Palantir Applied sciences (PLTR 2.53%) has been one of many hottest shares available on the market prior to now couple of years, rising an unbelievable 1,000% as of this writing and beating the S&P 500 index’s good points of simply 45% throughout this era by a heavy margin.

The software program specialist’s gorgeous rally may be attributed to the terrific demand for its Synthetic Intelligence Platform (AIP), which permits clients to embed generative AI capabilities into their operations. The demand for Palantir’s AIP has been so robust that the corporate’s progress accelerated impressively in 2024.

Even higher, Palantir’s spectacular progress appears right here to remain because the rising dimension of the corporate’s contracts, the fast enchancment in its buyer base, and the enlargement of its enterprise at current clients ought to guarantee wholesome top- and bottom-line progress for a very long time.

Nevertheless, there’s one large downside with Palantir proper now: the valuation. The inventory has gotten forward of itself as it’s now buying and selling at a whopping 72 occasions gross sales and 443 occasions earnings.

Although Palantir might be able to justify its costly valuation in the long term because of the massive alternative within the generative AI software program market, it might be a good suggestion for buyers to take a look at different choices which can be buying and selling at engaging valuations and have the potential to make them richer.

Let’s take a better have a look at two different names which can be method cheaper than Palantir and will match right into a diversified collection of shares for buyers seeking to assemble a million-dollar portfolio.

1. Nvidia

Semiconductor large Nvidia (NVDA 1.74%) has made buyers millionaires prior to now. As an example, a $5,000 funding made in Nvidia a decade in the past is now price simply over one million {dollars}. After all, anticipating Nvidia to duplicate such outstanding good points over the subsequent decade is not logical contemplating that it now has a market cap of just below $3 trillion, but it surely may nonetheless ship strong good points and appears a worthy candidate for a million-dollar portfolio.

That is as a result of Nvidia has a number of stable progress drivers that would pave the way in which for outstanding progress in income and earnings in the long term. From AI to gaming to automotive to digital twins, Nvidia can depend on a number of billion-dollar finish markets to maintain its spectacular progress.

Beginning with AI, the corporate’s dominant place available in the market for information heart graphics playing cards and its rising affect within the enterprise software program market has the potential so as to add billions of {dollars} to its income. The semiconductor bellwether reported a file $115 billion in information heart income within the not too long ago concluded fiscal 12 months 2025, which was a 142% enhance over the prior 12 months.

Contemplating that demand for chips deployed in high-performance computing (HPC), information facilities, and AI servers may hit $581 billion in 2035, Nvidia nonetheless has quite a lot of room for progress on this market. Importantly, Nvidia controls the lion’s share of the AI chip market, which noticed complete information heart GPU gross sales of $125 billion final 12 months.

Nvidia’s key opponents have been unable to make a lot of a dent in AI chips. After all, there’s a rising risk from the likes of Broadcom, which makes customized AI processors. However buyers ought to be aware that GPUs are the chip of selection in terms of accelerating AI workloads in an information heart, with an estimated market share of 60% of the general AI accelerator market in 2024.

On the identical time, Nvidia’s concentrate on promoting full AI server programs geared up with a number of chips that embody each GPUs and CPUs may assist the corporate preserve its spectacular share of this big finish market. That is as a result of an built-in system will allow clients to course of workloads quicker whereas decreasing power prices.

Not surprisingly, the demand for the corporate’s newest technology of Blackwell programs has ramped up at an unbelievable tempo, and Nvidia bought $11 billion of those chips within the earlier quarter. That was greater than double AMD‘s complete information heart GPU income in 2024.

However, Nvidia continues to take care of its dominance within the gaming GPU market with a share of 90%. This area is anticipated to generate a whopping $145 billion in income in 2035, suggesting that Nvidia’s gaming income may enhance considerably from the earlier fiscal 12 months’s stage of $11 billion.

Throw in different doubtlessly profitable alternatives reminiscent of digital twins and the sharp spike that is anticipated within the automotive enterprise, and it may be concluded that Nvidia is constructed for spectacular long-term progress.

What’s extra, Nvidia trades at simply 27 occasions ahead earnings, an enormous low cost to Palantir’s ahead earnings a number of of 145. This makes shopping for Nvidia a no brainer proper now. It may simply match right into a doubtlessly multibillion-dollar portfolio because of its engaging valuation and large progress alternatives.

2. C3.ai

Enterprise AI software program supplier C3.ai (AI 2.26%) has dropped considerably on the inventory market since going public in December 2020, shedding 76% of its worth as of this writing, but it surely may change into a terrific long-term guess. Like Palantir, C3.ai affords generative AI purposes and a growth platform that may combine AI into companies.

The corporate’s progress began choosing up prior to now couple of years.

AI Income (TTM) information by YCharts

C3.ai’s choices have been gaining traction not simply amongst business clients, however amongst authorities institutions as nicely. This was evident from administration’s feedback on the corporate’s February earnings convention name. C3.ai’s generative AI options can be found on main cloud computing platforms, resulting in robust progress within the adoption of its software program.

As an example, C3.ai witnessed a wholesome 72% year-over-year enhance within the variety of agreements it struck within the third quarter of fiscal 2025 (which ended on Jan. 31). The corporate reported a 26% enhance in quarterly income to $99 million, and there’s a good probability that it will likely be capable of ship stronger progress sooner or later thanks the variety of agreements it has been putting.

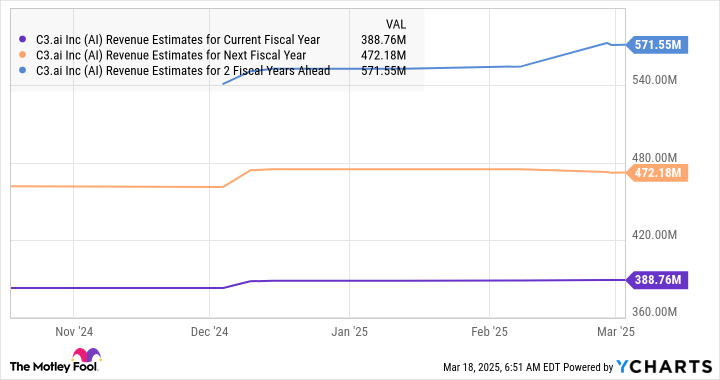

Furthermore, C3.ai factors out that a number of of its clients — each business and authorities — are getting into into “new and expanded agreements,” suggesting that additionally it is successful extra enterprise from its current shopper base. As such, it’s straightforward to see why analysts have raised their income expectations of C3.ai for the subsequent couple of fiscal years.

AI Income Estimates for Present Fiscal Yr information by YCharts

The corporate’s fiscal 2025 steerage means that its high line may bounce round 25% to $389 million on the midpoint. Nevertheless, stronger progress can’t be dominated out over the subsequent couple of fiscal years as C3.ai believes that it may step on the fuel by successful an even bigger share of the huge AI software program market.

Traders ought to be aware that the worldwide AI software program market is anticipated to leap fourfold between 2023 and 2030, producing $391 billion in annual income by the tip of the last decade.

C3.ai, subsequently, may maintain spectacular progress in its high and backside strains for a very long time to come back. Provided that C3.ai is at present buying and selling at simply over 7 occasions gross sales, it’s 10 occasions cheaper than Palantir in price-to-sales ratio. Now seems to be like a superb time to purchase C3.ai inventory as its capability to ship stable progress in the long term, together with its engaging valuation, make it one other good match for buyers seeking to assemble a million-dollar portfolio.