Market individuals kicked the week off in a optimistic temper, helped partly by talks of a extra measured U.S. tariffs implementation plan.

Danger rallies carried on till the New York session, propping shares and crude oil larger, whereas the greenback additionally discovered assist from PMI readings.

Listed here are the newest updates you might want to know and the way asset lessons fared.

Headlines:

- Over the weekend, a WSJ report urged that the Trump administration is contemplating focused reciprocal tariffs as an alternative of broad industry-specific ones deliberate for April 2

- U.S. and Ukrainian officers held a “productive and targeted” discuss in Riyadh to finish Russia’s invasion

- Australia S&P World Manufacturing PMI Flash for March 2025: 52.6 (50.7 forecast; 50.4 earlier)

- Australia S&P World Providers PMI Flash for March 2025: 51.2 (50.9 forecast; 50.8 earlier)

- Reuters reported OPEC+ will prone to proceed with output will increase but in addition power some members to scale back pumping in Could

- Japan Jibun Financial institution Manufacturing PMI Flash for March 2025: 48.3 (49.4 forecast; 49.0 earlier)

- Japan Jibun Financial institution Providers PMI Flash for March 2025: 49.5 (52.9 forecast; 53.7 earlier)

- Swiss Present Account for December 31, 2024: 9.8B (7.5B forecast; 6.3B earlier)

- France HCOB Providers PMI Flash for March 2025: 46.6 (46.8 forecast; 45.3 earlier)

- France HCOB Manufacturing PMI Flash for March 2025: 48.9 (46.5 forecast; 45.8 earlier)

- Germany HCOB Manufacturing PMI Flash for March 2025: 48.3 (48.0 forecast; 46.5 earlier)

- Germany HCOB Providers PMI Flash for March 2025: 50.2 (51.5 forecast; 51.1 earlier)

- Euro space HCOB Manufacturing PMI Flash for March 2025: 48.7 (48.3 forecast; 47.6 earlier)

- Euro space HCOB Providers PMI Flash for March 2025: 50.4 (51.1 forecast; 50.6 earlier)

- U.Ok. S&P World Providers PMI Flash for March 2025: 53.2 (51.1 forecast; 51.0 earlier)

- U.Ok. S&P World Manufacturing PMI Flash for March 2025: 44.6 (47.0 forecast; 46.9 earlier)

- Canada CFIB Enterprise Barometer for March 2025: 25.0 (49.0 forecast; 49.5 earlier)

- Canada Manufacturing Gross sales MoM Prel for February 2025: -0.2% (-0.3% forecast; 1.7% earlier)

- Chicago Fed Nationwide Exercise Index for February 2025: 0.18 (0.08 forecast; -0.03 earlier)

- S&P World U.S. Manufacturing PMI Flash for March 2025: 49.8 (52.1 forecast; 52.7 earlier)

- S&P World U.S. Providers PMI Flash for March 2025: 54.3 (51.1 forecast; 51.0 earlier)

- Trump says U.S. will impose 25% tariffs on international locations that purchase oil and gasoline from Venezuela

Broad Market Value Motion:

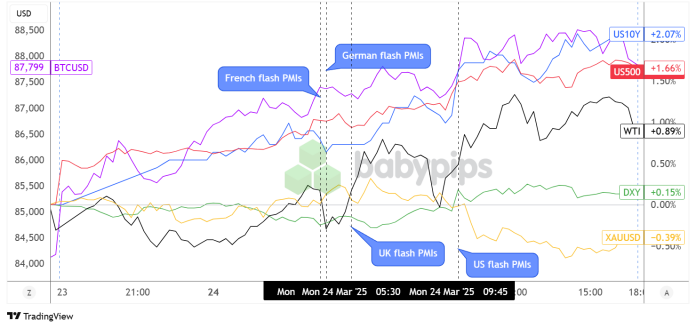

Greenback Index, Gold, SP 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Traders wakened on the fitting aspect of the mattress at the beginning of the week, as danger belongings like crypto and fairness futures began off within the inexperienced. This upbeat sentiment seemingly got here from weekend studies suggesting that the Trump administration is mulling a extra measured tariffs implementation versus the broad industry-targeted ones initially deliberate.

Geopolitical tensions additionally gave the impression to be easing, as officers from the U.S. and Ukraine had “productive and targeted” talks in Riyadh aiming for a broader ceasefire take care of Russia. Gold tried to carry its floor through the Asian and London periods however quickly caved to profit-taking amongst safe-havens as risk-taking accelerated later within the day.

Crude oil, which had a little bit of a shaky begin, quickly joined within the risk-on bandwagon on rumors that the OPEC+ might persuade some member nations to reduce manufacturing in Could, regardless of seemingly continuing with its deliberate output hike subsequent month. Trump’s threats to impose 25% tariffs on international locations shopping for oil from Venezuela additionally appeared to prop the commodity larger.

Bitcoin was on a tear all through the day, surging from the $84K ranges as much as $88K on improved market sentiment. Treasury yields had been additionally on a gentle upward trajectory, as traders seemingly dumped authorities bonds whereas pursuing riskier holdings. The S&P 500 index closed 1.66% larger, with rallies led by tech sector shares.

FX Market Conduct: U.S. Greenback vs. Majors:

Overlay of USD vs. Main Currencies Chart by TradingView

Greenback pairs had a combined begin, with the U.S. forex raking in good points towards the Japanese yen and Swiss franc from the get-go whereas giving up floor to higher-yielding counterparts. Enhancements in Australia’s flash manufacturing and providers PMIs helped maintain the Aussie afloat through the Asian session, although the Kiwi noticed some losses.

Flash PMI readings from the eurozone got here in combined, with the manufacturing sectors of Germany and France printing higher than anticipated ends in March whereas the German flash providers PMI fell in need of estimates AND noticed a downgrade to the earlier studying.

Over within the U.S., stronger than anticipated flash providers PMI helped buoy the greenback again to optimistic territory towards most of its friends, besides towards the stronger Canadian greenback. Expectations that Trump might shift to focused reciprocal tariffs appeared to offer some reduction for CAD, together with the rally in crude oil costs through the U.S. session.

By session’s finish, the greenback closed considerably larger versus the yen (+0.87%) whereas holding on to marginal good points versus EUR (0.13%), NZD (0.10%) and CHF (0.09%). USD closed within the crimson versus the remainder of its friends, most notably towards CAD (-0.26%).

Upcoming Potential Catalysts on the Financial Calendar:

- BOJ Core CPI y/y at 5:00 am GMT

- Germany Ifo Enterprise Local weather for March 2025 at 9:00 am GMT

- U.Ok. CBI Distributive Trades for March 2025 at 11:00 am GMT

- U.S. Fed Kugler Speech at 12:40 pm GMT

- U.S. Home Value Index for January 2025 at 1:00 pm GMT

- U.S. S&P/Case-Shiller Residence Value Index for January 2025 at 1:00 pm GMT

- U.S. Fed Williams Speech at 1:05 pm GMT

- U.S. New Residence Gross sales MoM for February 2025 at 2:00 pm GMT

- U.S. CB Shopper Confidence for March 2025 at 2:00 pm GMT

- Richmond Fed Manufacturing Index for March 2025 at 2:00 pm GMT

- API U.S. Crude Oil Inventory Change at 8:30 pm GMT

There’s not a lot in the way in which of top-tier market catalyst within the upcoming buying and selling periods, though it could possibly be price retaining tabs on the U.S. CB client confidence index which is taken into account a number one spending indicator.

Aside from that, be certain that to maintain your eyes and ears peeled for Fed coverage commentary from officers Kugler and Williams throughout their testimonies, in addition to extra tariffs-related bulletins from the Trump administration.

Don’t overlook to take a look at our model new Foreign exchange Correlation Calculator when taking any trades!