The crypto market took it on the chin early on Friday and it wasn’t the business’s fault. As an alternative, it was weak financial knowledge that precipitated the sell-off. For those who’re questioning why cryptocurrencies aren’t a hedge towards the economic system and inflation, you solely want to have a look at historical past. The final time the economic system slowed and inflation jumped, Bitcoin’s worth collapsed.

As of 1:30 p.m. ET, within the final 24 hours Bitcoin (BTC -4.09%) is down 3.6%, Ethereum (ETH -6.95%) is off 6.3%, and Dogecoin (DOGE -5.75%) is down 4.9%. Might the decline proceed?

Crypto’s financial actuality

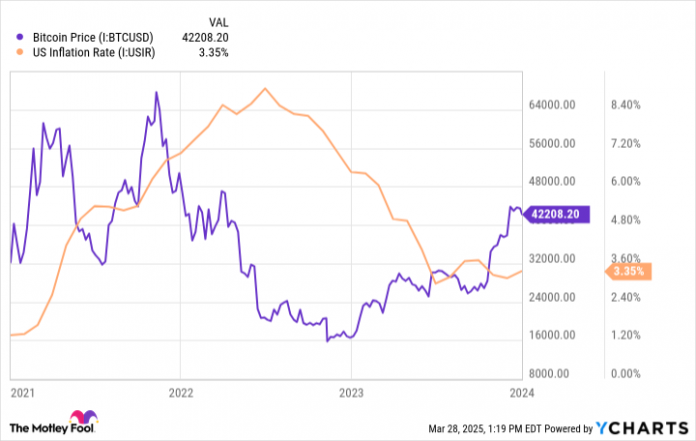

Prefer it or not, cryptocurrencies commerce extra correlated to development shares than they do as a hedge towards inflation or the broader economic system. On the whole, low rates of interest are good and better rates of interest are unhealthy. In a associated notice, low inflation is sweet for crypto and excessive inflation is unhealthy.

Bitcoin, specifically, has been offered as an inflation hedge, however historical past says it is the other.

Bitcoin Worth knowledge by YCharts

And that brings us to financial knowledge that got here out in the present day. The PCE value index, which measures private consumption expenditures, rose an anticipated 2.5% from a yr earlier, as anticipated, however core PCE was up 2.8% and January’s core PCE was revised upward. This was forward of any affect tariffs might have on the value of products sooner or later.

Greater costs put stress on the Federal Reserve, which wish to increase the economic system with decrease charges, however may have to boost charges to offset inflation. It is in a tricky place and better charges would probably be unhealthy for cryptocurrency valuations.

Customers are already feeling nervous

One other knowledge level in the present day was the College of Michigan’s client sentiment index, which dropped to a studying of 57 in March and the Convention Board’s Expectations Index fell to 52.6. A better studying means customers are getting extra bullish on the economic system whereas a decrease studying exhibits the other.

Decrease confidence and better costs are a foul mixture for the market, particularly dangerous property like crypto.

Why crypto’s collapse might not be completed

The fact for crypto traders is the worst should still be forward. It seems like greater costs are right here to remain given rising tariffs and a possible commerce battle with seemingly each nation that provides the U.S. with items.

A weaker economic system and better inflation would probably be horrible for cryptocurrency values. Crypto is a danger asset and it does not have any actual utility in the present day, so if folks want funds they’re more likely to both promote crypto or on the very least purchase much less. And with no underlying enterprise, cryptocurrency values depend on the following purchaser to stay viable. Patrons might dry up in a foul economic system.

I additionally suppose the tailwinds that drove the crypto restoration late in 2024 have not resulted in a elementary change within the business. Bitcoin, Ethereum, and Dogecoin aren’t accepted any extra by companies than they had been and the actual momentum is in stablecoins, which use the blockchain however haven’t got the volatility of cryptocurrencies.

I do not suppose the sell-off is over and it might be some time earlier than the economic system and market hit backside.

Travis Hoium has positions in Ethereum. The Motley Idiot has positions in and recommends Bitcoin and Ethereum. The Motley Idiot has a disclosure coverage.