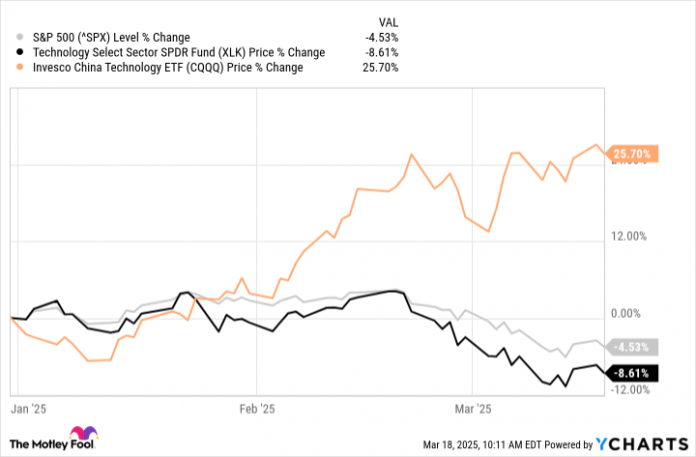

The inventory market has been falling in current weeks, and lots of tech shares have been performing particularly poorly. Because the begin of the yr, the S&P 500 is now down greater than 4%. And the Know-how Choose Sector SPDR Fund, which tracks the tech sector of the broad index, has plummeted by round 9%. Excessive valuations in tech have been an issue for some time, and hovering expectations associated to synthetic intelligence (AI) actually do not assist.

Nevertheless, not all tech shares are struggling. There’s even a tech-focused exchange-traded fund (ETF) that is doing extremely effectively this yr, up greater than 25%. And better of all, it has the potential to go even greater. The fund I am speaking about is the Invesco China Know-how ETF (CQQQ -2.46%).

Why the Invesco China Know-how ETF has been doing effectively this yr

Lately, tech shares have carried out pretty effectively for buyers. However Chinese language-based shares have largely underperformed, attributable to considerations associated to authorities overreach within the nation, and simply how protected these investments actually are.

However earlier this yr, AI firm DeepSeek rolled out an AI mannequin that was on par with its North American counterparts, together with ChatGPT. And significantly unsettling for the U.S. markets, it was supposedly at only a fraction of the price. That implies quite a lot of spending on AI might not be cash effectively spent. And if Chinese language firms are in a position to produce related sorts of chatbots, they could be higher funding alternatives given the decrease price of labor in China.

Within the chart above, you may discover that for the primary month, the China Know-how ETF was performing equally to the S&P 500 and the tech sector. However as DeepSeek rattled the markets towards the top of January and buyers started to pay extra consideration to Chinese language tech shares, a spot started to emerge, with the Chinese language-focused fund hovering greater ever since.

The China Know-how ETF nonetheless has extra room to run

Though the China Know-how ETF is up considerably this yr, it might not be too late to spend money on it. The fund averages a ahead price-to-earnings a number of of simply 19. That is low cost once you examine it to the Know-how Choose Sector SPDR Fund common of almost 26. Plus, tariffs may crush U.S.-based tech firms for so long as they continue to be intact. Chinese language tech firms, that are focusing totally on Chinese language markets, could also be safer funding choices by comparability. Whereas that does not imply they will not be uncovered to tariffs, the danger could also be far more modest.

Tencent, PDD Holdings, and Baidu are among the many high holdings within the ETF, and they’re among the many finest Chinese language shares to personal.

Baidu lately rolled out a brand new AI mannequin, Ernie X1, which it says can rival DeepSeek and is barely half the worth. In the meantime, earlier this month, Tencent’s AI chatbot, Yuanbao, overtook DeepSeek on the Apple iOS app retailer in China as probably the most downloaded free app. It has been hovering in recognition after the corporate revamped it with DeepSeek’s reasoning mannequin. The opposite inventory famous, PDD Holdings, is the e-commerce large that owns Temu, one of the crucial widespread on-line marketplaces on the planet. All three of those shares are promising buys all on their very own. And inside this ETF, buyers get publicity to all of them, and extra.

Is that this ETF price placing in your portfolio in the present day?

Investing in Chinese language shares might be a good way so that you can diversify your portfolio. Plus, this ETF can provide you a strategy to faucet into some undervalued tech shares which have quite a lot of room for extra development, significantly attributable to AI. The Invesco China Know-how ETF has been surging this yr and with a modest valuation, it may be one of many higher ETFs to spend money on in the present day.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Baidu, and Tencent. The Motley Idiot has a disclosure coverage.