response to Benzinga Edge Rating, GameStop outperforms SuperMicro Laptop SMCI in momentum and progress however lags in worth metrics.

GameStop Edge Rating

SuperMicro Computer systems Edge Rating:

Learn Extra:

Picture by way of Shutterstock

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and printed by Benzinga editors.

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.