The worth of Bitcoin has been caught inside the $81,000 to $86,000 consolidation vary over the previous week, exhibiting a excessive degree of indecisiveness between the bulls and bears. Whereas most on-chain indicators are portray a bearish picture for the premier cryptocurrency, the most recent piece of information means that the bull run won’t be over simply but.

BTC Traders Not But In Full Panic Mode: Blockchain Agency

In a brand new submit on the X platform, blockchain analytics agency Glassnode revealed {that a} particular class of Bitcoin holders often known as the “short-term holders” (STH) are dealing with growing market stress. This on-chain remark is predicated on the worth of unrealized losses of this investor cohort.

For readability, an unrealized loss refers to at least one that’s nonetheless on paper, because the investor remains to be holding on to and promoting an asset (with a declining worth). A loss solely turns into “actual” or “realized” when the holder sells the asset at a worth decrease than the acquisition worth.

In line with Glassnode, the unrealized losses of Bitcoin buyers have been climbing in current weeks, particularly pushing the short-term holders towards a major +2σ threshold. The STH Relative Unrealized Loss metric hitting the intense +2σ threshold has been related to elevated promoting stress previously.

Nonetheless, Glassnode famous that the scale of the STH losses nonetheless falls inside the vary usually noticed in a bull market. Particularly, the magnitude of those losses pales compared to the market-wide sell-off witnessed in 2021, suggesting that the bull cycle won’t be performed but.

Supply: @glassnode on X

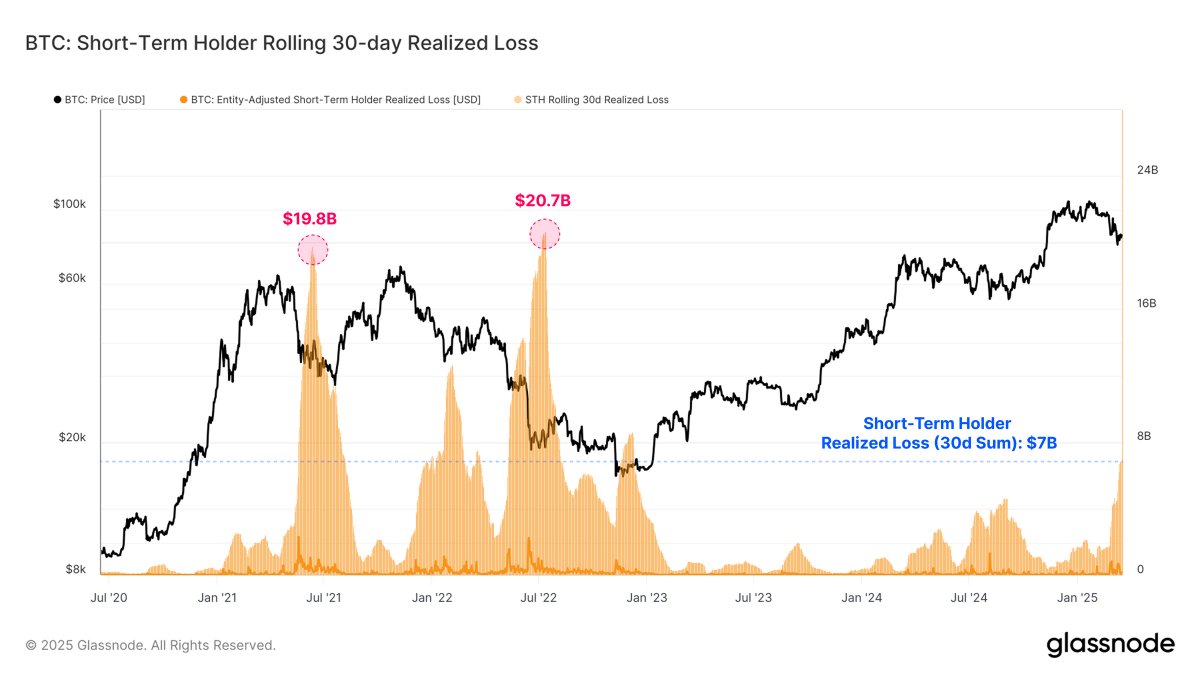

To additional illustrate this, Glassnode revealed that the rolling 30-day realized loss for Bitcoin’s short-term holders has now surpassed $7 billion, representing the most important sustained loss occasion within the present cycle. Regardless of the importance of this determine, it’s nonetheless far much less extreme than the capitulation occasions seen firstly of previous bear markets.

For example, Bitcoin’s realized losses rose to as excessive as $19.8 billion and $20.7 billion through the main worth corrections in Could 2021 and 2022, respectively. Contemplating that the realized losses are nonetheless properly under previous capitulation occasions, there’s a likelihood that the market has not but reached a full-scale panic mode.

Bitcoin Value At A Look

As of this writing, the value of Bitcoin stands at round $84,300, reflecting a 0.3% improve previously 24 hours. In line with knowledge from CoinGecko, the flagship cryptocurrency is down by merely 0.6% previously seven days, emphasizing the uneven state of the market.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.